Bitcoin Shatters $116,800 Barrier as Powell’s Fed Pivot Ignites Crypto Frenzy

Jerome Powell just handed crypto bulls the rocket fuel they've been waiting for.

The Federal Reserve's unexpected policy shift sends traditional investors scrambling for digital safe havens—and Bitcoin's leading the charge.

Market Momentum

Powell's dovish turn triggers institutional floodgates. Hedge funds and corporate treasuries pivot hard into digital assets, chasing yields that traditional markets haven't delivered since pre-2008.

Technical Breakout

Bitcoin smashes through resistance levels like they're made of paper. The $116,800 milestone isn't just a number—it's a psychological wrecking ball swinging through Wall Street's skepticism.

Regulatory Tailwinds

The Fed's softening stance pressures global regulators to accelerate crypto frameworks. Suddenly, everyone's playing catch-up while early adopters count their gains.

Because nothing makes regulators move faster than watching bankers miss out on triple-digit returns while they debate compliance paperwork.

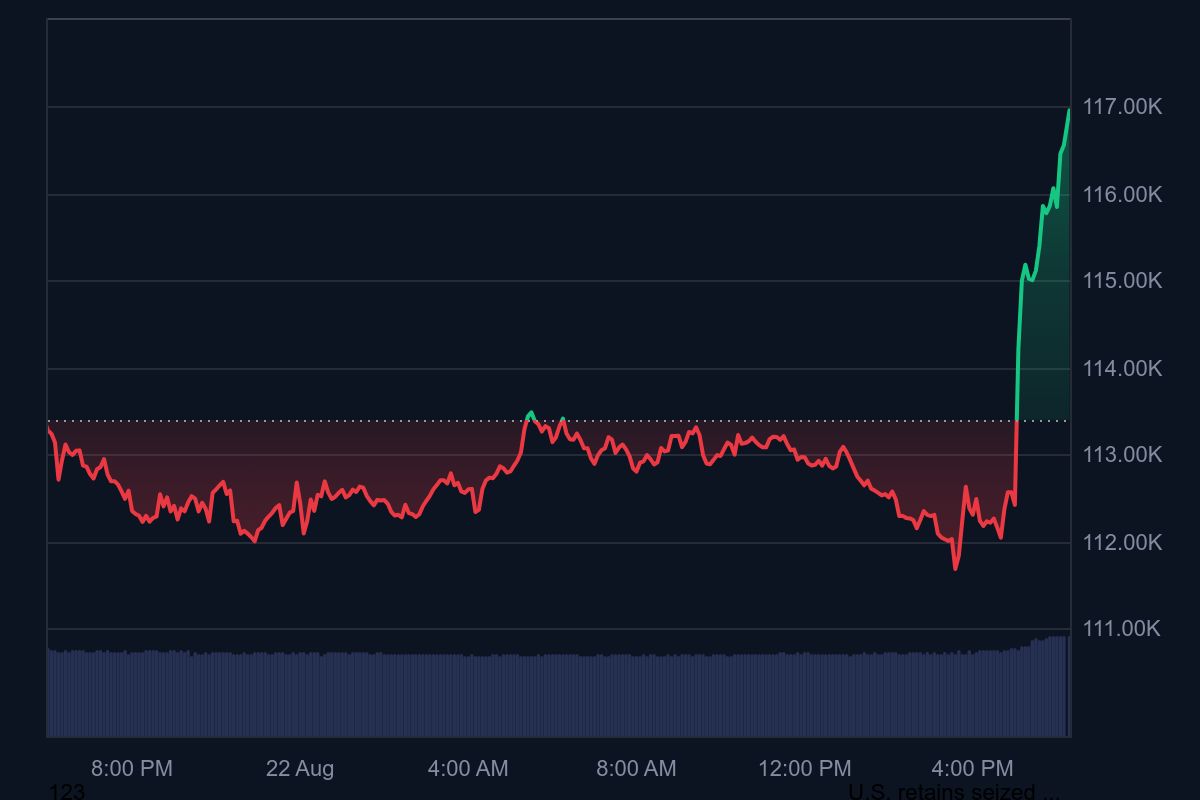

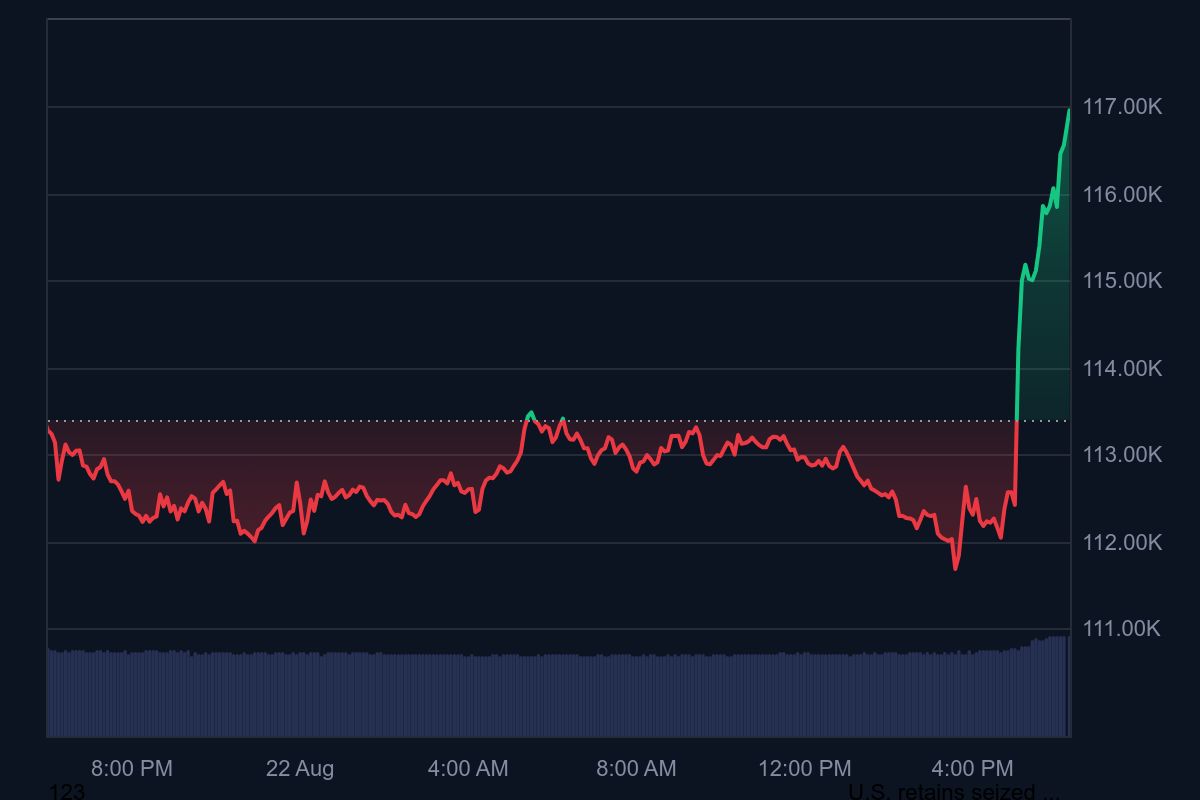

Bitcoin price action

According to CoinMarketCap, Bitcoin is trading at $116,890, up 3.5% in the past 24 hours. Its market capitalization now exceeds $2.32 trillion, while daily trading volume jumped to $69.13 billion, a 15.3% increase from the previous session.

