🔥 Top 5 Venture Deals This Week: Brale, Finary, and Stablecore Dominate Funding Frenzy

Venture capital pours millions into crypto's next disruptors—because apparently traditional finance wasn't complicated enough already.

Brale's Blockchain Breakthrough

Secured major funding to revolutionize decentralized infrastructure—because what the space really needs is another layer of complexity.

Finary's Financial Fusion

Raises capital to bridge traditional and digital assets, proving Wall Street still wants a piece of the crypto action despite pretending to hate it.

Stablecore's Settlement Solution

Lands investment for stablecoin infrastructure, because nothing says 'stable' like building on the most volatile asset class in history.

The Supporting Cast

Two additional ventures round out the week's top deals, collectively proving that investor FOMO outperforms actual due diligence every time.

While these deals signal continued institutional confidence, remember: in crypto, today's groundbreaking innovation is tomorrow's forgotten whitepaper.

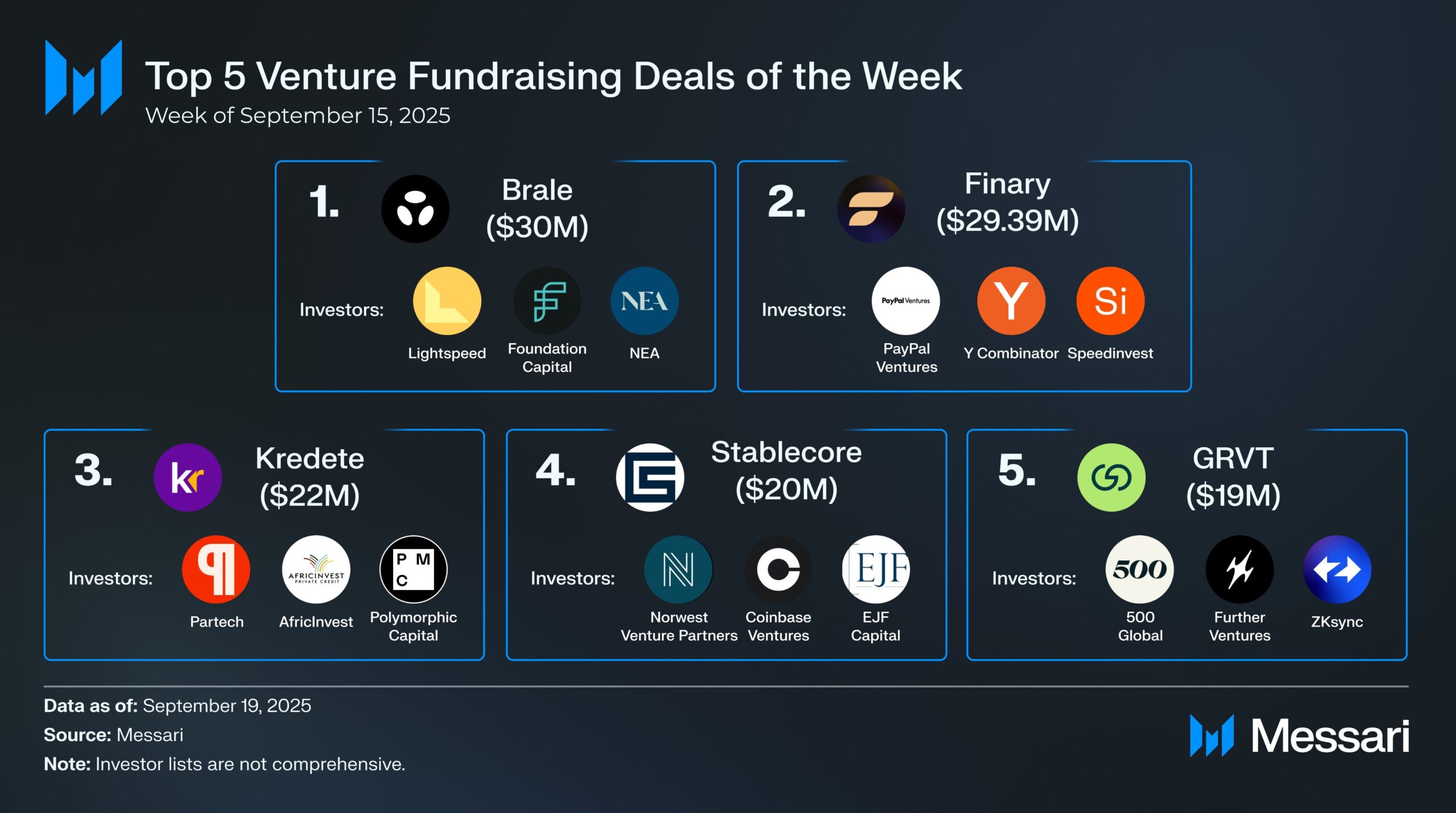

Close behind, Finary raised $29.39 million in a round led by PayPal Ventures, with participation from Y Combinator and Speedinvest. The Paris-based startup offers personal finance tools tailored for digital assets, a sector gaining momentum as consumer demand for multi-asset tracking grows.

Third place went to Kredete, which pulled in $22 million. Backed by Partech, AfricInvest, and Polymorphic Capital, the startup is focused on expanding financial access in emerging markets through AI-driven credit scoring.

In fourth, Stablecore attracted $20 million from Norwest Venture Partners, Coinbase Ventures, and EJF Capital. With stablecoins at the heart of regulatory debates and DeFi growth, its platform is positioned as a key player in the next phase of digital dollar infrastructure.

READ MORE:

Rounding out the top five is GRVT, which raised $19 million from 500 Global, Further Ventures, and ZKsync. The project is developing new tools for scalable decentralized ecosystems.

Together, these deals show investor focus stretching from Core blockchain infrastructure to real-world financial access, with stablecoins and consumer-facing apps drawing particularly strong momentum this week.

![]()