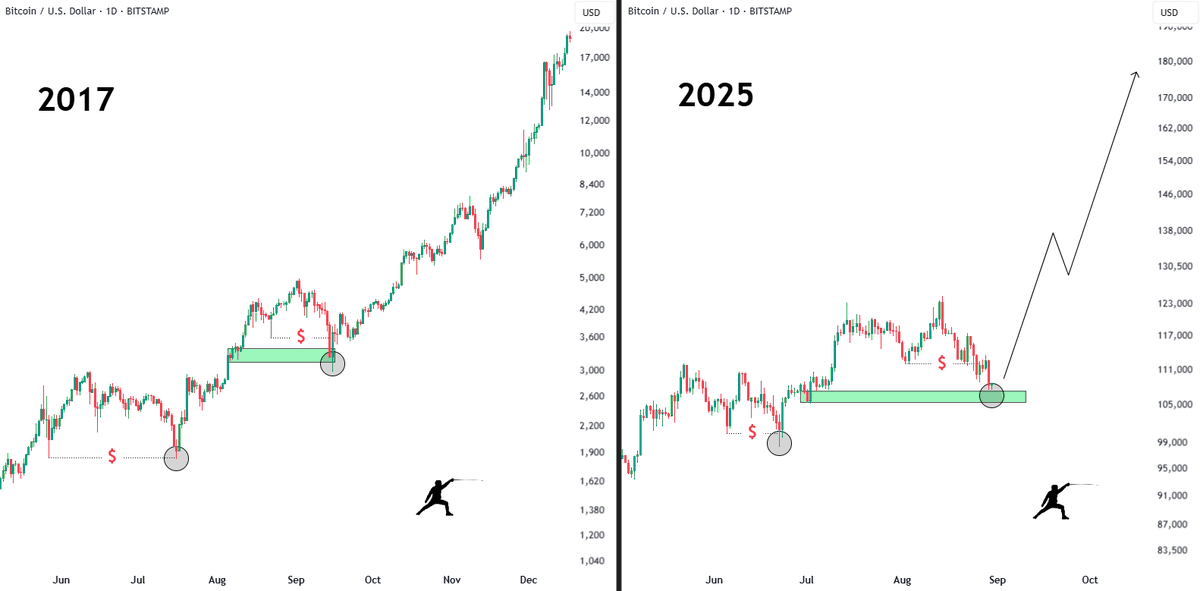

Bitcoin Mirrors 2017 Bull Run—September Slump Looks Unlikely

Bitcoin's price action is tracing the 2017 playbook—and this time, a September sell-off seems off the table.

Patterns Don't Lie

Historical cycles are flashing bullish. The same momentum that drove Bitcoin to its previous all-time high is building again, with key resistance levels breaking one after another.

Market Mechanics in Play

Institutional inflows are stronger, derivatives positioning is healthier, and retail FOMO hasn’t even peaked yet. Unlike 2017, the ecosystem is more resilient—liquidity is deeper, and panic sells get absorbed faster.

Timing the Top? Not So Fast

While some Wall Street analysts still preach caution—because what’s finance without a little unnecessary pessimism?—momentum traders and on-chain metrics suggest the run has room. Key support levels have held, and funding rates remain stable.

So for those waiting for a September dump: don’t hold your breath. History might not repeat exactly, but it sure loves to rhyme—especially when there’s money on the table.

Fencer suggests the 2025 setup is strikingly similar, noting that bears waiting for further downside risk missing the next leg of the bull run.

The latest chart comparison highlights how Bitcoin tends to trap late sellers before igniting its strongest uptrend phase. If the cycle continues to follow the 2017 blueprint, Bitcoin could soon break higher, targeting levels between $160,000 and $180,000.

READ MORE:

While September has historically been a weak month for crypto, current conditions suggest the correction phase is already complete. For investors, this raises the possibility that Bitcoin is entering its vertical growth stage, leaving cautious traders behind as bullish momentum takes over.

![]()