Top Cryptos to Buy in August 2025 as Bitcoin Mining Difficulty Hits Record Highs

Bitcoin miners just got handed their toughest challenge yet—and savvy investors are pivoting fast.

With BTC's mining difficulty scaling new peaks, altcoins are stealing the spotlight. Here's where the smart money's flowing as the crypto ecosystem adapts.

The Mining Squeeze Play

When Bitcoin's algorithm tightens the screws, historically two things happen: weaker miners fold, and capital migrates to assets with better risk-reward ratios. This isn't your 2021 bull run—this is survival of the most efficient.

Altcoins Poised for Breakouts

Ethereum's Shanghai upgrade finally put yield-hungry institutions at ease. Meanwhile, Solana keeps eating market share with sub-penny transaction fees that make TradFi brokers blush.

And let's not forget the dark horse: Monero's hash rate surge suggests privacy coins aren't just for crypto-anarchists anymore—they're for anyone who read their bank's last privacy policy update.

The Institutional Wildcard

BlackRock's BTC ETF approval was just the opening act. Now every hedge fund manager who mocked crypto in 2022 is quietly accumulating positions—right after telling clients it was 'just a speculative bubble.'

One thing's certain: when mining gets harder, portfolios need to get smarter. The question isn't whether to diversify—it's which assets will crush it in the next 12 months.

Relief Ahead? Bitcoin Mining Difficulty Expected to Drop 3% Next Week

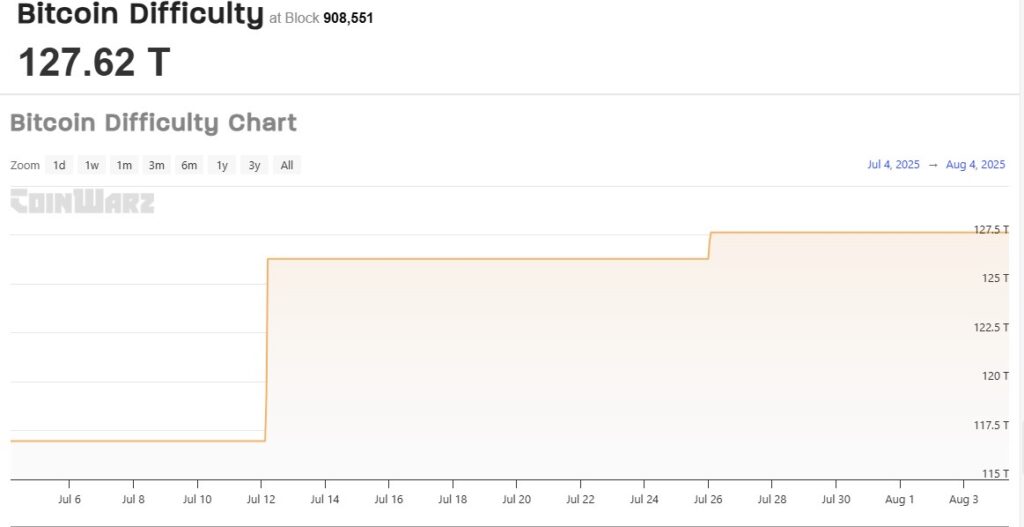

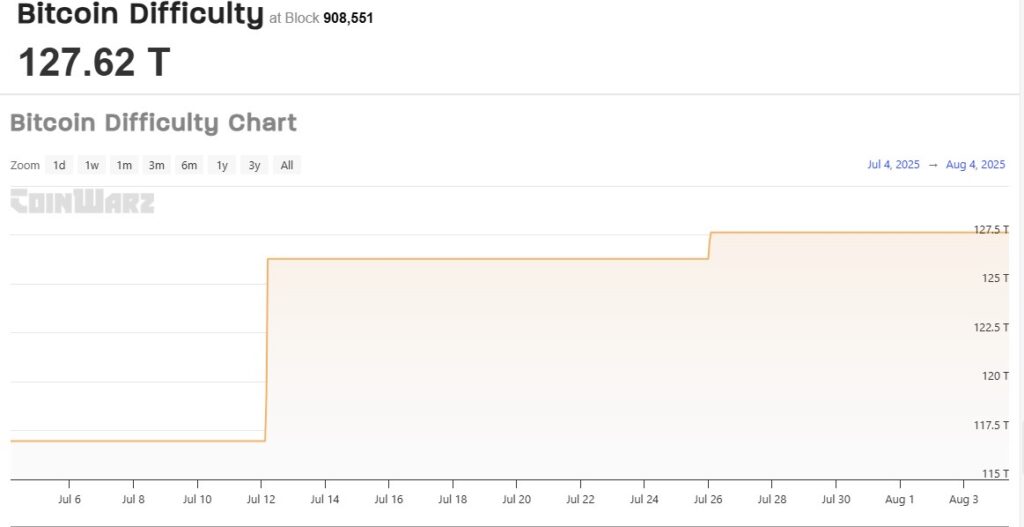

Bitcoin mining just got tougher. Data shows the network’s difficulty has hit a record 127.6 trillion, breaking past highs. This briefly pushed Bitcoin’s price to $113,005 before settling NEAR $113,250.

Surprisingly, the total computing power (hashrate) securing the network has actually dropped below 900 EH/s. That’s a step back from early 2025’s peak above 950 EH/s.

Rising electricity costs in major hubs like Texas and Washington seem to be the main culprits. This, combined with smaller, less efficient miners shutting down, is putting real pressure on operations.

It shows how tightly linked energy prices, hardware efficiency, and Bitcoin’s rewards really are. The hashrate dip naturally sparks concerns about security risks like “51% attacks.”

