Bitcoin Rally Alive: 3 Bullish Signals That Say BTC Hasn’t Peaked Yet

Bitcoin’s price action has traders asking one question: Is this the top? Not so fast.

Here’s why the charts—and the crowd—suggest there’s more gas in the tank.

1. Whale Accumulation Spikes While Retail FOMO Lags

On-chain data shows addresses holding 1,000+ BTC just added to their bags—a classic sign institutions aren’t done playing.

2. Derivatives Markets Flash Green

Futures open interest just hit a 3-month high without excessive leverage. Healthy speculation = runway for continuation.

3. The ‘Dumb Money’ Still Isn’t All-In

Google searches for ‘buy Bitcoin’ remain 60% below 2021 ATH levels. When your Uber driver starts giving crypto tips, then worry.

Of course, Wall Street could rug-pull everyone tomorrow—because nothing fuels a bull market like bankers pretending they invented decentralization.

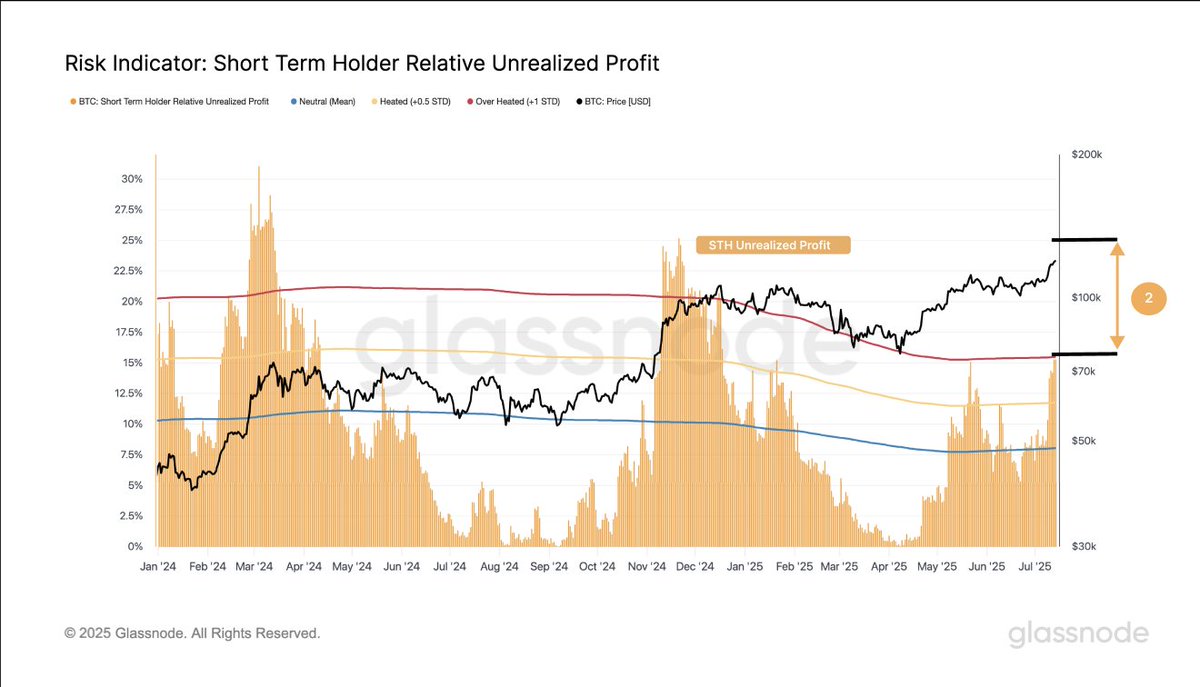

Profit-taking behavior stays in check

Glassnode’s Short-Term Holder Relative Unrealized Profit metric—used to assess the profitability of recent buyers—remains far below prior cycle peak thresholds from January and April 2024. Historically, this metric spikes when markets become euphoric, as investors rush to lock in gains. The current subdued reading indicates that traders are not yet in a frenzy of profit-taking, which often precedes a top.

Swissblockthis as a sign of ongoing market discipline, implying there’s still room for BTC to climb without triggering mass exits.

