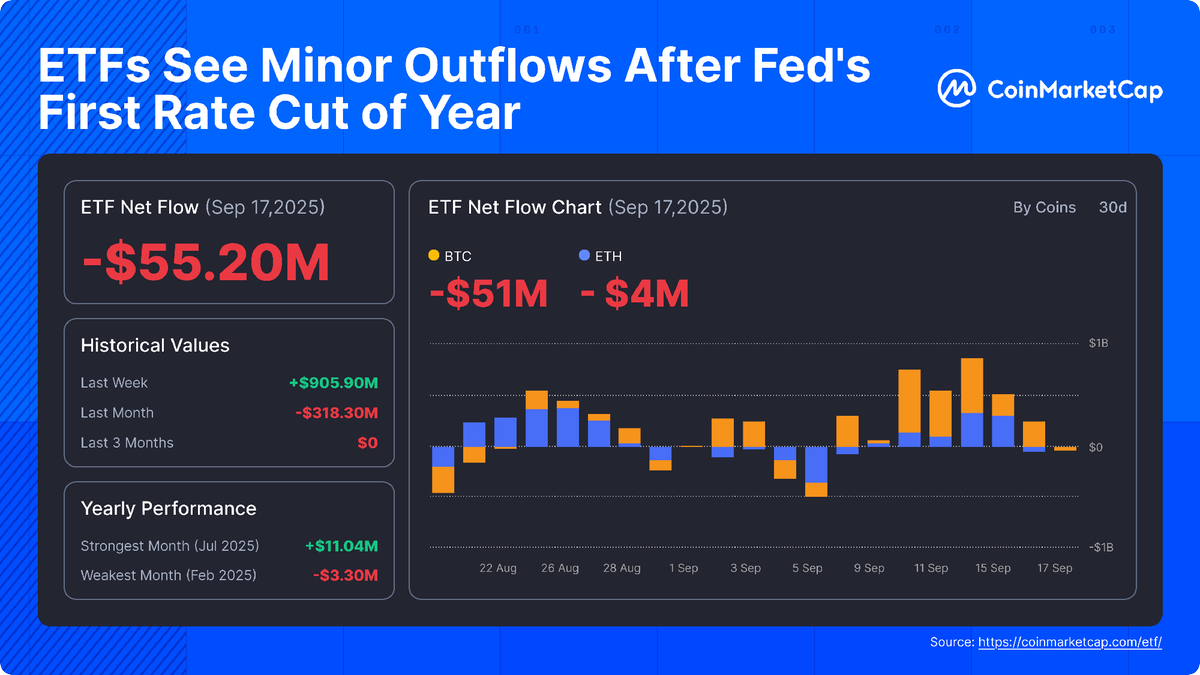

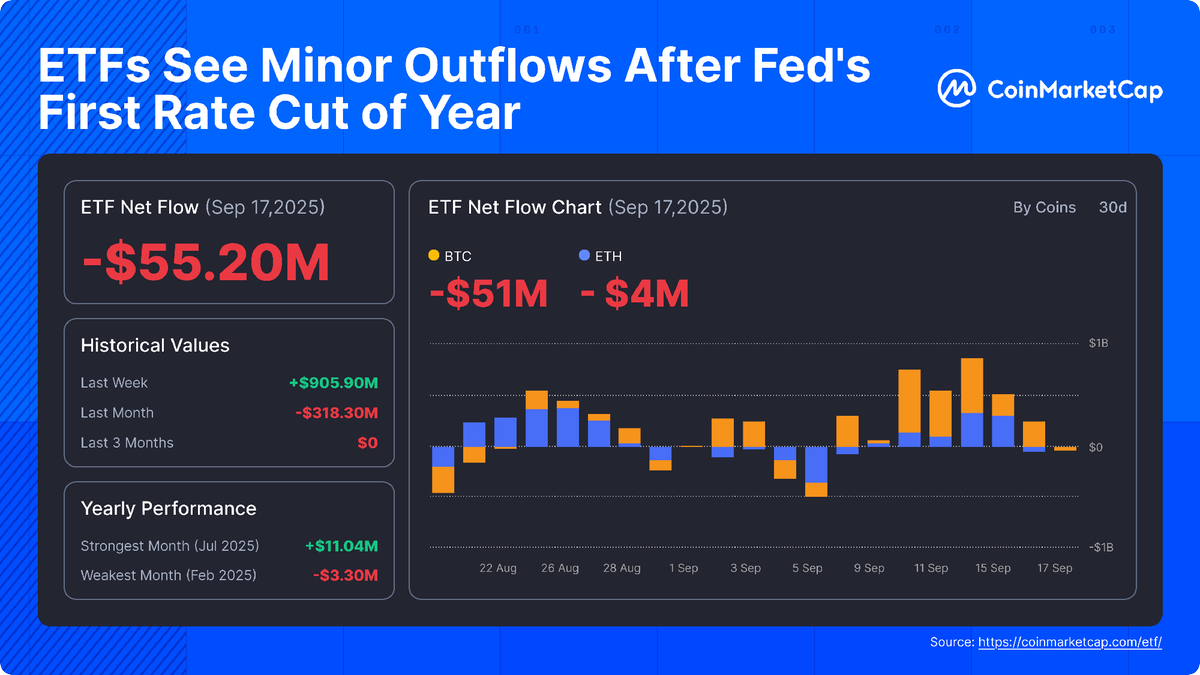

Crypto ETFs Bleed $55M Following Fed’s First 2025 Rate Cut - Here’s Why It’s Actually Bullish

Just when Wall Street thought it had crypto figured out, the Fed throws a curveball—and digital asset ETFs feel the immediate pinch.

The outflow paradox

Fifty-five million dollars exits crypto exchange-traded funds within days of Jerome Powell's first rate cut of 2025. Traditional finance brains scratch heads: shouldn't cheaper money boost risk assets? Not when the cut signals broader economic jitters that spook ETF tourists.

Smart money vs. weak hands

ETF flows represent the most reactive, sentiment-driven layer of crypto investment—the paper hands chasing headlines rather than technology. Real builders don't flinch at rate cycles; they keep deploying on-chain while traditional finance panics over basis points.

The bigger picture

Short-term outflows clean out weak positions and create buying opportunities for those who understand crypto's real value proposition: decentralized systems outperforming centralized monetary experiments. The Fed plays with dull levers; Bitcoin writes its own rules.

Never forget: Wall Street embraces crypto fastest when it needs innovation most—but still can't handle the volatility it signed up for.

Weekly Gains Reversed

The latest pullback stands in stark contrast to the prior week, when ETFs saw inflows of nearly $906 million, one of the strongest weekly performances of 2025. Over the past month, however, flows remain negative at – $318 million, highlighting volatile investor sentiment as macro policy shifts weigh on risk assets.

Fed Cut Sparks Mixed Reactions

The Federal Reserve’s decision to trim rates by 25 basis points – its first reduction in 2025 – was expected to buoy risk appetite. Instead, crypto ETFs saw modest outflows, suggesting investors are repositioning rather than committing fresh capital.

Historically, Fed rate cuts have fueled long-term equity rallies, but near-term uncertainty often triggers profit-taking and liquidity reshuffling.

READ MORE:

Year-to-Date Context

Despite the September setback, crypto ETF performance remains resilient. The strongest inflow month of the year was July 2025 (+$11.04B), while February marked the weakest with -$3.3B in net outflows. Analysts caution that macro headlines will likely dictate ETF demand in the weeks ahead, particularly as traders weigh the pace of further Fed easing.

![]()