Altcoin Season Alert: Coinbase Spots Early Surge Signals

Hold onto your memecoins—the altcoin pumps are coming.

Coinbase's latest market pulse suggests we're entering the 'greed phase' of crypto cycles, where speculative altcoins start outpacing Bitcoin. Ethereum leads the charge with DeFi tokens and layer-2 projects hot on its heels.

Watch the ETH/BTC ratio

Historically, when Ethereum starts gaining against Bitcoin, it drags the rest of the altcoin market up with it. This time? The ratio just punched through a 3-month resistance level.

Retail's back—and so are the bagholders

Trading volumes for small-cap tokens spiked 40% this week. Cue the 'when lambo' crowd rediscovering leverage—just in time for the usual pre-halving volatility. Never change, crypto.

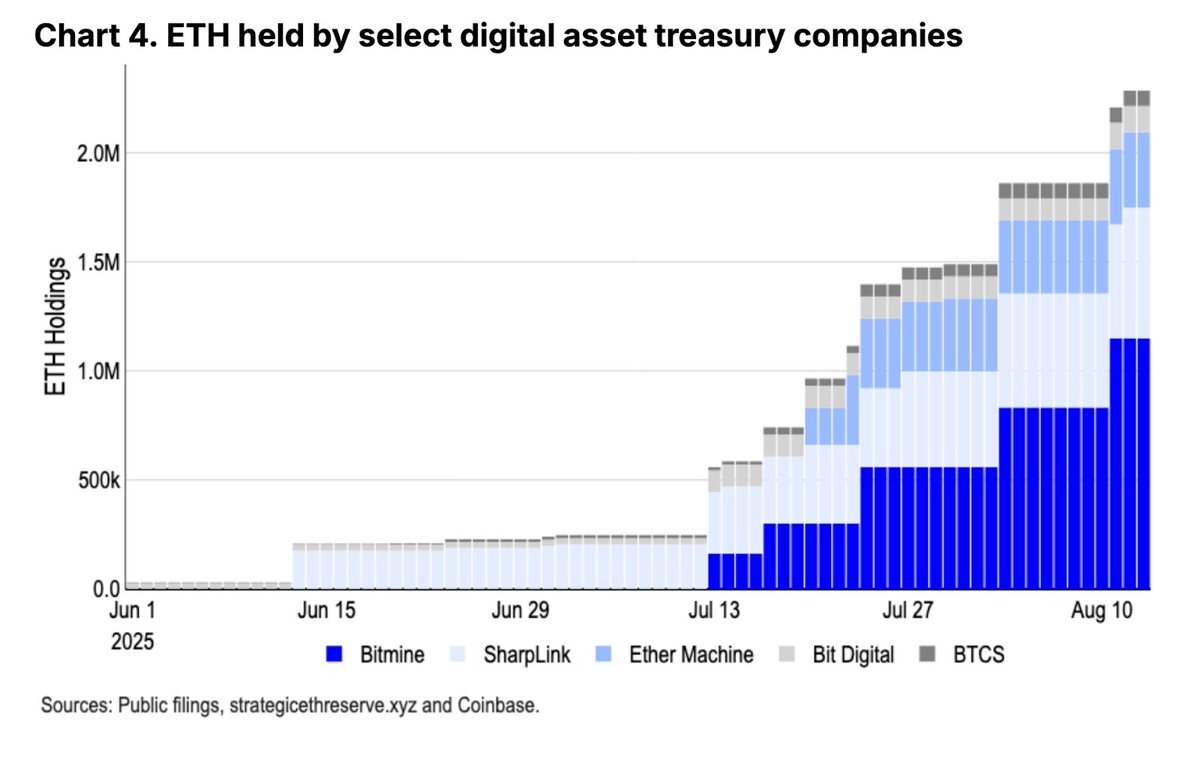

ETH emerges as the frontrunner for institutional allocations

One of the clearest signs of this shift is the rapid accumulation of ethereum by corporate digital asset treasuries. Since early June, holdings by firms such as Bitmine, SharpLink, Ether Machine, Bit Digital, and BTCS have surged past two million ETH, according to public filings tracked by Coinbase. Much of this buying has been tied to narratives around stablecoins and digital asset treasuries, both of which have been gaining traction with institutional allocators.

