Fitell Corp Bets $100M on Solana Treasury Strategy – Will SOL Hit $300?

Fitell Corp just dropped a nine-figure bomb on Solana—staking $100 million squarely on the blockchain's future. This isn't just another corporate treasury move; it's a massive vote of confidence in SOL's potential to defy gravity.

The $300 Question

Can Solana actually triple its current valuation? Fitell's bet suggests they're banking on more than just hype. The move injects serious institutional credibility into a network that's already processing transactions at breakneck speeds—leaving traditional finance infrastructure in the dust.

Wall Street's FOMO Moment

While legacy banks still debate blockchain adoption, corporations are bypassing the middlemen entirely. Fitell's allocation screams what every crypto native already knows: digital assets aren't the future—they're the present. Meanwhile, traditional finance continues to overpay for settlement systems that move at the speed of dial-up.

Solana's trajectory now looks less like a speculative asset and more like a strategic infrastructure play. Whether $300 becomes reality depends on whether the rest of corporate America catches up—or gets left holding bags of outdated treasury bonds.

Australia’s first → Solana’s next chapter.

The company will generate returns not only through staking but also through DeFi opportunities, risk management frameworks, and yield innovations.

Australia’s First $100M Solana Treasury Goes Live

The Solana treasury strategy includes structured products, including options, snowballs, on-chain liquidity provisioning, and other highly liquid approaches with managed downside risk.

Fitell has brought on David Swaney and Cailen Sullivan as advisors to guide the company’s digital asset treasury roadmap.

David Swaney has been operating in the digital asset sector since 2017, focusing on institutional adoption of on-chain finance.

His broad advisory and consulting background covers treasury design, structured yield strategies, and market infrastructure.

Cailen Sullivan has worked in the digital asset sector for over a decade and joined Coinbase as an early employee in 2013.

He currently focuses on investing in and supporting projects across the Solana ecosystem, serving as co-founder of Adrena, one of Solana’s leading perpetual DEXs by trading volume.

Sam Lu, Chief Executive Officer of Fitell Corporation, stated that “the launch of our Solana digital asset treasury places Fitell at the forefront of Solana adoption in Australia and the Asia Pacific region.”

“Our goal to become the region’s largest publicly listed Solana holder demonstrates our confidence in the network’s long-term potential,” he added.

Fitell has also initiated the process toward a dual listing on the Australian Securities Exchange (ASX), expanding access and exposure for regional investors to SOL.

Initial SOL assets will be held with BitGo Trust Company, Inc. in the U.S. and staked through institutional-grade infrastructure.

Solana Treasury Strategy Adoption Accelerates

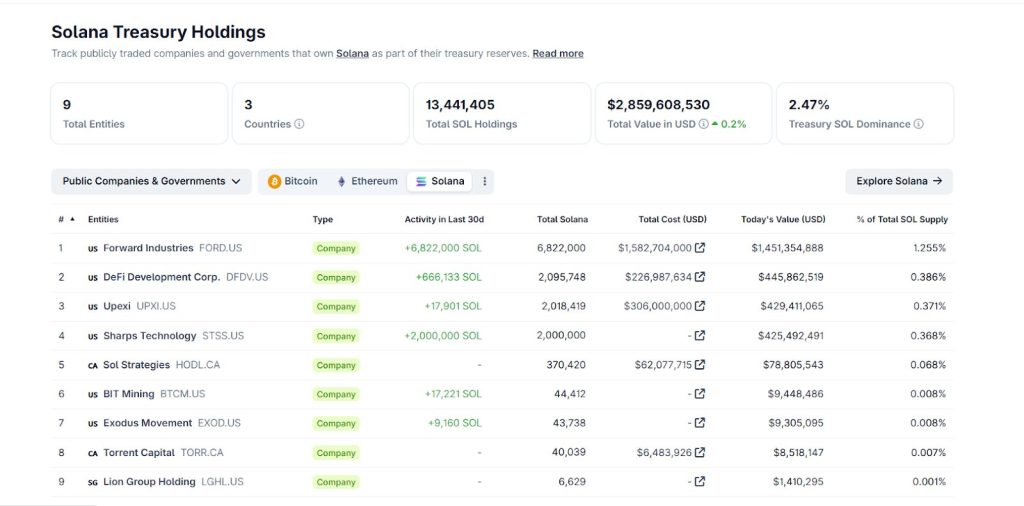

Solana treasury companies are rapidly expanding their holdings, with total reserves reaching 13.44 million SOL ($2.86 billion), as institutional interest in the network continues to grow.

On September 23, Brera Holdings (NASDAQ: BREA) completed an oversubscribed $300 million PIPE led by the UAE’s Pulsar Group alongside Ark Invest, RockawayX, and UAE investors to purchase SOL for its digital asset treasury.

On September 15, Helius Medical Technologies secured $500 million in funding, led by Pantera Capital, to establish a Solana treasury focused on acquiring SOL.

![]() Helius Medical raises $500M backed by Pantera Capital for $1.25B Solana treasury with stock surging 159% after announcement.#Solana #Treasuryhttps://t.co/xG4c9AN0dF

Helius Medical raises $500M backed by Pantera Capital for $1.25B Solana treasury with stock surging 159% after announcement.#Solana #Treasuryhttps://t.co/xG4c9AN0dF

Forward Industries, a Nasdaq-listed company, recently pivoted from medical design to digital assets and filed for a $4 billion at-the-market (ATM) equity program to raise capital for its Solana-focused strategy.

As the leading Solana treasury strategy firm, Forward Industries has accumulated over 6.8 million Solana (SOL) tokens valued at approximately $1.58 billion.

Other companies, including BIT Mining and Upexi Inc., are also building their Solana portfolios.

BIT Mining Chairman and COO Bo Yu noted that many Nasdaq-listed companies are beginning to recognize the value of strengthening their presence within the Solana ecosystem.

Technical Analysis Points to SOL $300 Target

These institutional acquisitions are prompting analysts to project that SOL could reach $300 before year-end.

Chart analyst Ali Martinez has identified a TD Sequential pattern indicating a double buy signal on SOL with a near-term target of $250.

On the technical front, the SOL/USDT 4-hour chart shows a clear upward channel that has guided price action since early August, with multiple rejections NEAR the resistance zone around $250.

After breaking out of a prolonged range, Solana rallied strongly but failed to maintain momentum at the top, forming a double rejection near the resistance level.

The recent decline has pushed the price back toward the confluence area around $208, where upward channel support and the downward trendline intersect.

This zone is critical. If Solana holds here, a rebound toward $230 and potentially $250 remains possible, keeping the bullish structure intact.

However, a decisive break below $208 WOULD expose the next support at $185, with deeper risk toward $162 if selling pressure intensifies.

Currently, the chart suggests a short-term pullback into the confluence area before any recovery attempt.