Bitcoin’s August Showdown: Plunge to $100K or Skyrocket to $125K?

Bitcoin traders are buckling up for a wild August as the king of crypto teeters between two extremes—a gut-wrenching drop to $100K or a euphoric surge past $125K. Market sentiment? Split down the middle like a DeFi fork.

The Bull Case: Institutional FOMO Meets Scarcity

With spot ETF inflows hitting record highs and the halving’s supply squeeze in full effect, whales are placing bets on a parabolic move. One hedge fund manager quipped, 'We’re either early or very wrong—our risk models can’t tell anymore.'

The Bear Trap: Liquidity Crunch Looms

But dark clouds gather as overleveraged longs face margin calls. 'The $100K support isn’t just technical—it’s psychological,' warns a veteran trader. 'Break that, and we’re back to arguing about 'store of value' while bags get heavier.'

Meanwhile, traditional finance pundits are suddenly experts—again—on why 'this time it’s different.' Spoiler: Their 2017 'bubble' hot takes aged like milk left on a mining rig.

Bitcoin Looks Shaky Amid Ongoing Consolidation Period

Bitcoin is down about 1% in the past day and 4% for the past week. It’s still up over the last 30 days, but the recent pullback has wiped out a solid chunk of gains.

The coin’s market cap has taken a hit too, slipping to about $2.26 trillion, and traders aren’t exactly piling into Leveraged positions – open interest in perpetual futures has been steadily declining.

But despite this cool-off, some analysts aren’t worried yet. crypto Rand, for instance, recently pointed out that underlying demand for Bitcoin is pretty strong. According to his tweet, buyers keep stepping in during these dips, which typically means there’s bullish momentum beneath the surface.

Even so, if you’re checking the charts daily, you’ve probably noticed that technical signals are mixed. There’s no clear short-term trend, and Bitcoin’s just bouncing around, waiting for a catalyst to drive price in either direction.

Is BTC Headed for $100K or $125K This August?

Let’s talk about the big question: is Bitcoin more likely to drop to $100,000 or surge toward $125,000 this month? Dropping to $100,000 WOULD mean a 12% decline from where we’re at now, putting BTC at its lowest level since June. Meanwhile, a rally to $125,000 would be a 10% climb – and it would mark a fresh all-time high.

Right now, the upside target has a lot going for it. That’s because Bitcoin’s daily chart is still trending upward. It keeps forming higher highs and higher lows – classic bull market behavior.

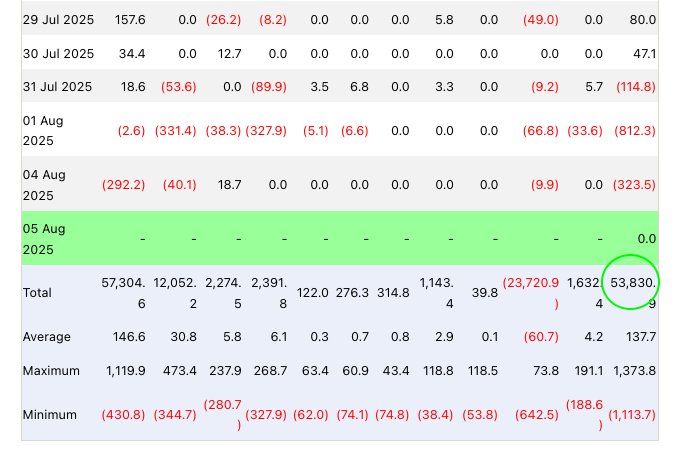

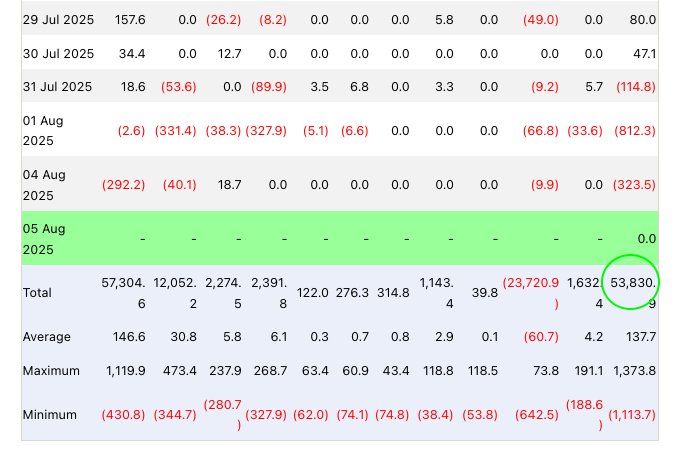

Then you’ve got institutions throwing their weight behind Bitcoin. Spot BTC ETFs have raked in over $19 billion in inflows this year alone, and $53 billion since they went live, meaning these funds now own roughly 6.8% of all Bitcoin in circulation. Big money keeps pouring in, and that’s often a sign that BTC will keep rising.

Plus, the Fed might lend a helping hand. If inflation data comes in weaker than expected, the chance of a rate cut in September increases, creating a risk-on environment. When considering all this, it’s far more likely that Bitcoin pushes higher this month than breaks down.

Bitcoin Hyper Set to Benefit If BTC Breaks Higher as Presale Hits $7M Milestone

If Bitcoin does make a MOVE upward this month, projects tied to it – like Bitcoin Hyper – could see a surge in interest. Bitcoin Hyper is a new Layer-2 network aiming to solve some of Bitcoin’s most frustrating problems: slow transactions, high fees, and a lack of smart-contract capabilities.

But unlike other scaling solutions you’ve seen before, Bitcoin Hyper takes an unusual approach. It uses ZK-rollups and integrates the Solana VIRTUAL Machine (SVM), allowing developers to create fast, flexible apps similar to those found on Solana.

You take your BTC, bridge it trustlessly onto the Bitcoin Hyper network, and then it can be used across DeFi, NFTs, staking, or even gaming apps. When you’re done, your BTC can easily bridge back out – no worries about losing custody.

Bitcoin Hyper’s presale has already raised $7 million, showing real excitement from early investors. And it makes sense why: the more Bitcoin’s price rises, the more valuable the BTC bridged into Bitcoin Hyper’s ecosystem becomes.

Higher prices mean more users, more liquidity, and stronger demand for the HYPER token itself. It’s a positive feedback loop that YouTuber Borch Crypto thinks could lead to “100x” returns for presale investors.

Ultimately, if we see another BTC breakout, traders will be looking for low-cap altcoins that could capitalize – especially ones linked to Bitcoin. HYPER fits that bill perfectly, making it a clever play if BTC stays bullish.

Visit Bitcoin Hyper Presale

![]()