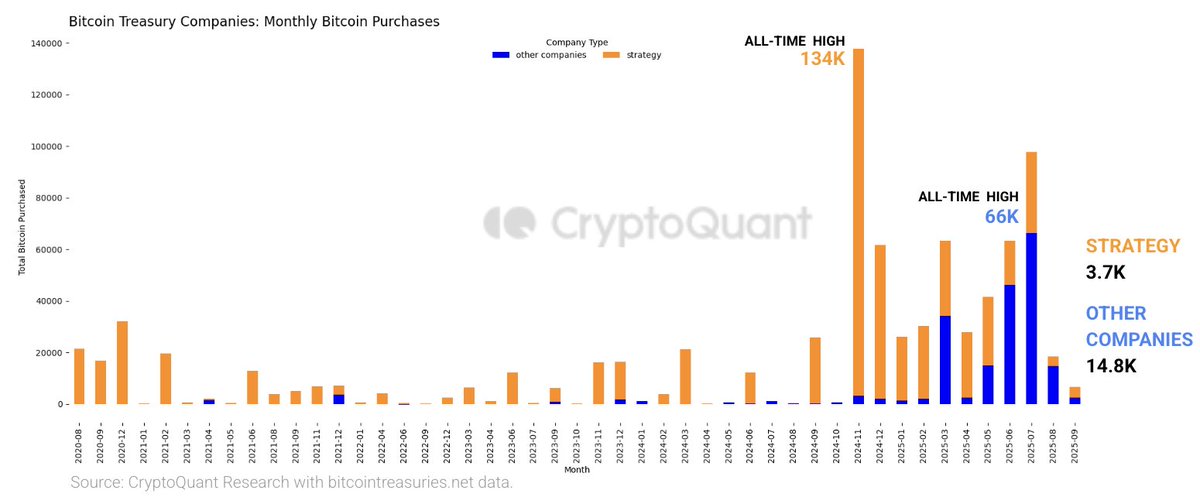

Bitcoin Treasuries Soar to 840K BTC—But Watch for These Cooling Demand Signals

Corporate Bitcoin holdings smash new records—yet momentum may be slowing.

Demand Dynamics Shift

While treasury balances hit 840K BTC, on-chain data and exchange flows hint at institutional accumulation easing up. Large buyers aren’t jumping in like they were—even as Bitcoin flirts with recent highs.

Market Feels the Dip

Fewer big-ticket purchases ripple across liquidity. Bid support weakens slightly—no crash, but less ferocious buying. Classic finance whales love to buy high and panic low, don’t they?

What’s Next?

Keep an eye on macro triggers and ETF flows. Demand might be cooling, but the reservoir of institutional Bitcoin is deeper than ever.

This shift suggests institutions are not pulling back entirely but are buying more cautiously, perhaps waiting for clarity on market direction and regulatory signals. The slowdown is especially notable given the backdrop: U.S. spot bitcoin ETFs launched in late 2024, and Trump’s election win earlier this year added momentum to corporate adoption.

Even with cautious positioning, the broader trend remains clear-corporations continue to treat Bitcoin as a treasury asset. The challenge is that growth is slowing just as Bitcoin hovers NEAR cycle highs. If demand doesn’t pick up, it could temper bullish expectations built on the idea of endless institutional inflows.

READ MORE:

For now, Bitcoin’s corporate treasuries reflect a paradox: record ownership on paper, but waning enthusiasm in practice. The coming months will show whether this is merely a pause before another wave of accumulation-or the first sign that big buyers are reaching their limits.

![]()