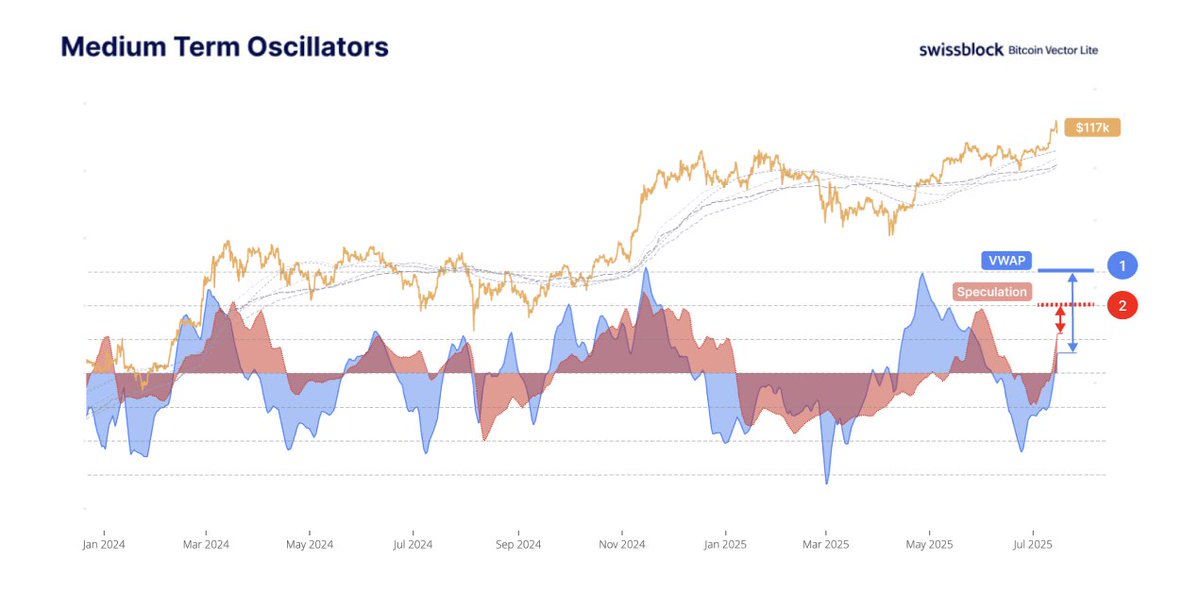

Speculation index and liquidity flows remain balanced

Woonomic’s Speculation Index and VWAP Liquidity, two key sentiment and liquidity oscillators, also remain within neutral zones. These tools, which measure risk appetite and liquidity stress, show no signs of excess—unlike prior cycle peaks where these indicators reached extreme levels.

This balance indicates that the rally is not being driven by reckless leverage or overconcentration of capital, but rather by steady demand and orderly accumulation. In fact, BTC’s price is climbing alongside healthy liquidity dispersion—a hallmark of sustainable growth rather than speculative blow-off.

READ MORE:

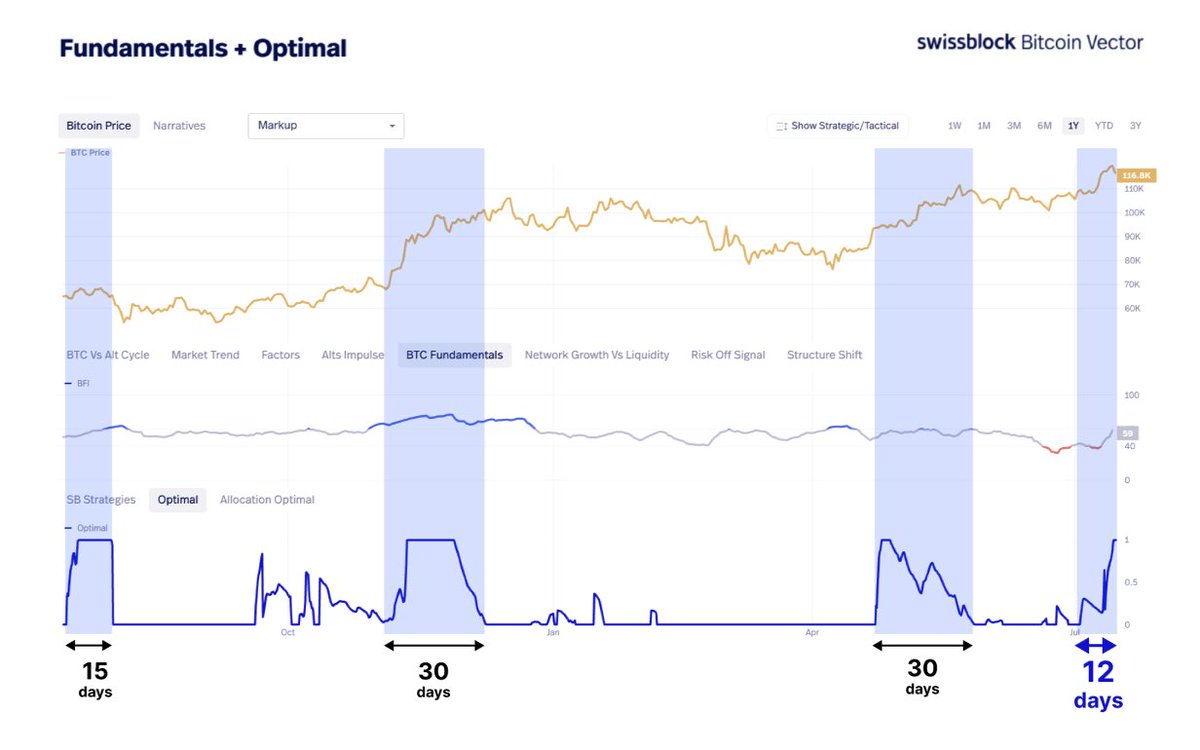

The cycle clock says there’s still time

Swissblock’s Optimal Signal, built by BitcoinVector, tracks the duration of Bitcoin’s past major rallies. Historically, strong upward moves last between 15 and 30 days. The current uptrend is only 12 days in, suggesting this cycle is far from over. Previous expansions in similar setups often experienced peak momentum in the second half of the rally window.

Adding further weight to this thesis is capital rotation into Ethereum, which typically follows Bitcoin’s lead mid-cycle as investors seek higher beta exposure.

Bottom line: No top—yet

While traders naturally wonder, “Has $BTC topped?”, Swissblock’s data suggests otherwise. Key profit, liquidity, and timing indicators show restraint and balance—not the reckless abandon that has marked previous cycle climaxes.

![]()