Network-Based Stablecoins: Can They Really Challenge Tether and Circle’s Dominance?

The stablecoin wars just got interesting—decentralized contenders are mounting their assault on the establishment.

Beyond the Giants

While Tether and Circle dominate headlines with their massive market caps, a new breed of network-native stablecoins is quietly building momentum. These aren't your grandfather's dollar-pegged tokens—they're algorithmically managed, blockchain-native assets that cut out traditional banking middlemen entirely.

Technology vs Tradition

Protocol-controlled value mechanisms allow these upstarts to maintain pegs through code rather than custody. Smart contracts automatically adjust supply—minting when demand spikes, burning when it dips. No bank accounts required, no quarterly audits needed—just pure mathematical enforcement.

The Liquidity Question

But can they achieve critical mass? Network effects matter when traders need deep pools for billion-dollar positions. Existing giants boast established banking relationships—the boring infrastructure that keeps stablecoins stable during market chaos.

Regulatory Roadblocks

Watch for regulatory scrutiny to intensify. Decentralized doesn't mean anonymous when the SEC comes knocking—just ask any project that thought they could outsmart Washington's compliance machinery.

The Verdict

While technologists cheer the innovation, Wall Street veterans smirk—because when the crypto markets crash, everyone still runs to the stablecoins backed by actual dollars in actual banks. Sometimes boring banking beats brilliant code.

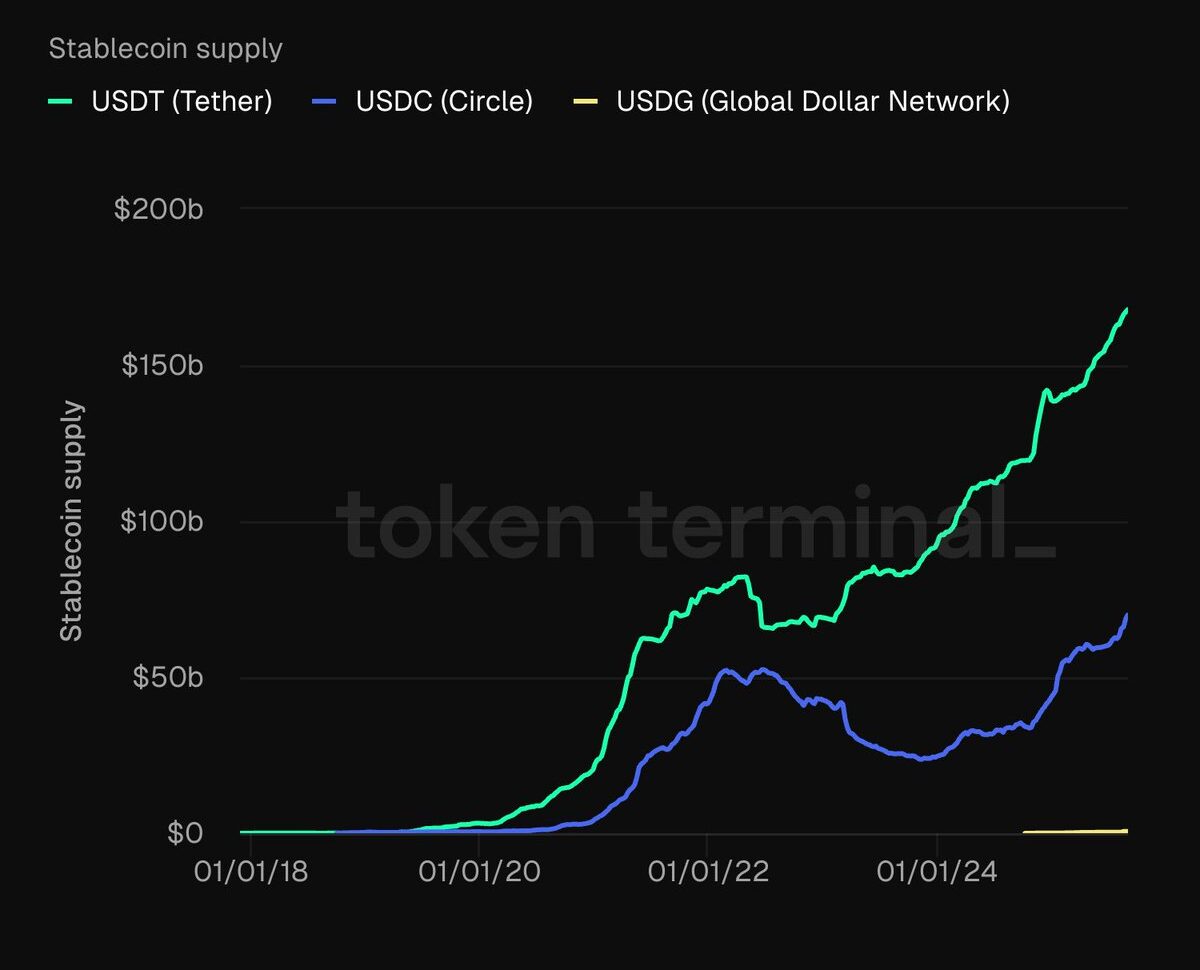

A decade of dominance

According to data from Token Terminal, USDT and USDC have seen exponential growth since 2020. Tether’s supply has surged to around $200 billion, while USDC maintains a substantial share above $60 billion. Their long-standing track records, liquidity depth, and integrations across exchanges have entrenched their positions as the go-to stable assets for traders and institutions.

The network-based model

Unlike traditional issuers that operate centrally, projects such as USDG are experimenting with decentralized, network-based issuance. This approach distributes control and collateral responsibilities across participants, aiming to reduce concentration risk while scaling supply through broader adoption.

READ MORE:

The question posed by Token Terminal is whether this model represents the only competitive pathway for new stablecoins. Given the massive lead of incumbents, challengers may need to rely on network effects, interoperability, and decentralized infrastructure to carve out relevance.

What’s at stake

Stablecoins underpin much of the crypto economy, from trading pairs to payments and DeFi collateral. As regulators intensify scrutiny and competition heats up, the battle between centralized incumbents and decentralized challengers could determine whether the market consolidates further, or evolves into a multi-model ecosystem.

For now, Tether and Circle remain firmly ahead. But as network-based projects gain traction, the next decade may bring a reshuffling of stablecoin power dynamics.

![]()