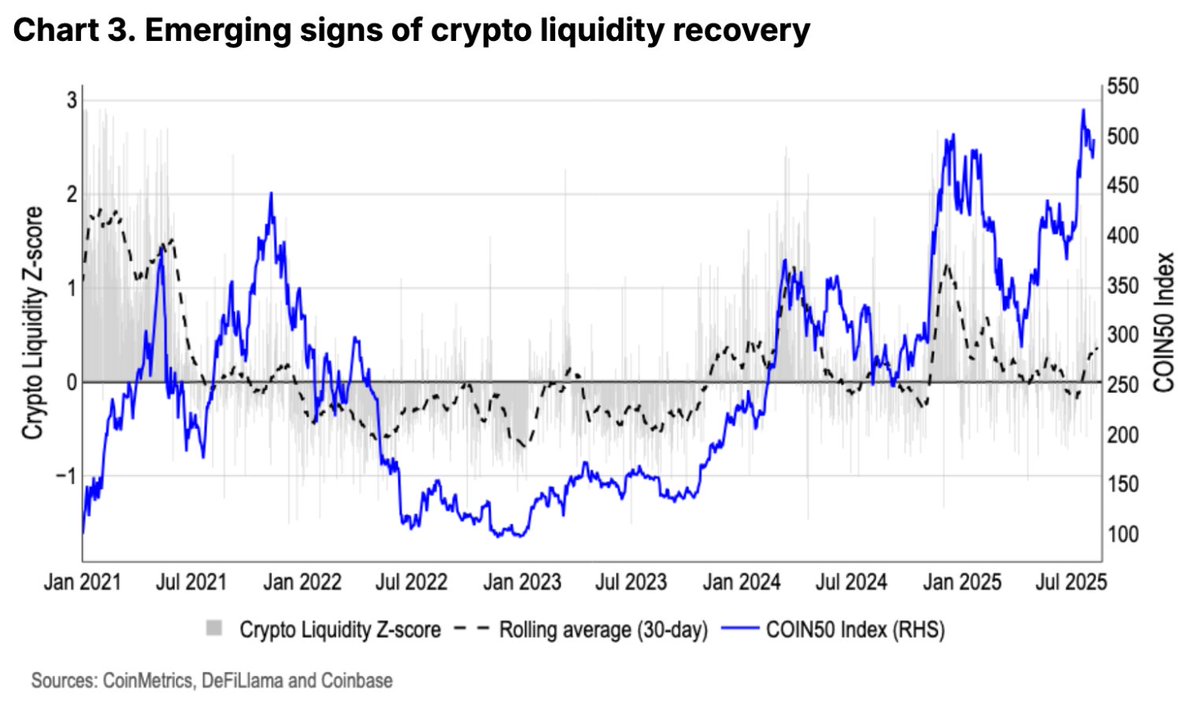

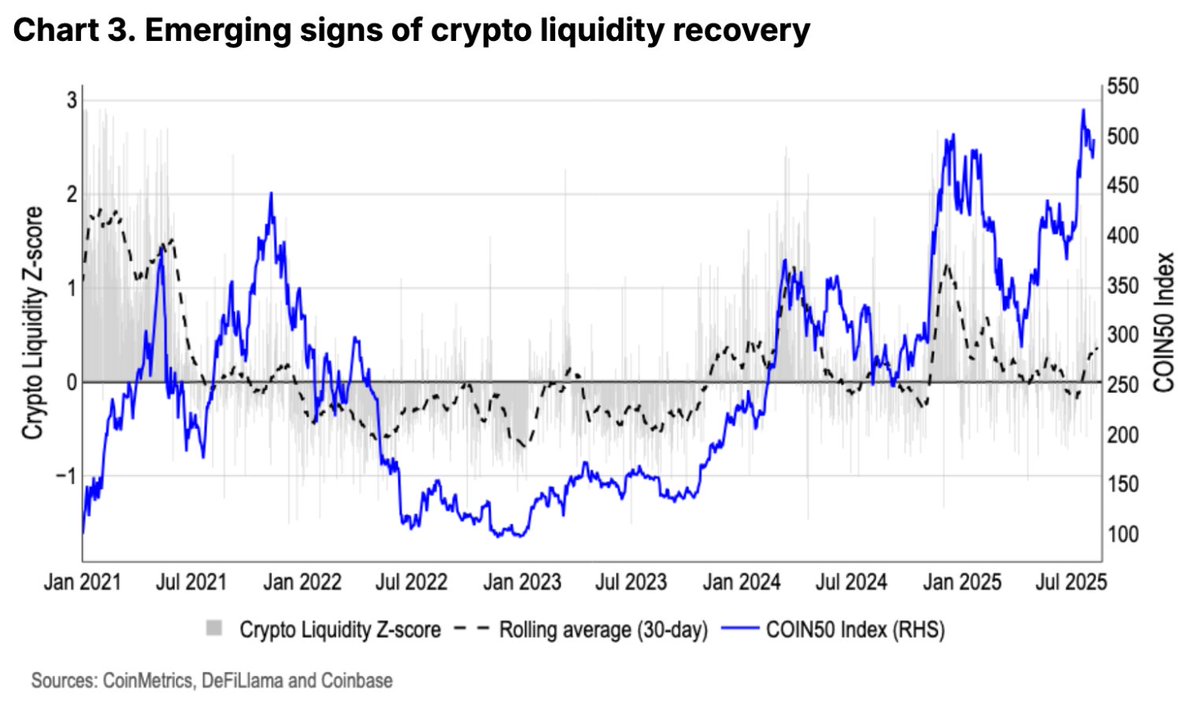

Liquidity recovery changes the market mood

After half a year of steady decline, crypto liquidity metrics are turning positive. Coinbase data shows improvements in trading volumes, order book depth, and net issuance of stablecoins. Analysts attribute the rebound partly to a friendlier regulatory environment, which has encouraged market makers and long-term participants to re-enter with greater conviction. This shift could provide the necessary fuel for sharper altcoin rallies if momentum holds.

