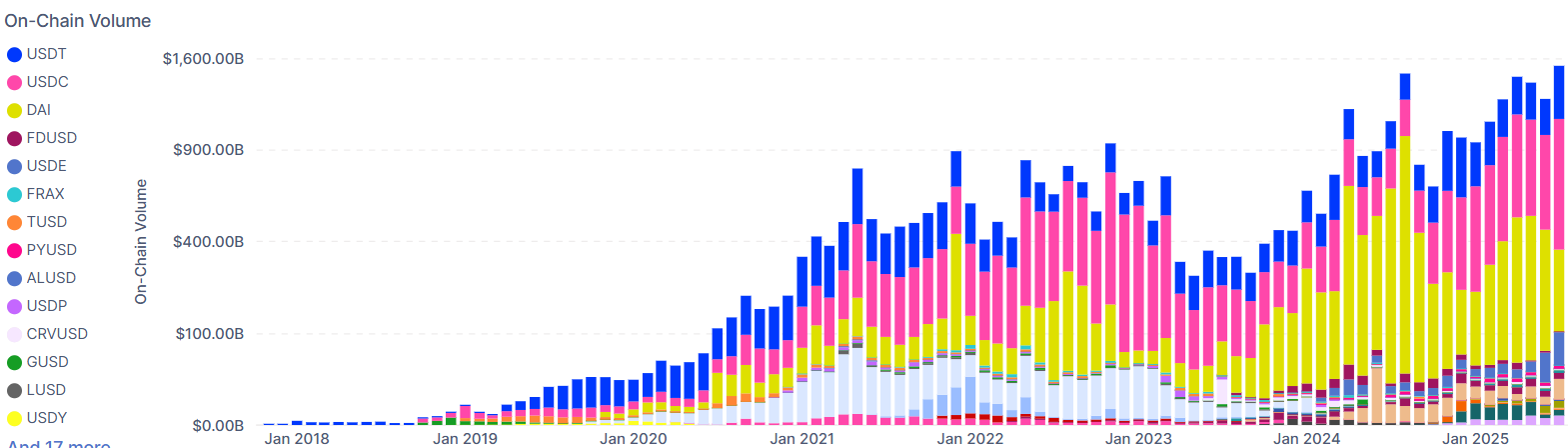

🚀 Stablecoins Smash $1.5 Trillion in Monthly Volume—Cementing Crypto’s Dominance in Global Finance

Stablecoins just flexed their utility muscles—processing over $1.5 trillion in on-chain volume in a single month. Traders, institutions, and even skeptical regulators are taking notice.

Why this milestone matters: The surge isn’t just hype. Stablecoins now handle more settlement volume than some legacy payment rails—while Wall Street still debates 'blockchain adoption.'

Behind the numbers: No flukes here. Demand for dollar-pegged assets in DeFi, remittances, and arbitrage keeps climbing—even as traditional banks slap on 3-day holds for 'security.'

The irony? These 'volatile crypto' instruments are now the most reliable liquidity bridges in finance. Tell that to your boomer uncle still waiting for his ACH transfer.

One thing's clear: when fiat rails creak, stablecoins don’t just compete—they dominate.

USDT and USDC Dominate Activity

Asin Sentora’s volume breakdown, USDT continues to lead, clearing over $1.6 trillion in cumulative on-chain transactions. USDC follows closely as the second-largest contributor, showcasing growing demand for both centralized and decentralized stablecoin options.

Recent months also saw noticeable increases in usage for stablecoins like FDUSD and DAI, indicating a broader diversification in user preference across ecosystems. Smaller players such as FRAX, TUSD, and PYUSD also registered modest but growing activity, pointing to continued innovation and fragmentation within the space.

READ MORE:

Driving Forces Behind the Surge

Several macro and sector-specific factors appear to be fueling this upswing:

- Regulatory clarity in key markets like the U.S. and Europe.

- The GENIUS Act, signed into law on July 19, established clear federal guidelines for stablecoins and digital asset-backed financial products. The legislation includes reserve requirements and Federal Reserve oversight, a framework likely to foster deeper institutional trust and long-term stability in the sector.

- Increased adoption of stablecoins in cross-border payments, DeFi protocols, and remittance platforms.

The data also suggests that stablecoins are playing a bigger role in enabling liquidity and settlement across Layer-1 blockchains, DeFi apps, and centralized exchanges.

The Rise of the “Stablecoin Summer”

The historic volume milestone has been dubbed part of a broader trend that Sentora refers to as #StablecoinSummer—a period characterized by rapid capital inflows into stablecoin infrastructure and usage. This comes as financial institutions and fintech platforms increasingly explore integrations with on-chain stable assets.

![]()