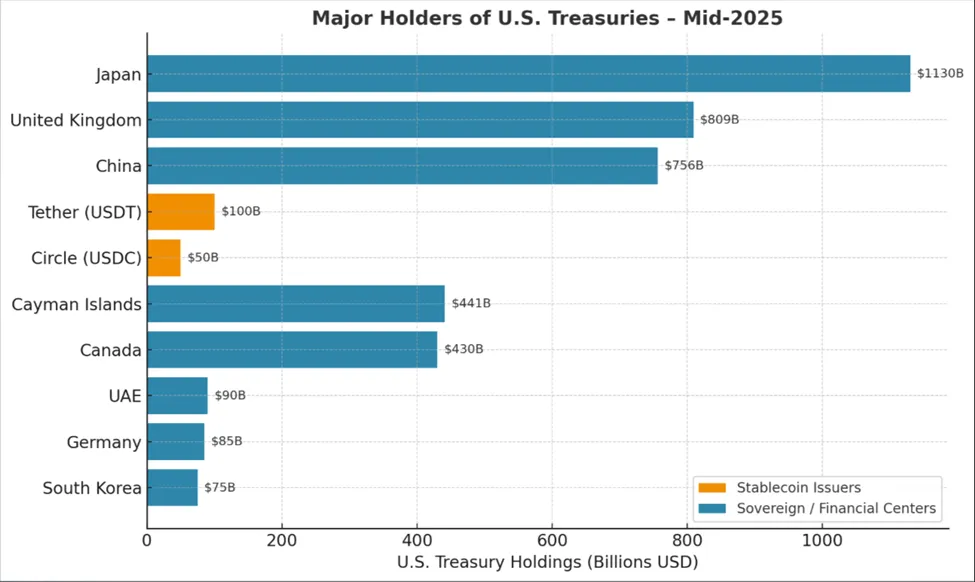

Stablecoins Now Hold More U.S. Debt Than Most Countries—And Nobody Noticed

Move over, Japan and China. There’s a new heavyweight in U.S. Treasury holdings—and it’s not even a country.

Stablecoins have quietly amassed a pile of U.S. debt that dwarfs most sovereign nations. The dollar-pegged tokens now hold more Treasuries than economic powerhouses like Germany or India. Who needs a central bank when you’ve got algorithmic stability?

The irony? Traditional finance still dismisses crypto as a ‘niche asset class’—while it quietly eats their lunch. Maybe those ‘stable yields’ aren’t so imaginary after all.

The shift comes as major U.S. debt buyers like China and Japan reduce holdings, leaving room for new, unconventional buyers. Advocates see stablecoin issuers as reliable, long-term purchasers that can bolster the dollar’s global dominance. Skeptics, however, caution that such reliance on a still-young sector could amplify market risks if confidence falters.

READ MORE:

From trading floors to corporate treasuries, what began as a crypto convenience is now influencing U.S. bond market dynamics – a sign that stablecoins’ role in mainstream finance is no longer a question, but an inevitability.

![]()