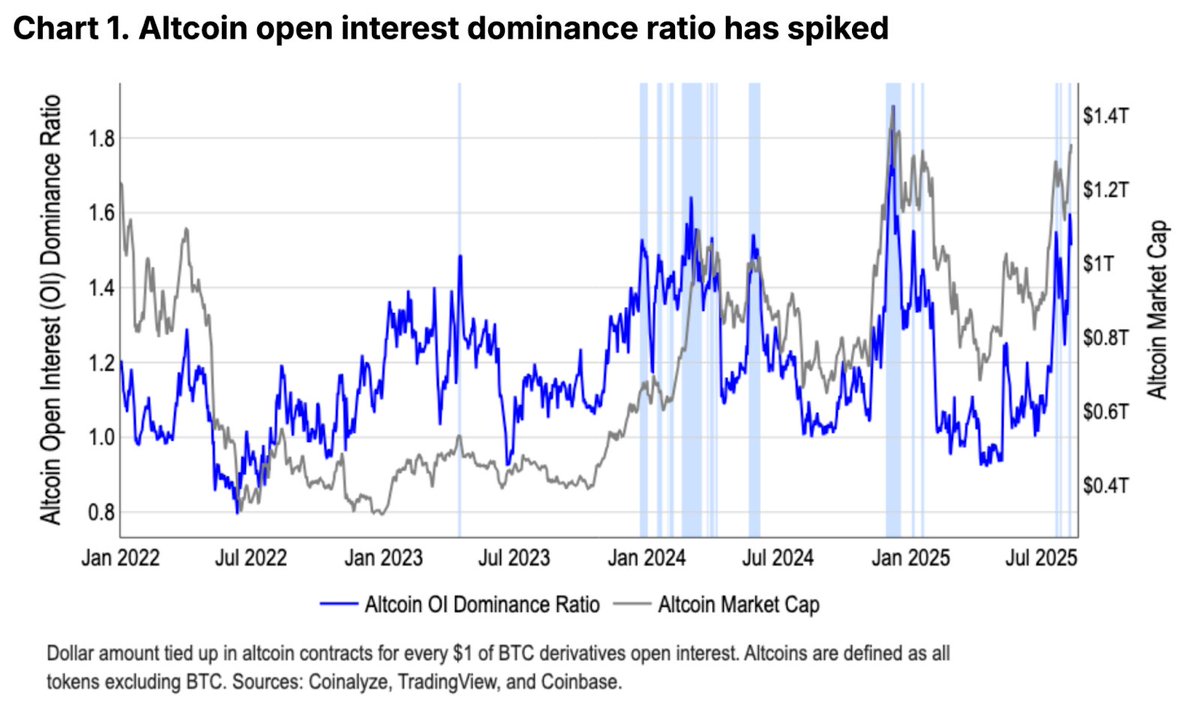

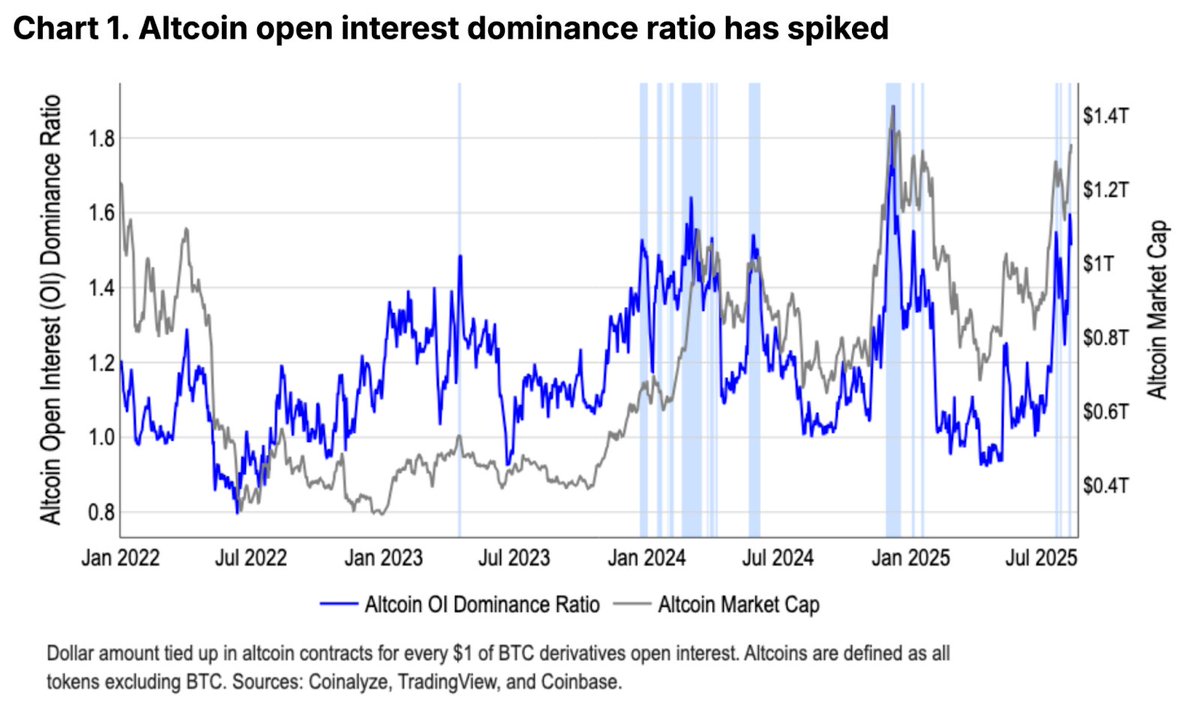

Leverage and positioning point to an altcoin rotation

Open interest dominance in altcoin derivatives has also spiked, signaling that traders are increasingly willing to position for outsized moves outside Bitcoin.

READ MORE:

While the Altcoin Season Index still sits at 40% – well below the 75% threshold marking a confirmed season -a projected liquidity wave in late Q3 to early Q4 could accelerate rotation into smaller-cap assets.

Macro tailwinds set the stage for Q3 and beyond

Coinbase’s latest outlook points to potential Federal Reserve rate cuts and regulatory advancements as catalysts for the next growth phase. With institutional demand for ETH rising, liquidity recovering, and derivatives markets heating up, conditions are forming for a more sustained altcoin cycle.

If these trends continue into September, the market could be on the verge of its most significant altcoin season since 2021—only this time, institutions may be leading the charge.

![]()