Bitcoin Holds Critical Support - $118K Rebound in Bulls’ Sights

Bitcoin's proving its mettle at a crucial technical juncture—traders are watching this level like hawks.

The Bull Case

Market sentiment's shifting from cautious to cautiously optimistic. That $118,000 target isn't just pie-in-the-sky thinking—it aligns with historical breakout patterns after solid support holds.

Why This Matters

Institutional money's waiting in the wings, retail's getting FOMO-y again, and let's be honest—traditional finance hasn't offered this much excitement since the last time they invented fees for existing.

Next Moves

Watch for volume confirmation on any upward moves. No volume, no conviction—simple as that. Break through resistance, and we're talking proper momentum play territory.

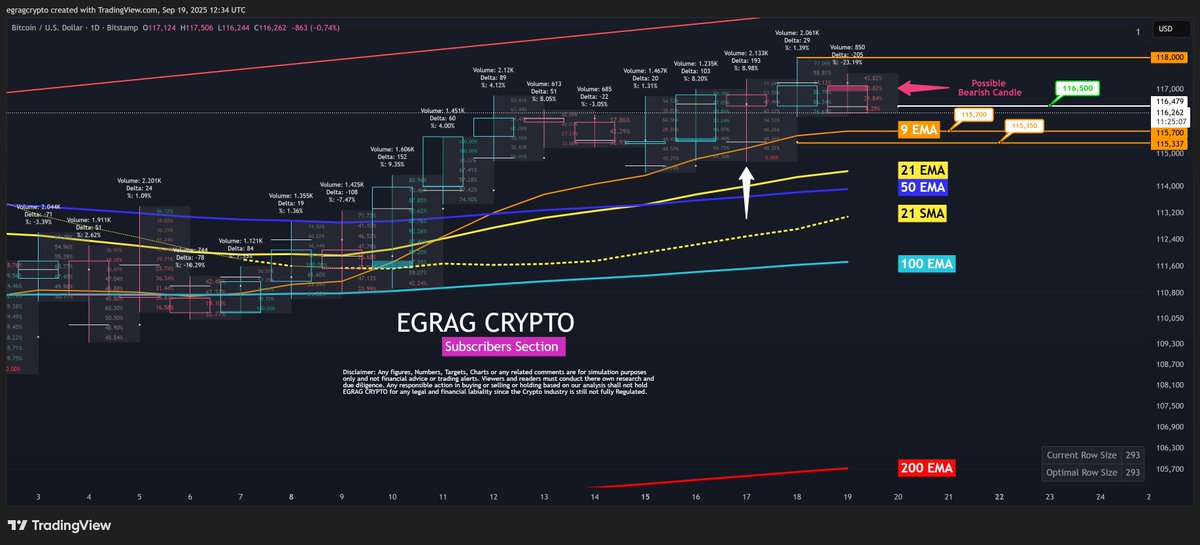

Bears Hold Control, But Support Levels Matter

At present, Bitcoin’s Volume Delta indicates that bears remain in control of short-term price action. However, Egrag points out that if the price dips into the $115,700 – $115,350 zone, bulls could step in with renewed buying interest. A successful rebound from this range might trigger momentum toward the $118,000 mark, reinforcing the broader bullish outlook.

200 EMA: The Bigger Picture Reset

Long-term traders are also watching the 200-day EMA, a level Bitcoin frequently retests during consolidation phases. Egrag notes that while a potential drop of $12,000 may seem steep, such resets often precede larger rallies. Historically, these pullbacks have cleared the way for Bitcoin to set up its “next big pump.”

READ MORE:

Weekend Watch and Monday Close

Market watchers will keep a close eye on Bitcoin’s performance over the weekend. According to Egrag, the daily close on Monday could prove decisive in confirming whether bulls can reclaim control or whether further downside is likely before the next leg higher.

Outlook

For now, the roadmap appears clear: a bounce from the mid-$115K zone could send bitcoin toward $118K quickly, while a deeper test of the 200 EMA may delay but not derail the bullish setup. As Egrag concluded, “time will tell.”

![]()