Crypto Buybacks Explode: Protocols Pour $40M Into Token Repurchases to Fortify Markets

Protocols unleash massive buyback spree—market mechanics get a $40 million adrenaline shot.

The Repurchase Rampage

Forget subtle market moves—this isn't some timid corporate stock buyback program. Crypto protocols just deployed $40 million in capital to snatch their own tokens off the open market. That kind of aggressive purchasing doesn't just signal confidence—it actively soaks up supply and pressures shorts.

Market Mechanics on Steroids

Token buybacks function like turbocharged share repurchases—except there's no SEC watching, no quarterly earnings calls, and definitely no boardroom bureaucracy. Protocols deploy treasury funds, execute transparent on-chain purchases, and often burn the tokens—permanently reducing circulation while demonstrating tangible value support.

Smart Money or Desperate Measure?

Some call it strategic price defense; others whisper about protocol desperation. Either way, $40 million doesn't just vanish into the order books—it creates instant buying pressure, rewards long-term holders, and signals that development teams actually believe in their own economics. Unlike traditional finance's buyback theater, these moves happen on-chain for everyone to audit—no shady off-exchange deals here.

When protocols buy their own tokens, they're not just supporting price—they're making a public bet on their own survival. Try finding that level of conviction in your average S&P 500 boardroom—most executives won't even hold their stock through a lockup period.

According to tracking data from Dune, Hyperliquid dominated last week’s activity, accounting for $24 million in repurchases. Meme-focused launchpad Pump followed with an additional $10 million, underscoring how even community-driven platforms are adopting buyback strategies to strengthen token value.

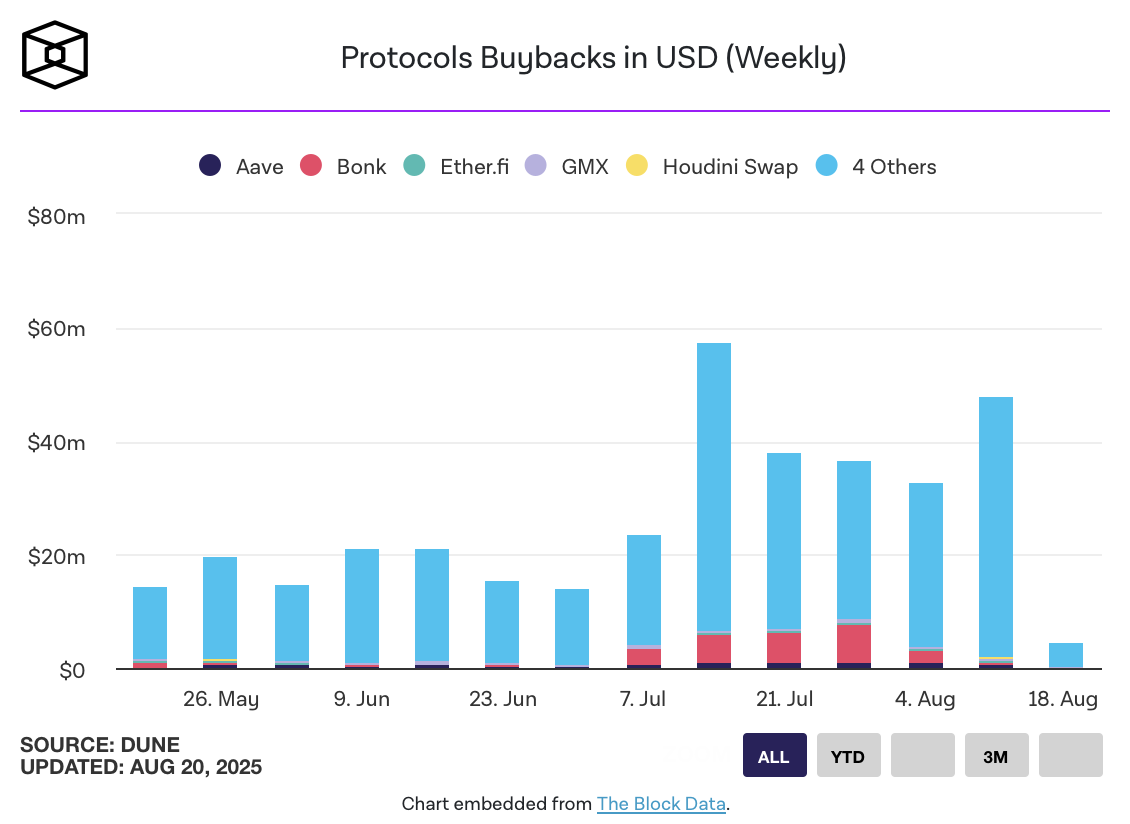

Weekly charts show that buyback activity has spiked several times since early July, with peaks exceeding $50 million on multiple occasions. Much of this activity has come from high-revenue protocols, suggesting that consistent fee generation is enabling projects to recycle capital back into their ecosystems.

READ MORE:

Industry observers point out that these repurchases serve multiple purposes. Beyond tightening supply, buybacks can send a signal of confidence from Core teams, potentially attracting outside investors during uncertain market conditions. However, skeptics warn that buybacks alone cannot offset broader macroeconomic pressures or prolonged downturns in crypto markets.

Still, the rising scale of these programs suggests they are becoming a staple in the sector. With buyback totals now regularly surpassing tens of millions each week, protocols are positioning themselves to weather volatility while laying the groundwork for long-term token sustainability.

![]()