USDH Stablecoin Launches on Hyperliquid with $2.2M Opening Volatility – Is This Tether’s Successor?

Another stablecoin enters the arena—this time with serious backing and immediate traction. USDH just went live on Hyperliquid, and the market's already voting with its wallet.

The Early Numbers Don't Lie

$2.2 million in trading volume within hours of launch signals more than just curiosity. It suggests institutional players might be testing the waters, looking for alternatives to the established giants. The DeFi space has been hungry for credible stablecoin options, and USDH's architecture promises something different.

Technical Edge or Marketing Hype?

Hyperliquid's integration gives USDH immediate access to a sophisticated derivatives ecosystem. The platform's users can now collateralize positions with what promises to be a more transparent stablecoin—addressing the black box concerns that have dogged Tether for years. Whether that transparency holds under pressure remains to be seen.

Can It Actually Displace Tether?

Tether's dominance isn't just about first-mover advantage—it's about liquidity depth that new entrants struggle to match. But every challenger chips away at the margins, and USDH's rapid early adoption suggests there's appetite for alternatives. The real test comes when markets turn volatile and stability gets tested.

Because nothing builds confidence in a stablecoin like watching traditional finance institutions panic-sell during a 2% dip—truly the bedrock of cryptocurrency stability.

Native Markets Begins Controlled USDH Rollout

Native Markets structured the launch as a gradual expansion, initially capping individual transactions at $800 per user while Core functions undergo real-world testing.

“USDH is now live for all Hyperliquid users,” the company announced on social media, highlighting completion of bothandtoken deployments.

Several integration phases will unfold over the coming months, beginning with HyperEVM integrations, followed by the expansion of USDH’s role as a spot quote asset.

Future developments include native minting directly on HyperCore and USDH-margined perpetual contracts through the proposed HIP-3 protocol upgrade.

The issuer structured USDH reserves using cash and short-term U.S. Treasury holdings managed off-chain by BlackRock, while on-chain tokenized assets operate through Superstate and Stripe’s Bridge infrastructure.

Meanwhile, Native Markets is also committed to directing 50% of its reserve yield toward Hyperliquid’s Assistance Fund, with the remaining portions allocated for USDH ecosystem development.

This revenue-sharing model emerged from the company’s competitive proposal that secured validator approval against better-known rivals during September’s governance process.

Hyperliquid currently hosts over $5.5 billion in Circle’s USDC, representing approximately 8% of the token’s total supply and generating an estimated $220 million annually in treasury yield revenue for Circle.

Stablecoin Competition Intensifies as Platforms Pursue Revenue Independence

The USDH launch contributes to a broader shift within defi, as trading platforms seek to reduce their dependence on external stablecoin issuers and capture reserve yield revenue internally.

Tether’s USDT currently dominates the market, with $173.05 billion in circulation, processing over $24.6 billion daily on TRON alone through approximately 2.4 million transactions, according to Coingecko’s data.

This infrastructure advantage extends to reserve backing, where Tether claims 75.86% U.S. Treasury Bills and 12.09% overnight repos across its reserve portfolio.

Native stablecoins like USDH are taking a different strategic approach, targeting specific ecosystem integration rather than the cross-chain ubiquity that characterizes established players.

Bloomberg characterized similar governance contests as “bidding wars” spreading across DeFi platforms as institutions recognize substantial revenue potential from stablecoin reserves.

![]() The USDH power struggle on @HyperliquidX has concluded, with Native Markets securing the stablecoin mandate. Analysts say competition now hinges on branding and partnerships.#DeFi #Stablecoins https://t.co/vRvxxuLmEM

The USDH power struggle on @HyperliquidX has concluded, with Native Markets securing the stablecoin mandate. Analysts say competition now hinges on branding and partnerships.#DeFi #Stablecoins https://t.co/vRvxxuLmEM

The stablecoin landscape is showing increasing fragmentation, despite USDT’s dominance, with Chainalysis reporting $2.5 trillion in sector-wide transaction volumes that accommodate specialized players.

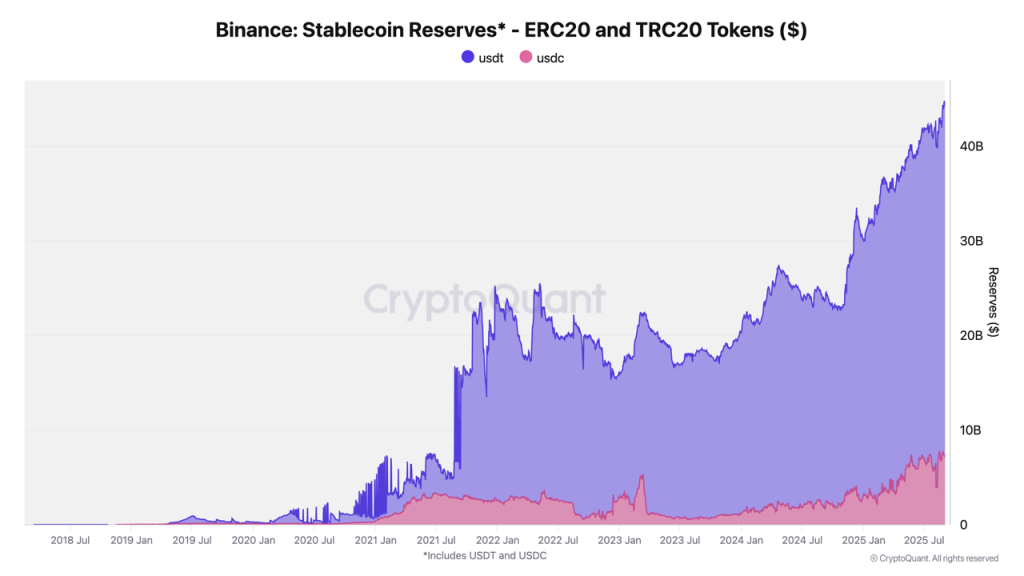

Binance currently holds 67% of all exchange stablecoin reserves, amounting to $44.2 billion, comprising $37.1 billion in USDT and $7.1 billion in USDC.

Smaller stablecoins have also shown rapid growth trajectories, with euro-denominated EURC expanding 89% month-over-month from $47 million to $7.5 billion in transactions during the past year.

Similarly, PayPal’s PYUSD accelerated from $783 million to $3.95 billion over the same period.

These competitive dynamics emerge as regulatory frameworks evolve, with the Trump-backed GENIUS Act and the EU’s MiCA creating opportunities for compliant alternatives to capture market share.

Industry projections from Citigroup suggest the sector could reach over $2 trillion market capitalization by 2030, which could potentially create space for multiple players to coexist rather than winner-take-all scenarios.

Looking forward, the success of ecosystem-focused stablecoins will likely depend on the growth trajectories of their host platforms. For instance, Hyperliquid generated $106 million in revenue during August 2025 alone, while slashing spot trading fees by 80% to bolster liquidity ahead of the stablecoin launch.