Bitcoin Holds Breath Before the Storm – The Final Parabolic Surge Could Be Brewing

Bitcoin's price action stalls—but don't mistake hesitation for weakness. The king of crypto coils like a spring, and the charts whisper one word: parabola.

Why this pause matters

Every bull run needs to catch its breath. The current consolidation under resistance isn't capitulation—it's the market loading up for what comes next.

The technicals don't lie

Wave counters spot textbook Elliott patterns. Retail traders panic while institutional order books flash green. The last time these signals aligned? Right before the 2021 breakout.

The cynical take

Wall Street will pretend they saw it coming—after the fact. Meanwhile, crypto natives stack sats while traditional finance debates 'appropriate allocation percentages.'

One thing's certain: when this dam breaks, the flood will make history.

Swissblock: “Just a pause—not a breakdown”

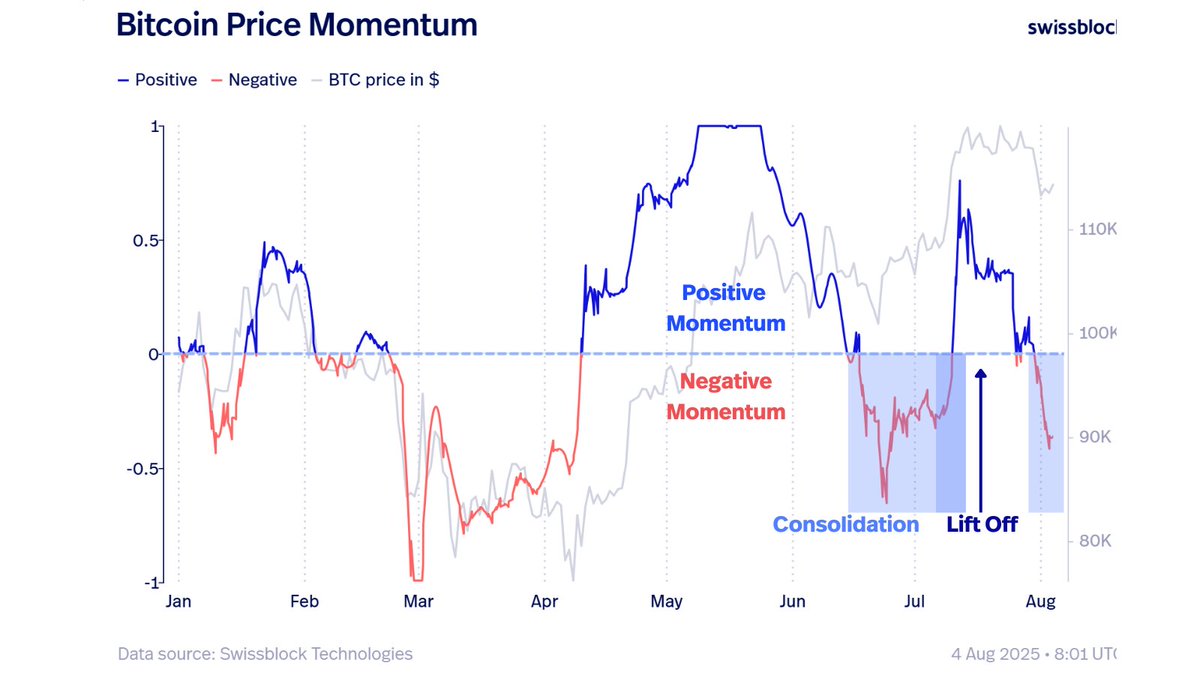

In atitled Bitcoin price Momentum, analytics firm Swissblock notes that Bitcoin’s rally has entered a consolidation phase, with bullish momentum fading in early August. The firm compares this behavior to June’s slow build-up, where positive momentum took time to reassert after a prolonged negative streak.

“BTC consolidates here, and bearish pressure fades,” they wrote on X. “Then, with time and patience, upside reignites. No breakdown. Just a pause.”

