Cardano Blasts Past $0.74 — Is $1 the Next Stop in This Bull Run?

Cardano's ADA isn't just climbing—it's moonwalking past resistance levels with the swagger of a DeFi darling. The $0.74 breakout sparks the obvious question: when do we party at $1?

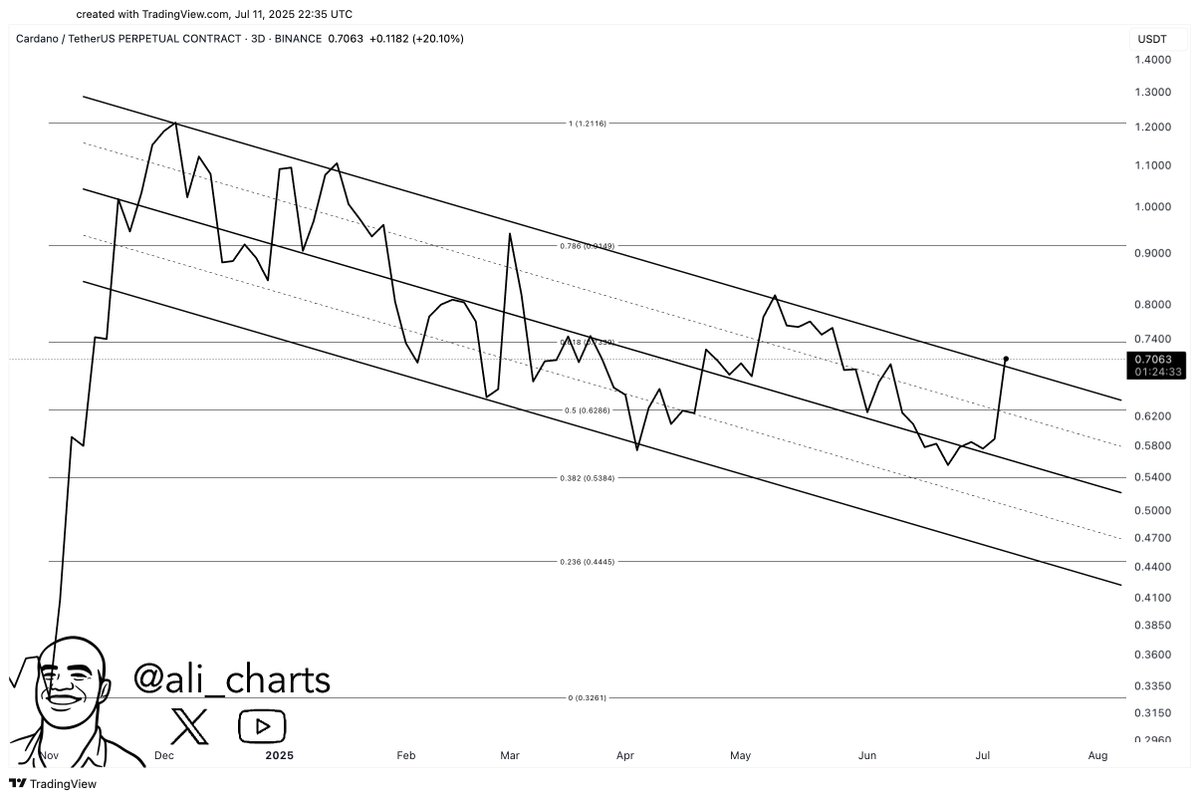

The Technicals Don't Lie

No fluff—just a clean 20% weekly pump. Chartists spot a textbook ascending triangle (yawn), but retail traders see green candles and FOMO fuel.

Ecosystem Heat Check

While Bitcoin maximalists scoff, Cardano's devs keep shipping. Hydra upgrades? Check. DEX volume uptick? Double-check. Institutional money eyeing the staking yields? Naturally.

The Cynic's Corner

Let's be real—Wall Street still thinks 'Cardano' is a luxury sedan. But when Lambo? Maybe sooner than the suits expect.

Treasury proposal adds fuel to rally

Cardano’s ecosystem momentum received a boost after IOG proposed converting $100 million worth of ADA from the community treasury into bitcoin and stablecoins to fund DeFi development. The controversial yet forward-looking move sparked intense debate but ultimately signaled proactive treasury management.

Charles Hoskinson, Cardano’s founder, reinforced community confidence with a mocking response to bearish critics on X, just days after the proposal. ADA held its gains post-announcement, indicating market support for the initiative.

Broader market sentiment aligns

Cardano’s breakout coincides with Bitcoin’s surge past $118,000, lifting sentiment across major altcoins. ADA’s 24-hour trading volume stood at $1.43 billion, despite a 36% dip from the prior day, suggesting a shift from speculative churn to longer-term accumulation.

READ MORE:

The asset’s market cap has now surpassed $26 billion, securing its position as the 10th-largest cryptocurrency by value. With a circulating supply of 35.38 billion ADA, traders are eyeing further upside if momentum sustains above the $0.74 pivot.

Outlook

If ADA maintains support above $0.74, next upside targets include $0.90 and $1.00, with resistance expected NEAR $1.20 based on Martinez’s Fibonacci projections. A return of network activity and institutional confidence could help sustain the rally, especially if Bitcoin stabilizes above its all-time highs.

![]()