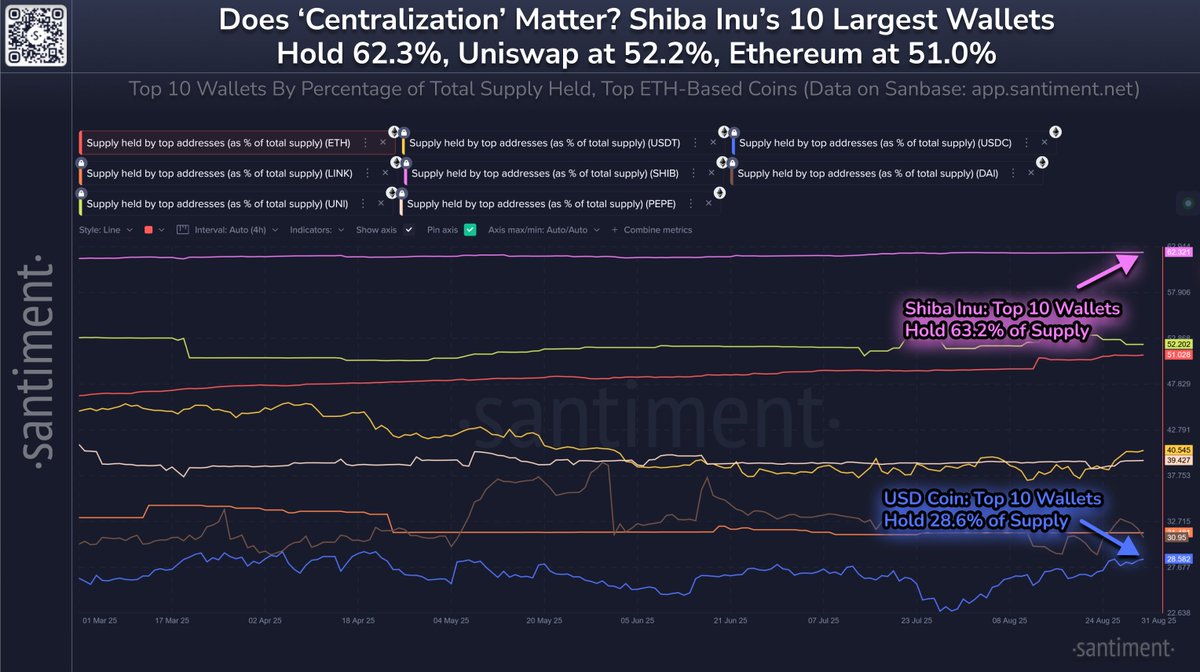

Crypto’s Dirty Secret: Top 10 Wallets Dominate Ethereum, SHIB, and UNI Supply

Crypto's decentralization promise hits brutal reality check as new data reveals staggering concentration of power.

Wealth Gap Goes Blockchain

The top ten Ethereum wallets control enough ETH to make central bankers blush—while SHIB's distribution looks more like a billionaire's playground than a 'people's crypto.' UNI's governance tokens? Concentrated in fewer hands than a private equity firm's Rolodex.

Market makers and early whales hoard supply like digital dragons—creating puppet markets that dance to their whims. Retail traders chase pumps while insiders control the strings.

Decentralization was supposed to be the revolution. Instead, we got the same old wealth distribution—just with fancier technology and better marketing. Wall Street would be proud.

Stablecoins appear less centralized but still show noticeable clustering. For example, USD Coin (USDC) has 28.6% of its supply parked in just ten wallets, according to Santiment’s chart. Other assets, including LINK and PEPE, show varied but notable levels of accumulation among leading addresses.

For traders and investors, this underscores an ongoing debate: does heavy concentration make assets more vulnerable to volatility if a whale decides to MOVE funds, or does it provide stability by reducing available supply on the open market?

READ MORE:

As Ethereum continues to anchor the DeFi landscape, the reality that over half its supply is in the hands of so few addresses will likely remain a focal point in discussions about network resilience, governance, and the very idea of decentralization.

![]()