The data highlights that Bitcoin’s momentum profile flipped to negative territory despite prices holding NEAR $90K–$100K support. However, as seen in past cycles, such momentum resets have often preceded major upside moves once selling pressure subsides.

Merlijn the Trader: Final profit zone is near

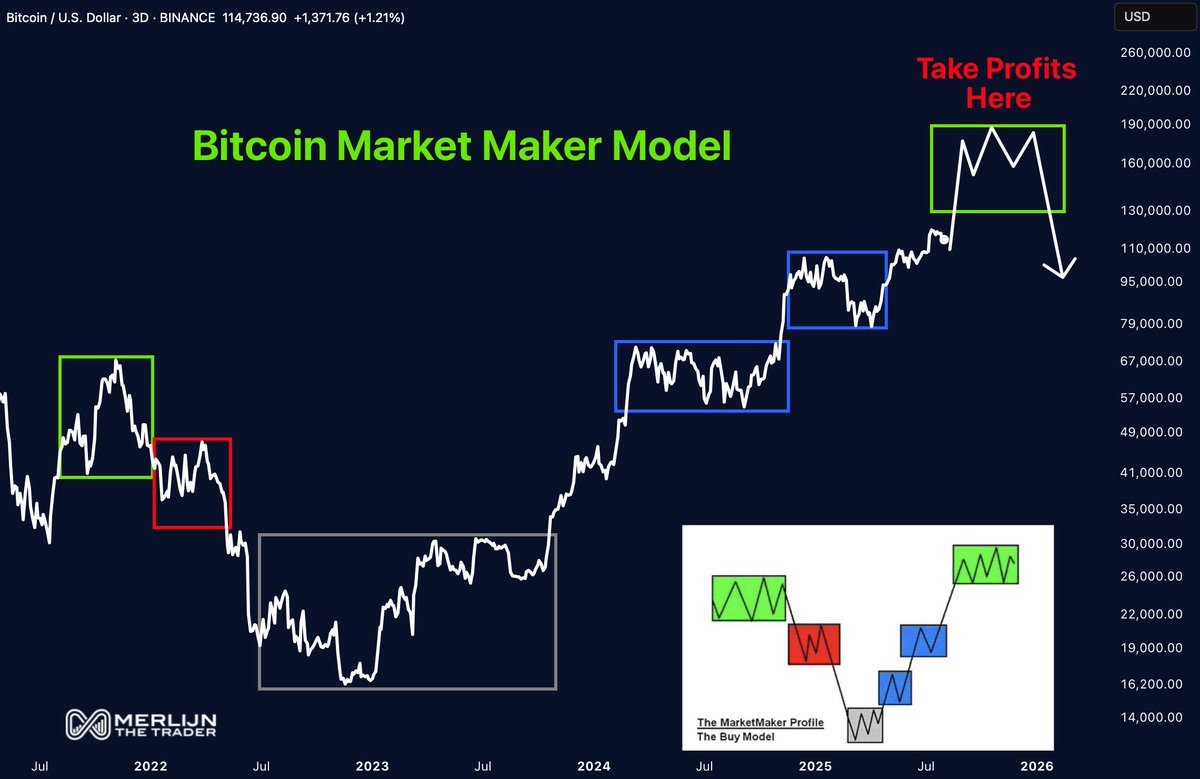

In contrast, Merlijn the Traderthat Bitcoin may be entering the final parabolic phase of its market cycle. Using a Market Maker Model chart, he suggests BTC could soon complete its current wave, targeting between $160K and $220K before a major correction hits.

“Every cycle ends the same: strength first, dump after,” he wrote. “This is the profit zone. Secure the win before it’s gone.”

The chart outlines distinct phases: accumulation, markup, and distribution. According to Merlijn, bitcoin is now in the distribution phase, where smart money begins to exit as retail investors rush in—typically preceding a downturn.

READ MORE:

Conclusion: Patience vs. profit-taking

With momentum cooling but no technical breakdown in sight, Bitcoin appears trapped between short-term consolidation and long-term climax. For now, traders face a strategic crossroads—accumulate during the pause, or take profits before the top locks in.

![]()