However, experts widely see such an attack as highly unlikely, requiring immense resources and coordination.

The situation is further complicated by increasing regulatory scrutiny. US authorities are examining mining’s environmental impact, leading to tighter rules.

Meanwhile, China continues restricting mining in areas with grid strain or strong environmental goals, forcing many miners to relocate.

There’s a potential break coming. Analysis suggests mining difficulty could drop by around 0.33% on August 9th. This is part of Bitcoin’s regular adjustment process every two weeks.

While helpful, this adjustment may come too late for some. Older, less efficient miners face a serious challenge. As difficulty rises, so do costs. Staying profitable is getting harder, especially for those with outdated gear.

Best Crypto to Buy Now

The sharp increase in mining difficulty and rising operational costs highlight the growing importance of efficiency and adaptability for the long-term success of any crypto asset. As block rewards decrease and network stability becomes a priority, investors are turning their attention to projects designed to perform well under challenging conditions. This shift is helping to identify the best crypto to buy now.

TOKEN6900

With a $5 million hard cap, TOKEN6900 presents itself as a potential alternative to Bitcoin, particularly as investor concerns grow around Bitcoin’s network stability and security. It brings a raw, honest approach that sets it apart.

Unlike newer meme coins packed with ambitious promises, TOKEN6900 keeps things brutally simple. It offers no utility, no roadmap, and no long-term vision. Frankly, it doesn’t pretend to.

Instead, it leans entirely into speculation and community hype, aiming for explosive gains after launch. This stripped-back strategy seems to resonate: it hit $1 million in presale funding in under two weeks.

Visually, the project embraces its rough edges. The website feels intentionally outdated, think basic graphics and meme overload. Compared to flashier rivals, TOKEN6900 stands out by offering nothing tangible. Even its tokenomics section feels like an inside joke. Yet, its community sees real potential here.

Token6900 going worldwide pic.twitter.com/PokE3Z78Zk

— Token6900 (@Token_6900) August 3, 2025

Notably, TOKEN6900 follows industry standards where it counts. Smart contracts underwent audits by Coinsult and SolidProof, two respected names adding a LAYER of trust to this otherwise unconventional launch.

Buy TOKEN6900Bitcoin Hyper

Built for a more sustainable future, Bitcoin Hyper uses a decentralized, non-custodial bridge at its core. This allows users to convert native BTC into wrapped tokens compatible with the Layer 2 network. As older systems face increasing challenges, its advanced design provides a strong and reliable alternative.

![]()

![]()

Once wrapped, one can dive into SVM-powered applications: high-speed DeFi platforms, NFT marketplaces, games, lending protocols, and swaps.

$HYPER is tackling Bitcoin’s biggest limitations with a new Layer 2 solution built on the Solana VIRTUAL Machine (SVM). This integration aims to bring Solana’s speed, think fast transactions, low fees, and robust programmability, directly to Bitcoin’s ecosystem. It’s a technical leap many believe Bitcoin sorely needs.

Right now, Bitcoin’s base layer is painfully slow and functionally rigid. Developers can’t easily deploy smart contracts or build scalable dApps natively. While rock-solid as digital gold, it’s famously inflexible.

$HYPER changes that equation. By merging Bitcoin’s unmatched security and decentralization with SVM’s agility, it opens the door to a truly programmable future for Bitcoin.

Look out Meme world..$HYPER is taking over. ⚡️https://t.co/VNG0P4FWNQ pic.twitter.com/er9XciLyJp

— Bitcoin Hyper (@BTC_Hyper2) August 2, 2025

Once the process is complete, funds can be withdrawn seamlessly. The Layer 2 converts wrapped tokens back to native BTC and sends them directly to the original wallet. Simple, secure, and designed to feel effortless.

Buy Bitcoin HyperSnorter

The crypto trading bot market is huge, valued at $40 billion, but most bots can’t handle today’s volatile meme coins. When new tokens can explode 50x in hours, traders need lightning-fast execution, not clunky web interfaces built for a slower era.

![]()

![]()

Snorter (SNORT) is the Telegram-based solution that has already raised $2.6 million in presale, with analysts predicting major momentum after listing. Clearly, traders are hungry for something faster and smarter.

What sets Snorter apart is its all-in-one integration of DEX tools directly within Telegram. The wallet, token scanner, trade executor, and risk controls all operate within a single chat window. It’s structured like a race car dashboard, placing everything needed for precision trading in one accessible place.

Its automated sniping is equally impressive: load a token address, and the bot buys the instant liquidity appears. The built-in scam detector adds crucial protection, catching 85% of honeypots and rug pulls in beta tests before they endanger your funds.

According to popular YouTuber ClayBro, Snorter is among the top three altcoins identified by Grok AI with strong potential to deliver significant returns.

What truly sets Snorter apart? It’s building a real business, not just hype. The revenue model fuels ongoing development, covers exchange listing fees, and enables future token buybacks to support SNORT’s value. Being built on solana adds another advantage, positioning it to ride any potential “Solana season” wave alongside other native projects.

Buy SnorterConclusion

Bitcoin’s record difficulty and hashrate dip spotlight a key truth. That is mining success now hinges on both cutting-edge tech and agile strategy. As regulators sharpen their gaze on energy use and network safety, projects that marry efficiency with environmental mindfulness will lead the charge.

Savvy investors should consider how each token weathered these headwinds before placing their bets. After all, in a market reshaped by tougher mining conditions, picking the best crypto to buy now means favoring resilience over hype.

![]()