Stablecoins Disrupt Traditional Banking: Credit Card Adoption Threatens Bank Deposits

Move over, legacy finance—stablecoins are now gatecrashing the plastic party. Visa and Mastercard issuers are quietly integrating dollar-pegged crypto into their networks, and banks aren't laughing.

Why your checking account should worry

When consumers can pay with USDC instead of USD, those 0.01% APY deposits start looking even more pathetic. Stablecoin-backed cards bypass the fractional reserve system entirely—every transaction settles like a wire transfer, without the $30 fee.

The cynical twist? Banks spent decades lobbying against crypto... only to adopt its most boring innovation. Nothing says 'progress' like finance giants tokenizing the dollar after failing to kill decentralized alternatives.

A lifeline in high-inflation economies

In more than 22 countries, inflation exceeded 10% in 2024. Nations like Argentina, Venezuela, Turkey, and Nigeria, long plagued by currency instability, saw some of the largest surges in stablecoin adoption. According to Chainalysis, Turkey recorded the highest stablecoin purchasing volume relative to GDP. Dollar-pegged digital assets are increasingly seen as stable savings tools in regions where local currencies rapidly lose value.

Real-world spending and financial infrastructure

DeFi protocols like Hyperbeat are bridging the gap between blockchain assets and daily finance. Built on Hyperliquid, Hyperbeat enables users to load USDC or USDT and spend directly via a Visa card powered by Rain. Unspent funds can even earn yield or cashback rewards in HYPE. This blend of on-chain assets and real-world utility creates flexible, yield-generating spending lines backed by crypto.

READ MORE:

