Sei Network’s Q2 Explosion: DeFi & AI Fuel Unstoppable Momentum

Sei Network just ripped through Q2 with growth that left traditional finance scratching its head. The blockchain platform became the unexpected darling of both DeFi degens and AI innovators—proving once again that while Wall Street debates rate cuts, crypto builds the future.

DeFi Drives Real Utility

Sei's architecture didn't just handle volume—it devoured it. Transactions surged as developers deployed everything from perpetual swaps to yield optimizers, leveraging Sei's parallelized processing to bypass Ethereum's congestion tax.

AI Finds Its On-Chain Home

AI projects flocked to Sei like quant funds to a loophole. The network's low latency became the secret sauce for inference markets and agent-based protocols—because apparently even algorithms prefer cheaper gas fees.

The Ironic Twist

Here's the kicker: this growth happened while traditional VCs were still writing think pieces about 'crypto winter.' Meanwhile, Sei's ecosystem kept shipping, proving that product-market fit beats macroeconomic whining every time. Maybe banks should try building instead of complaining.

Q2 by the Numbers

- SEI price jumped 63.5% quarter-over-quarter, underscoring growing investor demand.

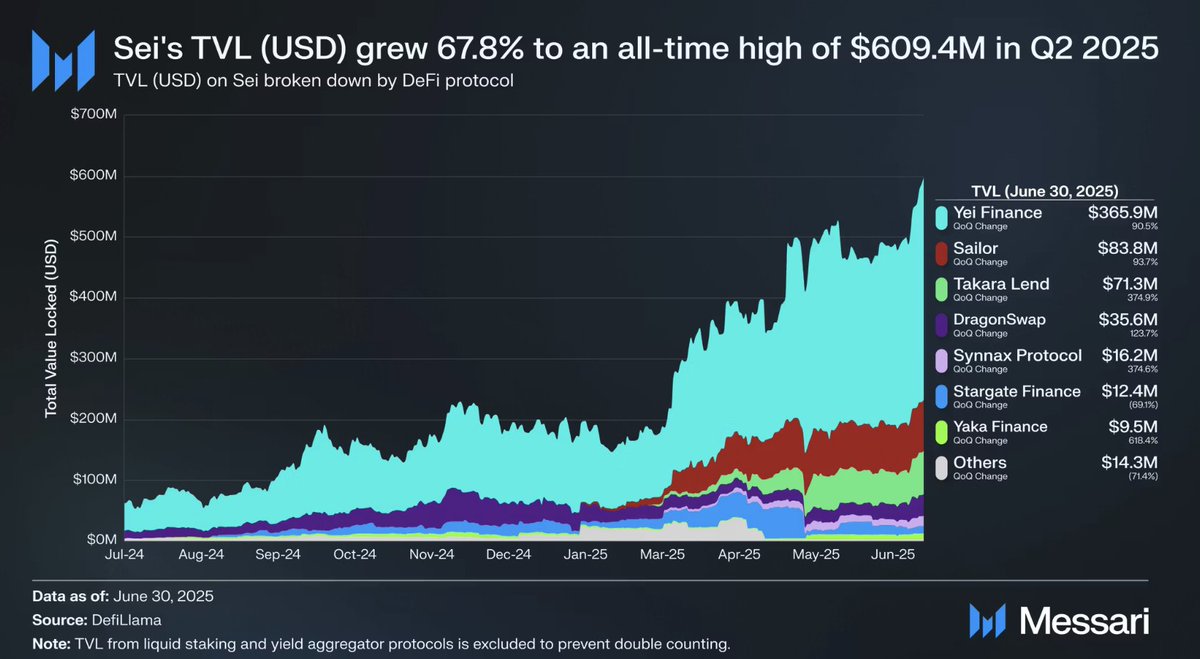

- DeFi total value locked (TVL) surged 67.8%, hitting a record $609.4 million by June 30, 2025.

- Daily active addresses climbed 36.6%, highlighting rising user engagement across the ecosystem.

Much of this growth has been attributed to the network’s transition toward EVM-only compatibility, a MOVE that significantly expands developer access and improves interoperability with Ethereum-native applications.

Driving Forces: DeFi and AI

The largest share of Sei’s TVL is concentrated in Yei Finance ($365.9M), followed by projects like Sailor ($83.8M), Takara Lend ($71.3M), and DragonSwap ($35.6M). Collectively, these DeFi platforms account for the majority of the chain’s activity and liquidity growth.

Alongside DeFi, SEI is also investing in artificial intelligence use cases, with initiatives designed to merge blockchain performance with AI-powered financial tools. This positioning aligns the project with one of the most dominant narratives of 2025: the convergence of AI and crypto.

READ MORE:

Looking Ahead

As Sei gears up for the Giga upgrade, analysts are watching whether the project can sustain its rapid expansion. If momentum continues, Sei could strengthen its position as one of the leading new-generation blockchains bridging DeFi, AI, and EVM compatibility.

![]()