Wall Street Crowns Coinbase the ’Amazon of Crypto’ as Shares Explode to Record Highs

Wall Street's latest darling isn't another tech unicorn—it's the crypto exchange that just shattered expectations.

The Amazon Comparison That Sticks

Analysts draw parallels to Amazon's early dominance, suggesting Coinbase's infrastructure play mirrors the e-commerce giant's ruthless expansion. They're not just trading digital assets—they're building the plumbing for the entire crypto economy.

Market Momentum Defies Traditional Logic

Shares rip through previous resistance levels as institutional money floods into crypto infrastructure. Traditional finance veterans scratch their heads while digital asset natives stack gains—another reminder that Wall Street always arrives late to the party it claims to host.

Regulatory Clouds Can't Dampen the Rally

Even regulatory uncertainty fails to slow the momentum. The SEC's mixed signals on crypto classification seem almost irrelevant when institutional adoption hits critical mass—because nothing moves markets like fear of missing out.

The real story? Traditional finance finally admitting that crypto infrastructure matters more than their skepticism.

Coinbase Extends Rally to Multi-Year Highs

Coinbase gained 5%, reaching its highest level since November 2021 and extending a rally of more than 40% since the Senate passed the GENIUS Act last week. The landmark legislation sets the stage for a comprehensive regulatory framework around stablecoins, a MOVE Wall Street analysts say could unlock new growth for digital assets.

Bernstein’s Gautam Chhugani, who recently branded Coinbase the “Amazon of crypto financial services,” raised his price target on the stock to $510 from $310, assigning it an Outperform rating. Shares hovered near $375 on Thursday, marking a staggering rebound of more than 950% from late 2022 lows when the FTX collapse rocked the industry.

Visit HYLQStablecoin Partnerships Fuel Growth

Analysts say Coinbase’s success is now tied not just to trading but to its expansion into payments and stablecoins. Earlier this month, Shopify partnered with Coinbase and Stripe to enable global stablecoin payments, a development expected to boost mainstream adoption.

