Crypto Billionaire Arthur Hayes Predicts $3.4M Bitcoin by 2028 – What Does He Know That Wall Street Doesn’t?

The bold prediction from BitMEX co-founder Arthur Hayes sends shockwaves through traditional finance circles. $3.4 million per Bitcoin within four years? Either he's spotted something the suits missed—or this is the most ambitious crypto forecast since Satoshi vanished.

Hayes' Track Record Speaks Volumes

The man who built one of crypto's earliest derivatives empires doesn't make predictions lightly. His $3.4M call implies a market cap that would dwarf most national economies—a thought that probably gives central bankers night sweats.

Behind the Numbers

Hayes points to macroeconomic forces that traditional analysts consistently underestimate. Rampant money printing, institutional adoption waves, and the sheer mathematical scarcity of Bitcoin create a perfect storm. Meanwhile, Wall Street still thinks gold is a safe haven—how quaint.

The Institutional Floodgates Are Opening

BlackRock, Fidelity, and every major bank now scrambling for Bitcoin exposure proves Hayes isn't alone. The smart money recognizes what retail investors knew years ago: digital gold can't be printed into oblivion like fiat currencies.

Why 2028 Matters

The timeline aligns with Bitcoin's next halving cycle and potential global debt crises. Hayes bets that when traditional systems crack, Bitcoin becomes the lifeboat everyone needs. Banks will still be charging fees for wire transfers while Bitcoin settles value globally in minutes.

Either Hayes just made the call of the decade—or this is the ultimate test of crypto conviction. One thing's certain: the old financial guard won't see this coming until it's too late.

Trump Administration Targets Federal Reserve Control

Hayes, who manages the Maelstrom investment fund, bases his calculation on an estimated $15.229 trillion in combined Federal Reserve and commercial banking credit growth through 2028.

His model assumes the Fed will purchase 50% of new Treasury debt issuance while bank credit expands by $7.569 trillion during Trump’s remaining term.

The analysis focuses on Bessent’s plan to regain control of the Federal Reserve through strategic board appointments and regulatory pressure.

Hayes nicknamed the Treasury Secretary “Buffalo Bill” for his anticipated dismantling of the Eurodollar banking system, comparing the strategy to seizing control of foreign non-dollar deposits worth an estimated $34 trillion globally.

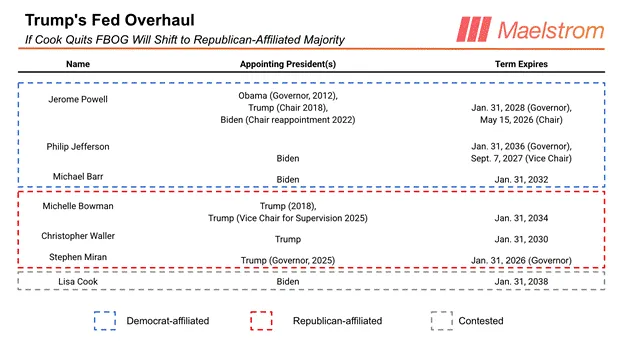

Trump needs four seats for a Federal Reserve Board of Governors majority to manipulate short-term rates through the Interest on Reserve Balances mechanism.

Hayes identifies potential allies in Governors Bowman and Waller, who dissented at recent Federal Open Market Committee meetings, as well as newly confirmed Stephen Miran, bringing Trump’s camp to three supporters.

Fed Governor Lisa Cook faces mounting pressure to resign over alleged mortgage fraud accusations from Federal Housing Finance Agency head Bill Pulte.

The Department of Justice is reviewing whether to seek a grand jury indictment for bank fraud, which Hayes believes will force Cook’s departure by early 2026.

Meanwhile, Trump’s team plans to replace Fed district bank presidents during the February 2026 elections.

Hayes argues that the administration only needs three out of four new voting governors to secure Federal Open Market Committee control, which will enable the printing of money to purchase Treasury debt that private markets won’t buy.

Stablecoin Infrastructure to Absorb Global Banking Deposits

In his last month’s blog post, Hayes outlines how Bessent could redirect $10-13 trillion in Eurodollar deposits by threatening to withdraw Federal Reserve support for foreign banks during future financial crises.

This policy shift WOULD force Eurodollar depositors toward compliant stablecoin issuers like Tether, which invest exclusively in U.S. bank deposits and Treasury bills.

The strategy extends beyond traditional banking to capture $21 trillion in Global South retail deposits through U.S. social media platforms equipped with crypto wallets.

Hayes envisions WhatsApp providing seamless stablecoin payment functionality to users in countries like the Philippines, effectively creating digital dollar bank accounts for billions while bypassing local banking regulations.

Central banks in emerging markets would lose monetary control as citizens adopt dollar-pegged stablecoins for daily transactions.

Local governments lack effective responses beyond internet shutdowns, while the Trump administration could wield sanctions against officials who resist stablecoin proliferation by threatening their offshore wealth holdings.

European deposits face similar pressure as Hayes predicts the euro’s collapse due to Germany-first and France-first policies splintering the currency union.

Adding European bank deposits of $16.74 trillion creates a total addressable market of $34 trillion for stablecoin conversion.

The forced adoption would create price-insensitive demand for Treasury bills, allowing Bessent to offer yields lower than Fed Funds rates while maintaining profitability for stablecoin issuers.

This mechanism could give the Treasury control over short-term interest rates regardless of Federal Reserve policy decisions.

Hayes Exits HYPE Position Despite Bold Predictions

Despite his bullish long-term outlook for DeFi protocols, Hayes recently sold his entire HYPE position for $823,000 profit, citing the need to fund a Ferrari Testarossa deposit.

The sale involved 96,628 tokens just weeks after he predicted 126x gains for Hyperliquid at Tokyo’s WebX conference.

The timing coincided with the massive token unlocks beginning on November 29, when 237.8 million HYPE tokens, worth $11.9 billion, will create $500 million in monthly sell pressure over 24 months.

Hayes warned through the Maelstrom Fund that current buyback mechanisms can only absorb $85 million per month.

![]() Whale withdraws $122 million in HYPE tokens as Arthur Hayes and Ansem exit ahead of massive November token unlock events.#Hyperliquid #Hypehttps://t.co/aWzra4hBDO

Whale withdraws $122 million in HYPE tokens as Arthur Hayes and Ansem exit ahead of massive November token unlock events.#Hyperliquid #Hypehttps://t.co/aWzra4hBDO

A major whale also withdrew $122 million worth of HYPE tokens, identified as Techno_Revenant, with $90 million in unrealized gains from nine-month holdings.

Popular trader Ansem joined the exodus, selling $492,000 worth of tokens amid concerns about supply.

Despite maintaining his $250,000 Bitcoin target for 2025, Hayes cautioned investors against expecting overnight wealth.

He criticized short-term thinking that leads to liquidations while defending Bitcoin’s long-term performance against traditional markets when adjusted for inflation.