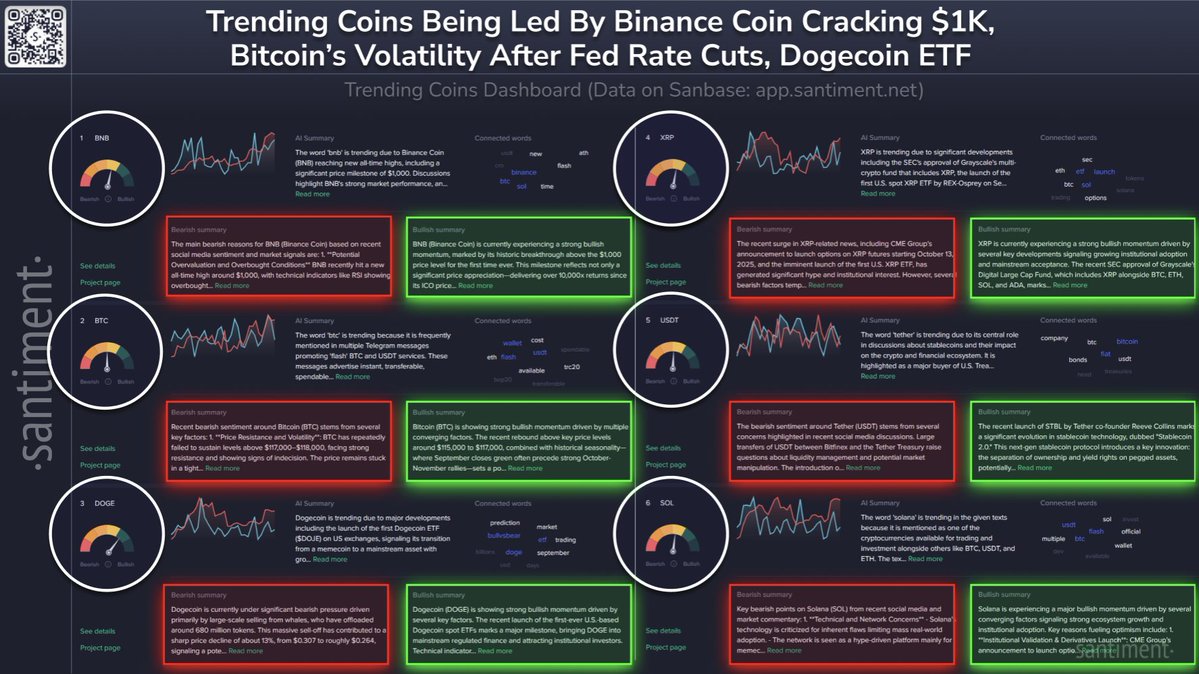

Binance Coin, Dogecoin, and XRP Lead Crypto Charge as Market Awaits Next Big Catalyst

Three heavyweight cryptocurrencies are stealing the spotlight as September's trading action heats up—BNB, DOGE, and XRP are driving momentum while traders hunt for the next market-moving narrative.

BNB flexes its ecosystem muscle with Binance's relentless expansion, while Dogecoin continues riding that meme magic—proving once again that in crypto, sentiment often trumps fundamentals. XRP's regulatory clarity keeps drawing institutional eyes, making it a perennial favorite for the 'when regulation finally comes' crowd.

Market watchers are eyeing macroeconomic signals and potential ETF developments as the next possible catalysts. Because nothing gets crypto pumping like traditional finance finally admitting digital assets might be here to stay—after years of calling it a scam, of course.

Keep an eye on trading volumes and social sentiment spikes. These three aren't just trending—they're setting the pace for the entire digital asset space as we head into the final quarter of 2025.

Meme coin Dogecoin (DOGE) is enjoying renewed momentum following the launch of the first Dogecoin ETF in the U.S. This shift has elevated DOGE from a community-driven token to one gaining institutional attention. Market watchers cite its inflationary supply model and expanding use in tipping and transactions as key drivers of its staying power.

XRP has also jumped in visibility thanks to a string of regulatory and institutional milestones. The SEC’s approval of Grayscale’s multi-crypto product, along with REX-Osprey’s planned U.S. spot XRP ETF and CME’s launch of XRP futures in October, underscores the token’s march toward mainstream acceptance.

READ MORE:

Elsewhere, solana (SOL) and Tether (USDT) are trending for different reasons. SOL remains central to crypto gaming and payment platforms, while USDT continues to spark debate over its role in U.S. Treasury markets and the stability of its reserves.

Together, these developments illustrate how investor focus in 2025 is shaped not just by price action, but by structural milestones—from ETF launches and regulatory approvals to the integration of stablecoins and tokenized assets into global finance.

![]()