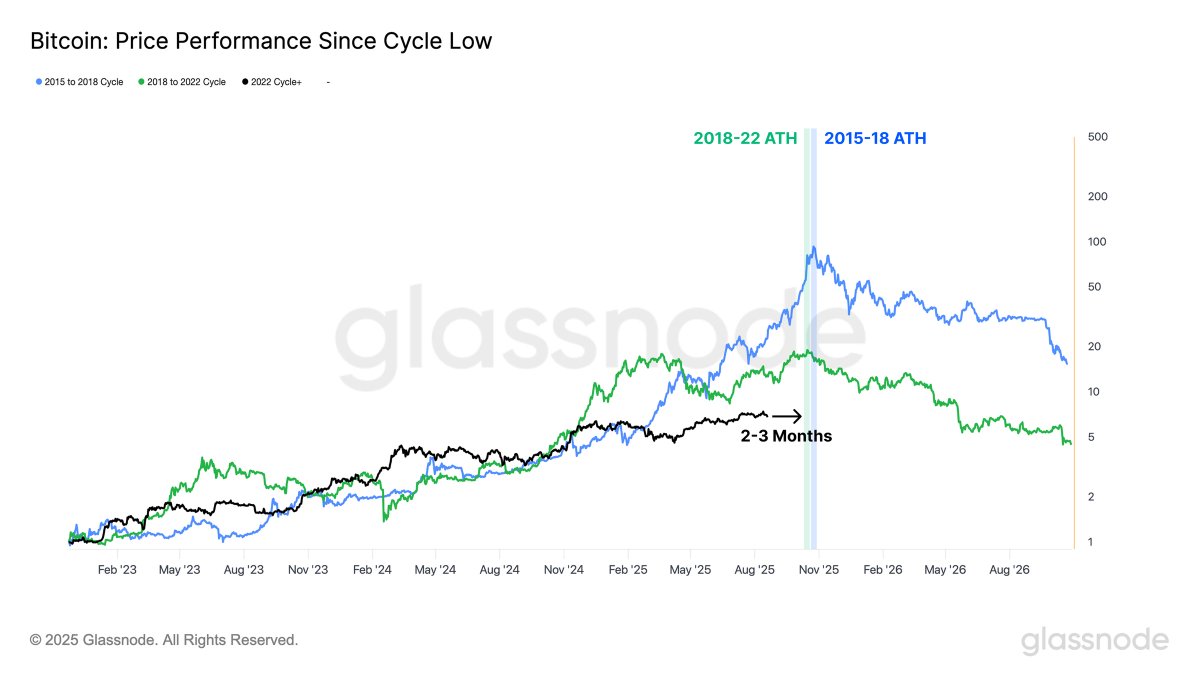

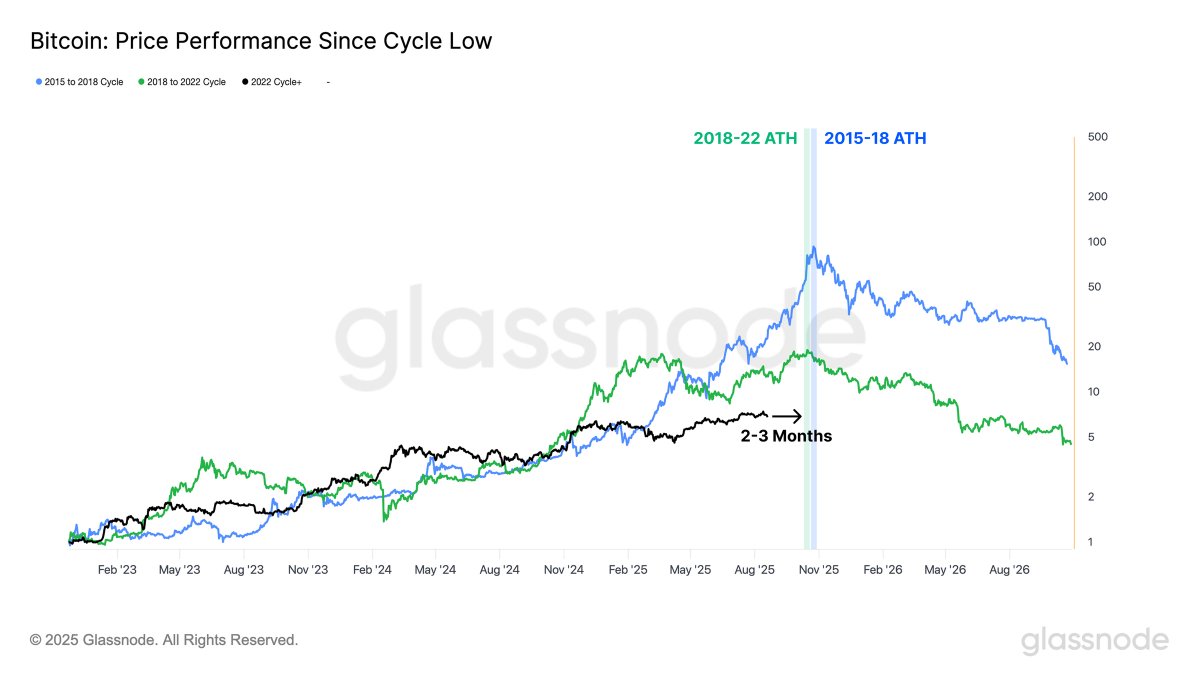

Bitcoin’s Historical Cycle Points to New All-Time Highs Within Months

Bitcoin's cyclical patterns suggest the crypto king could smash previous records sooner than many expect—just as traditional finance finally starts pretending to 'get it.'

Timing the Peak

Historical data doesn't lie—unless you're a Wall Street analyst adjusting EBITDA. Bitcoin’s four-year cycle, tied to its halving events, has consistently preceded major bull runs. If history holds, we’re on the brink of another explosive phase.

Market Momentum Builds

Institutional adoption isn’t just a buzzword anymore—it’s a floodgate. BlackRock’s ETF success, corporate treasuries dipping toes, and even pension funds sneaking in allocations… the smart money is positioning, not asking for permission.

Retail’s Delayed FOMO

Mainstream investors remain cautiously optimistic, which is code for ‘waiting to buy the top.’ By the time CNBC runs all-day Bitcoin coverage, the early birds will have already feasted.

Regulatory Wildcards

Sure, the SEC still seems to regulate by mood ring, and politicians love to announce ‘frameworks’ right before elections. But clarity—or the lack thereof—hasn’t stopped Bitcoin before.

So buckle up. The charts are hinting, the cycle is aligning, and the only thing surer than new all-time highs is some bank CEO calling it a ‘fraud’ right before launching their own crypto division.

Elevated activity signals heat

Analysts at Glassnode highlighted the importance of the timing, noting that current conditions already feature heightened speculative trading and aggressive profit-taking.

While history is not a guaranteed guide, the convergence of cycle patterns with market behavior is attracting close attention from traders and institutions alike.

A repeat or a divergence?

The data underscores how bitcoin continues to move within a rhythm of multi-year expansions and corrections. Still, with macroeconomic factors such as interest rate cuts and liquidity injections in play, some argue this cycle could evolve differently from those in the past.

READ MORE:

For now, the takeaway is clear: Bitcoin is entering a historically sensitive window, and the next 2–3 months could determine whether the cycle extends to new highs or cools prematurely.

![]()