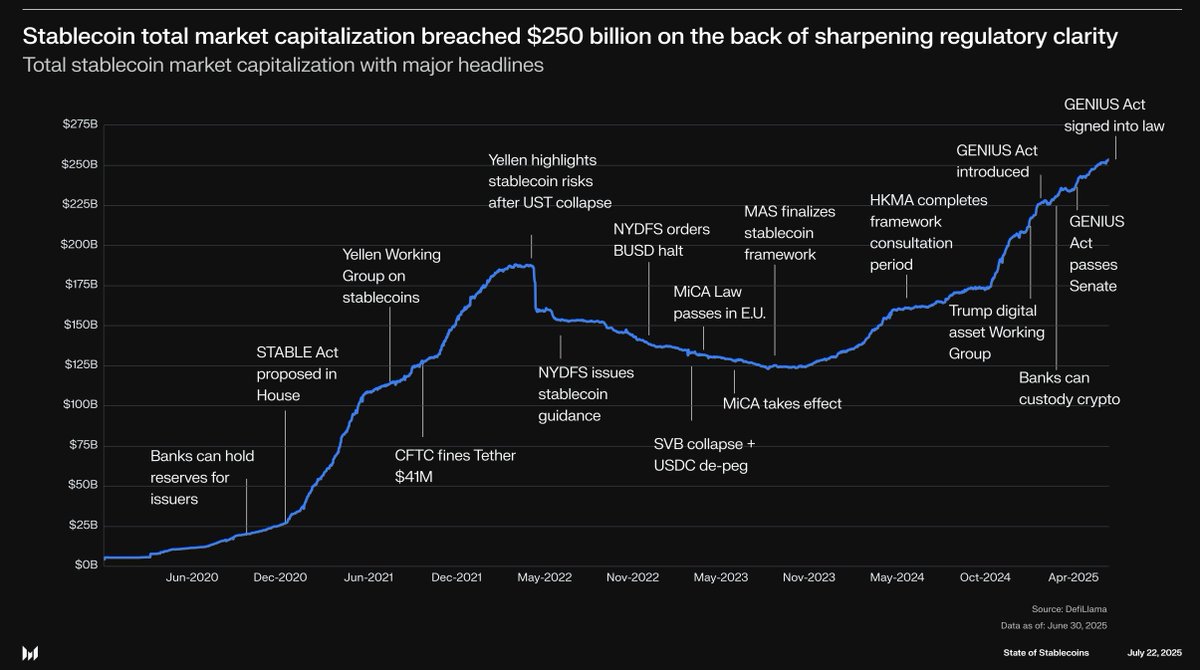

Stablecoin market now rivals traditional financial rails

With a total market capitalization exceeding $250 billion, stablecoins are closing in on legacy payment giants like Visa and PayPal. Regulatory advancements, including the GENIUS Act, have helped solidify their position. Cross-border payment volume is projected to surpass $320 trillion by 2032, and stablecoins present a powerful solution to reduce friction and costs in that process.

Threat to traditional banking?

The U.S. Treasury has warned that the rise of tokenized money market funds and yield-bearing stablecoins could undermine traditional bank deposits. Funds held in savings, time deposits, and transactional accounts may FLOW into higher-yield, blockchain-based alternatives.

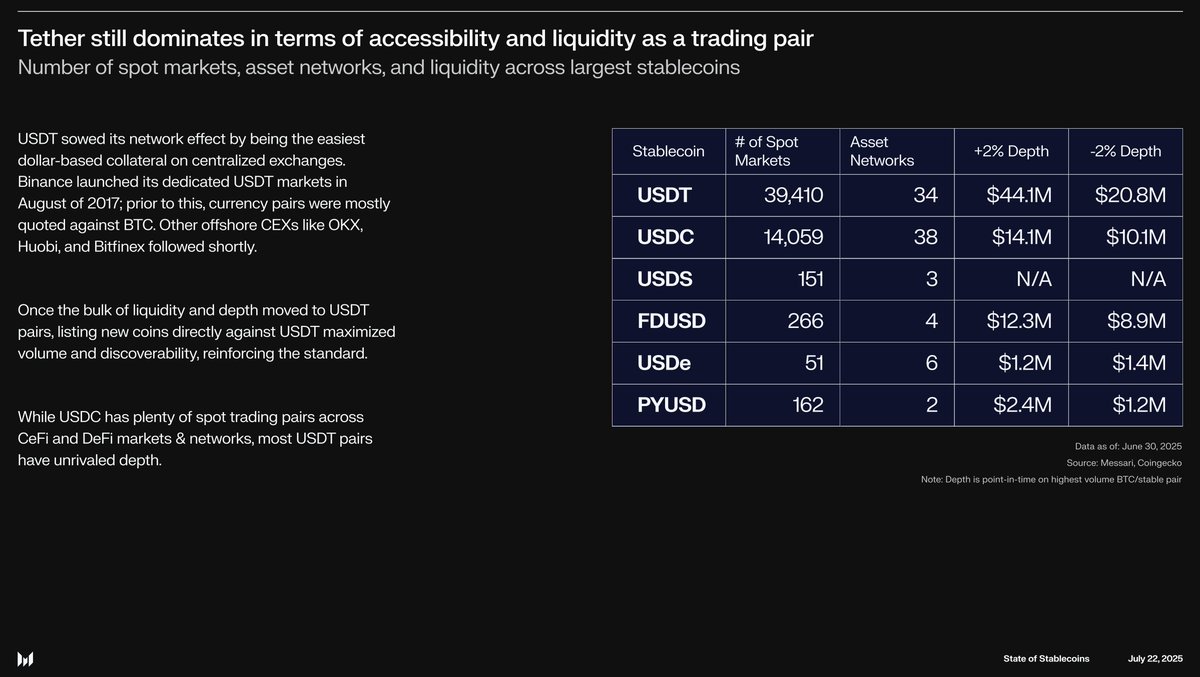

Dominance and profitability

Tether (USDT) remains the most widely used stablecoin, with over 39,000 trading pairs and unmatched depth across centralized exchanges. It now generates profits on par with the largest ETFs, solidifying its dominance in both crypto markets and emerging financial systems.

![]()