With 19.9 million BTC already in circulation and only 21 million total supply, the supply squeeze narrative continues to underpin price momentum. Analysts highlight that macro-driven rallies often amplify Bitcoin’s role as a “scarcity asset,” attracting institutional buyers during liquidity shifts.

Powell speech sets the tone

At the Jackson Hole summit, Powell noted that monetary policy is already in restrictive territory and flagged the potential for interest rate cuts in the coming months. Markets reacted swiftly, with the CME FedWatch tool showing a 91% probability of a September cut.

While equities gained broadly – the Dow Jones climbed 732 points – bitcoin outperformed as investors rotated into assets seen as hedges against both inflation and monetary debasement.

Outlook for Bitcoin

Bitcoin’s sharp breakout above the $115,000 resistance zone now places the next technical target NEAR the $120,000 level, where traders expect heavy profit-taking. If momentum holds, analysts suggest BTC could test new all-time highs before year-end.

Still, short-term volatility remains likely, particularly as macroeconomic data and Fed commentary continue to drive investor sentiment. Yet, with liquidity conditions easing and institutional inflows persisting, Bitcoin appears poised to remain one of the primary beneficiaries of Powell’s policy pivot.

Bitcoin’s rally underscores its unique position in global markets: a scarce, decentralized asset that thrives in times of monetary transition. Powell’s Jackson Hole speech may have sparked Wall Street’s rally – but Bitcoin is stealing the spotlight.

![]()