The Crypto Conundrum: Why 60% of Americans Still Won’t Touch Bitcoin in 2025

Wall Street's dabbling, El Salvador's betting the farm—yet Main Street still treats crypto like a back-alley poker game. What gives?

Fear, confusion, and that one uncle who lost his 401(k) to Dogecoin.

Here's why the adoption curve looks more like a rollercoaster—and how traditional finance keeps shooting itself in the foot with 19th-century thinking.

(Bonus jab: Your bank's 'blockchain strategy' is just a PDF from 2017 with the word 'Web3' scribbled in crayon.)

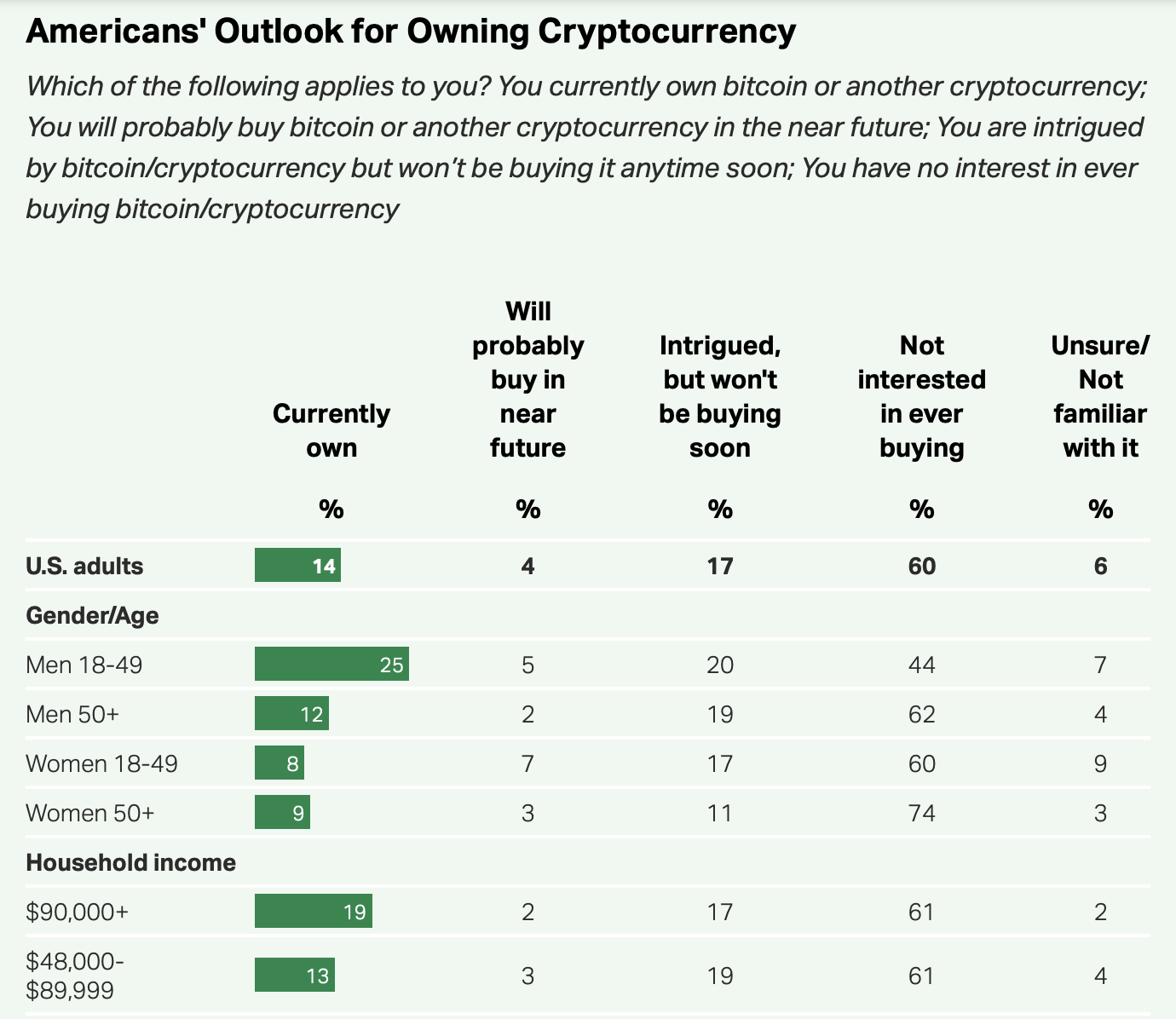

Younger men and high earners lead the way

Crypto ownership is far from evenly distributed. Men under 50 are leading adopters, with 25% in this group reporting crypto holdings. In contrast, only 8–9% of women—regardless of age—say they own any digital currency. Similarly, adults with higher incomes and college degrees are far more likely to be involved in the crypto space.

This demographic divide suggests that exposure to crypto is still concentrated among those with both the risk appetite and financial literacy to explore emerging technologies.

Familiar name, unfamiliar concept

Nearly all Americans say they’ve heard of cryptocurrency, but only 35% claim to understand it beyond a basic level. For many, it remains a complex and abstract financial product. This knowledge gap, paired with headlines about scams or volatility, continues to discourage broader participation.

READ MORE:

Even among those intrigued by the idea, just 4% say they plan to buy crypto soon, while 60% express no interest at all.

Regulatory clarity may shift sentiment—but slowly

The introduction of federal crypto regulation has sparked debate around safety, oversight, and innovation. While clearer rules may improve long-term confidence, it’s unlikely to drive an immediate adoption wave. For now, cryptocurrency remains a niche holding for younger, higher-income men, while the general public waits for stronger incentives—or fewer risks.

![]()