Ethereum Shatters Records with Historic Monthly DEX Trading Volume Surge

Ethereum just rewrote the rulebook on decentralized exchange performance—posting numbers that'll make traditional finance desks blush.

Decentralized Trading Goes Supernova

DEX volumes aren't just climbing—they're exploding past previous ceilings. Ethereum's network handled more trading activity this month than many small countries' stock exchanges. Traders flocked to decentralized platforms, bypassing traditional gatekeepers entirely.

The Institutional Tidal Wave

Smart money finally gets it. Why wait three days for settlement when Ethereum delivers finality in minutes? The volume spike signals more than retail enthusiasm—it's hedge funds and crypto natives moving big without asking for permission.

Finance's Ironic Twist

Wall Street still charges 2% management fees for underperforming the S&P while Ethereum's open infrastructure generates actual value—and actually settles trades. The old guard's watching from the sidelines as their 'risky' asset class out-engineers their entire legacy system.

This isn't a fluke—it's the new normal. Trading volume doesn't lie, even when traditional finance does.

Ethereum reclaims dominance

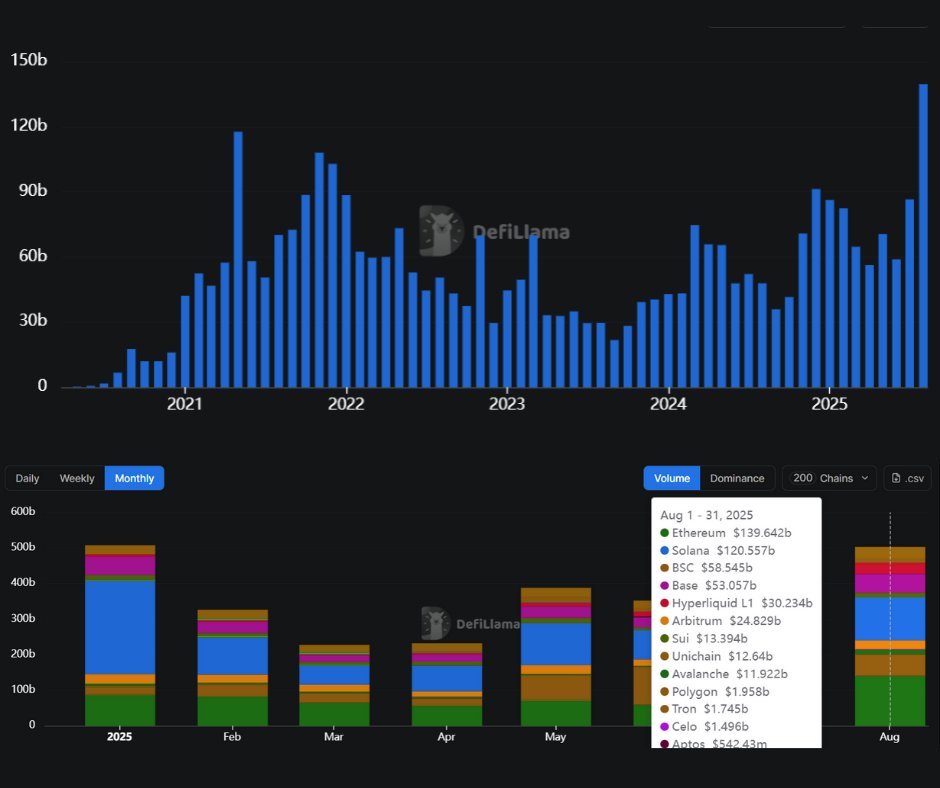

Themarks Ethereum’s strongest month ever for DEX activity, pushing it firmly ahead of Solana, Binance Smart Chain (BSC), and other competitors. solana secured the second spot with $120.57 billion, while BSC followed with $58.45 billion. Ethereum’s robust liquidity and deep DeFi ecosystem continue to set the standard for on-chain trading, solidifying its role as the leading Layer-1 network for decentralized finance.

Expanding ecosystem impact

Ethereum’s dominance comes at a time when new scaling solutions and Layer-2 integrations have improved user experience. Platforms such as Arbitrum ($24.8B), Base ($53B), and Polygon ($15.9B) also contributed significant volumes, highlighting Ethereum’s expanding reach through its broader ecosystem.

Notably, Base and Hyperliquid saw sharp growth, with Base capturing $53.05 billion in August, reflecting the growing adoption of Coinbase’s Layer-2 chain and its role in expanding Ethereum’s transaction capacity.

Competitive landscape

While Solana has remained a formidable challenger with its low-fee environment and growing DEX ecosystem, Ethereum’s established infrastructure, developer base, and institutional integration give it a sustained edge. Analysts argue that Ethereum’s ability to maintain this level of activity despite rising competition demonstrates the strength of its network effects.

READ MORE:

Outlook

The surge in DEX activity reinforces Ethereum’s central position in DeFi and could attract more liquidity providers and institutional players into the ecosystem. If Layer-2 scaling continues to reduce costs while maintaining security, ethereum may sustain its lead well into 2026.

![]()