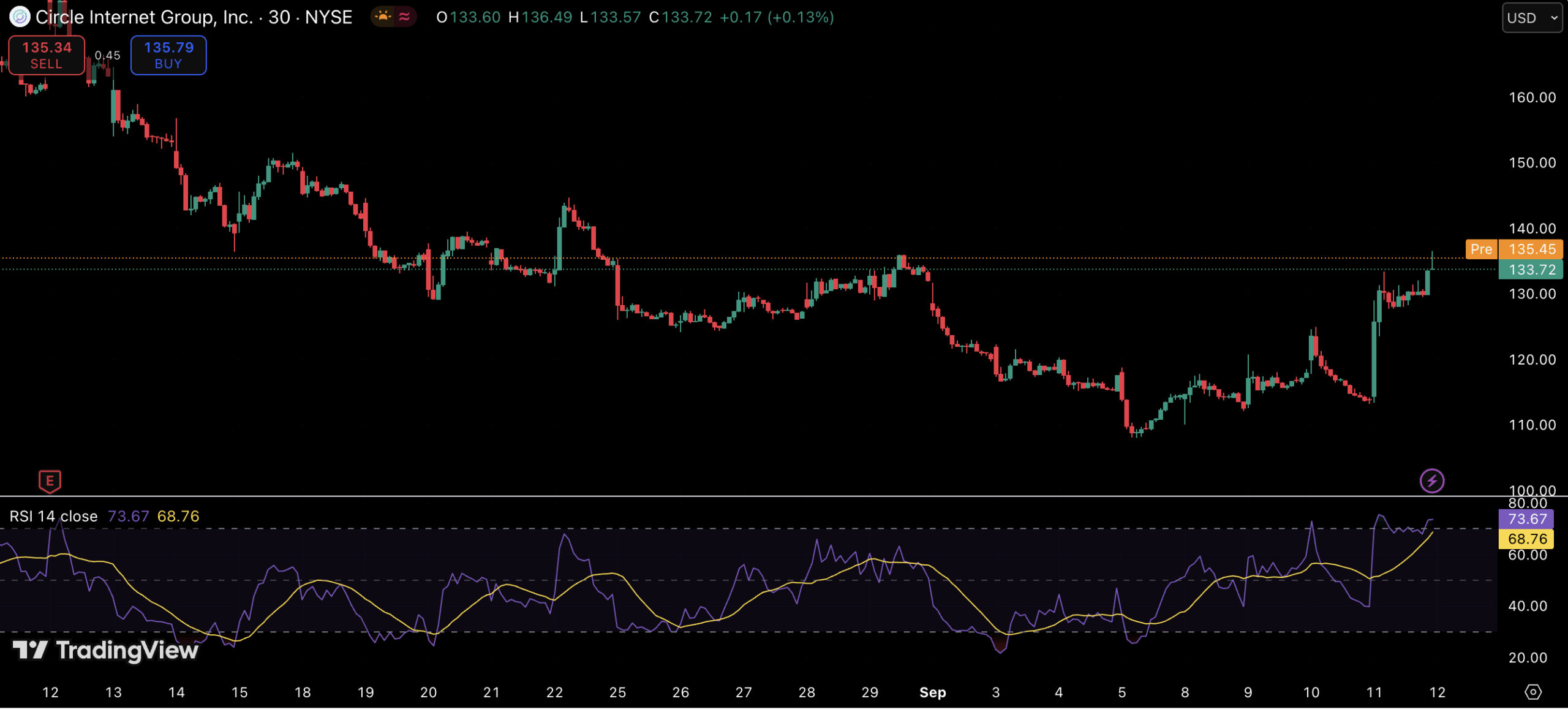

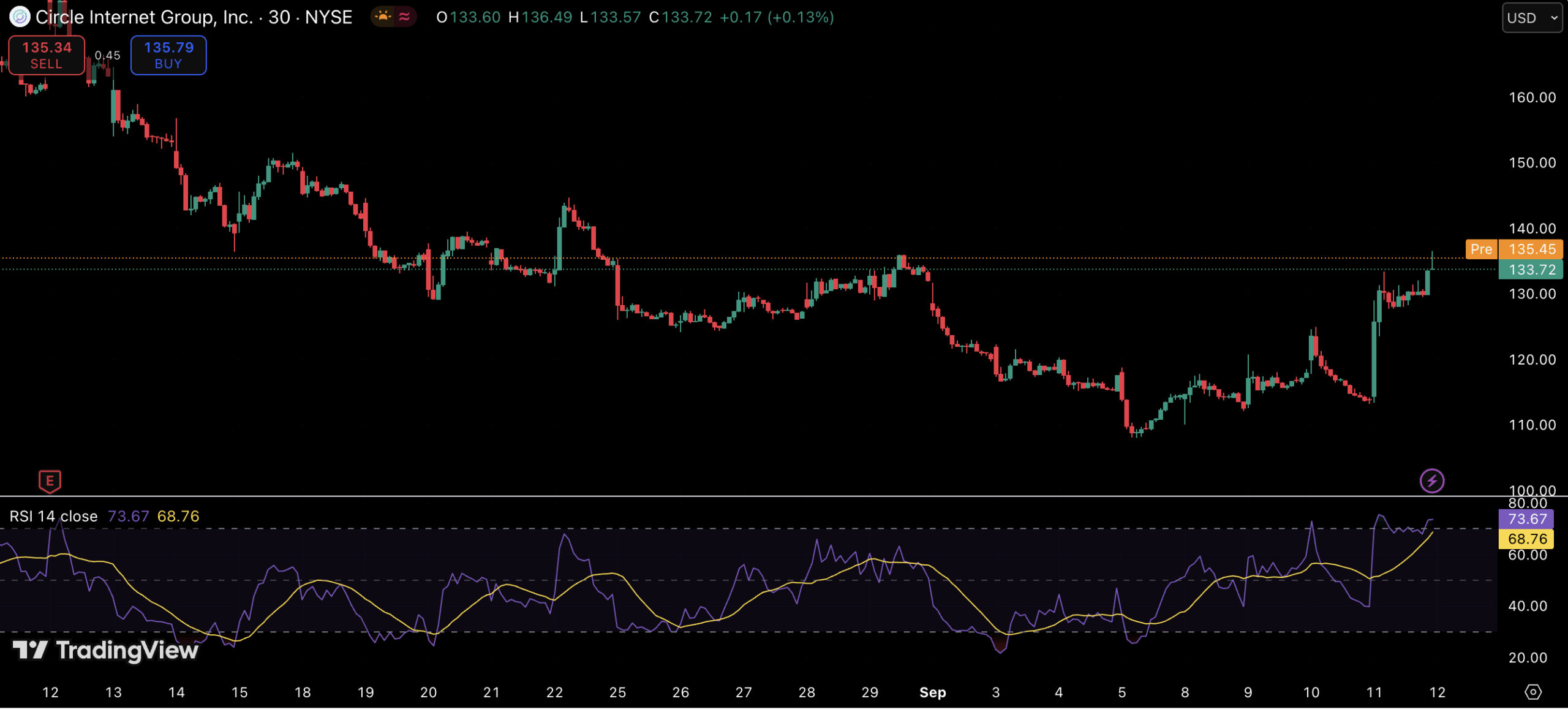

Circle Surges on USDC Demand

Circle, in which Coinbase holds a minority stake, has also emerged as a market favorite. Shares of the stablecoin issuer have surged more than 575% from their IPO price of $31, driven by strong demand for its flagship USDC token. On Thursday, CRCL stock traded around $210.

Bernstein initiated coverage this week with an Outperform rating and a $230 target, highlighting the long-term potential of stablecoins. Chhugani projected that total supply could grow from roughly $225 billion today to as much as $4 trillion over the next decade.

Competition Looms in the Stablecoin Market

Momentum has also been boosted by new entrants. Fintech giant Fiserv recently announced plans to roll out a stablecoin called FIUSD, leveraging infrastructure from both Paxos and Circle. Still, competition remains a looming risk. Compass Point’s Ed Engel warned that increasing entrants could pressure Circle’s market share and trimmed expectations with a Neutral rating and $205 target.

HYLQ’s Bet on Hyperliquid

While Coinbase and Circle dominate headlines, another player is quietly positioning itself within the digital asset economy. HYLQ Strategy Corp, listed on the Canadian Securities Exchange under the ticker HYLQ and trading in the U.S. as HYLQF, has staked its strategy on the Hyperliquid platform.

