Bitcoin’s Meteoric Rally Under Threat: Economist Flags Nasdaq Correlation Risk

Bitcoin’s bull run is hitting all-time highs—but one economist sees storm clouds gathering. The crypto king’s fate might be tied to an unlikely suspect: the Nasdaq.

When Stocks Sneeze, Crypto Catches a Cold

Traditional markets are flashing warning signs, and Bitcoin—despite its 'digital gold' narrative—isn’t immune. If tech stocks stumble, expect crypto to face a reckoning.

The Fragile Dance of Risk Assets

Institutional adoption? Sure. But when liquidity tightens, everything correlated gets sold. Even your precious Satoshis.

Closing Thought: Wall Street’s 'diversification' playbook looks suspiciously like herd mentality with extra steps.

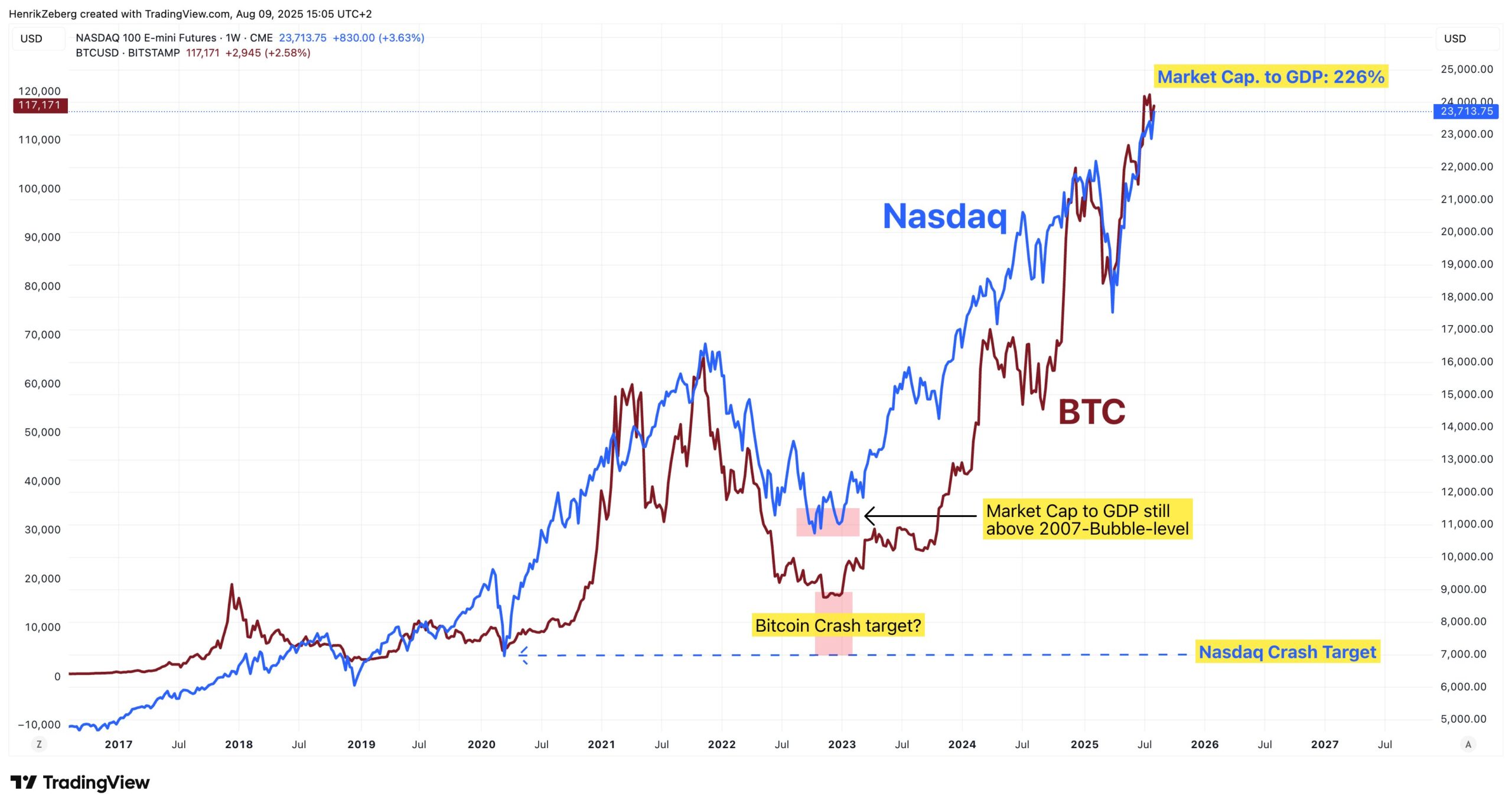

Instead of acting as a safe-haven asset, Bitcoin has tracked the boom-and-bust cycles of high-growth stocks for years. Zeberg warns that a significant drop in the Nasdaq, especially during an economic slowdown, could spark a rapid sell-off in crypto.

READ MORE:

For now, bitcoin remains above $110,000 alongside record equity highs. But Zeberg believes this could be the final stage of the rally, with any bubble burst potentially wiping out gains far faster than they were made.

![]()