Hyperliquid, one of the fastest-growing decentralized exchanges, operates on a custom Layer-1 blockchain that leverages HyperEVM technology capable of processing up to 200,000 transactions per second. Transaction volume across the ecosystem has already surpassed $2 trillion.

HYLQ’s approach centers on investment in the $HYPE token, the native asset of the Hyperliquid ecosystem. By doing so, the company not only gains exposure to potential token appreciation but also contributes to the growth of the underlying platform. With scalability and performance at its core, Hyperliquid is being positioned as a future heavyweight in decentralized trading.

Buy HYLQThe Road Ahead

The week’s sharp moves highlight how regulatory clarity and institutional adoption are reshaping the crypto landscape. With Coinbase scaling financial services, Circle riding the global demand for stablecoins, and firms like HYLQ backing next-generation decentralized platforms, the race to define the future of digital finance is accelerating.

For investors, this environment not only boosts confidence in leading exchanges and stablecoin issuers but also shines a light on thethat mirror this momentum and offer exposure without holding tokens directly. As these companies expand their influence and win market share, many traders are starting to compare their growth trajectory with earlier phases of the crypto market itself.

The growing overlap between blockchain-native projects and equity markets underscores how traditional finance is becoming increasingly tied to the evolution of digital assets, giving investors multiple pathways to participate in the sector’s next wave of expansion.

![]()