🚀 Bitcoin Smashes ATH Again as Hyper Presale Frenzy Hits – Is This the Ultimate Crypto Buy?

Bitcoin just bulldozed through another all-time high—again. Meanwhile, the Bitcoin Hyper presale is eating up capital faster than a Wall Street bonus pool. Coincidence? Hardly.

Here’s why traders are FOMO-ing into both.

The ATH machine: Bitcoin’s relentless rally

No surprises here—BTC’s price action is doing its usual ‘up and to the right’ routine. The only thing more predictable? Analysts calling for a ‘cool-down’ right before the next leg up.

Hyper Presale: Greed or genius?

The so-called ‘Hyper’ presale is soaking up retail funds like a crypto sponge. Early buyers claim it’s the next big thing. Skeptics whisper ‘greater fool theory’—but when has that ever stopped a bull market?

One thing’s certain: when Bitcoin runs, altcoins sprint. Whether that sprint ends in glory or faceplant? That’s the trillion-dollar question.

Pro tip: If your Uber driver starts pitching the presale, maybe check your risk exposure. Just saying.

Bitcoin Hits New ATH as Digital Gold Narrative Takes Hold

Bitcoin’s latest rally has reaffirmed the top crypto’s status as digital Gold – a macro hedge and long-term store of value in an uncertain economic era. Asset managers and even state treasuries are stockpiling BTC not as a payments tool, but as a hedge against inflation and geopolitical uncertainty.

Strong demand from institutions has become a primary driver of Bitcoin’s price action, pushing it into blue skies once again. BlackRock’s spot Bitcoin ETF (IBIT), which began trading in January 2024, now holds more than $80 billion in net assets – and the fund has nearly tripled its Bitcoin position in less than a year, setting a pace that took the largest gold ETF over a decade to achieve.

In fact, spot Bitcoin ETFs collectively just crossed the $51 billion cumulative net inflow milestone, with impressive one-day inflows (including over $448 million into IBIT alone on July 10) as Bitcoin hit record highs.

On July 10 (ET), Bitcoin spot ETFs recorded a total net inflow of $1.179 billion, marking the second-highest in history. ethereum spot ETFs saw a total net inflow of $383 million, also the second-highest on record.https://t.co/ueXcZjuIVU

— Wu Blockchain (@WuBlockchain) July 11, 2025

One of the biggest catalysts behind the growing institutional participation is a clearer regulatory landscape. The “Crypto Week” events taking place on Capitol Hill next week will advance long-awaited tax and regulatory measures, adding to Optimism that more explicit rules will further strengthen crypto’s position on Wall Street.

Yet for all its success as digital gold, Bitcoin’s on-chain utility remains limited. The base Bitcoin network can process only a handful of transactions per second, has relatively high fees, and lacks native support for smart contracts.

This means most BTC today sits in wallets as static capital – excellent for preserving wealth, but largely inactive when it comes to DeFi or other Web3 applications. Layer 2 solutions have long been seen as the best way to activate Bitcoin’s value, but existing attempts have fallen short.

Bitcoin Hyper is positioning itself to fill that gap. It aims to provide Bitcoin with the speed and programmability of a modern smart contract platform, without compromising on BTC’s security.

Inside Bitcoin Hyper’s Revolutionary Layer 2 Scaling Solution

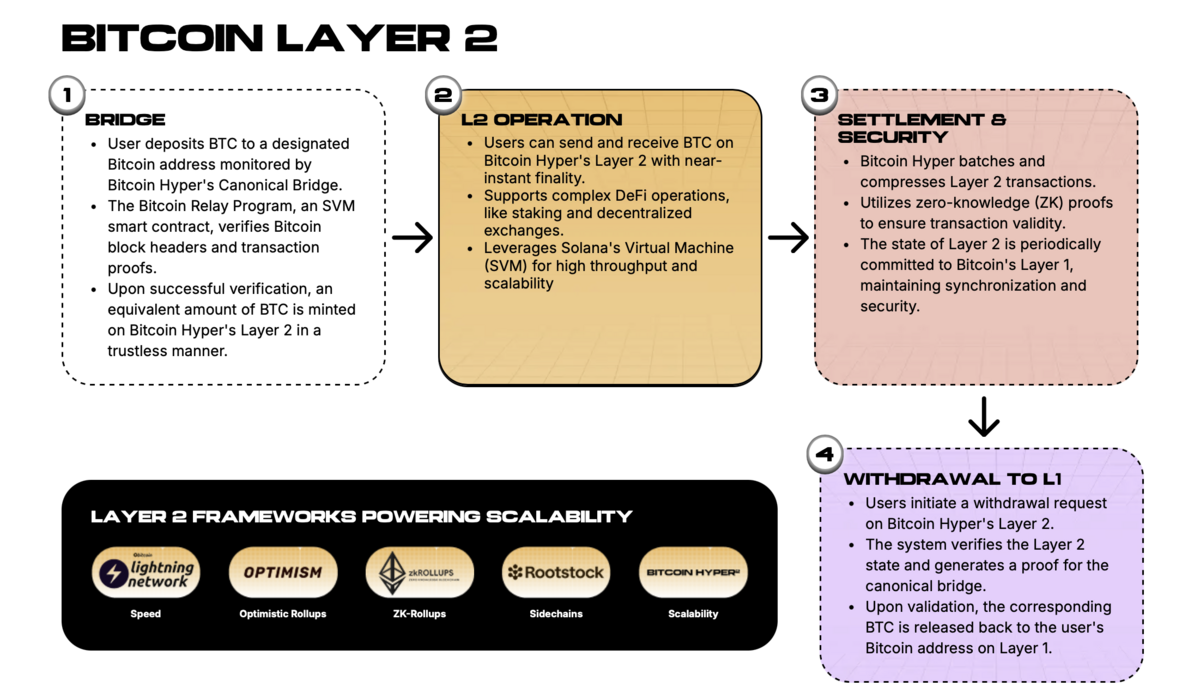

Bitcoin Hyper’s approach to scaling Bitcoin is both innovative and elegantly simple. It will create a Layer 2 blockchain that operates in tandem with Bitcoin’s main chain, leveraging the Solana VIRTUAL Machine (SVM) for ultra-fast throughput.

To unlock Bitcoin’s potential on this network, Bitcoin Hyper will use a decentralized canonical bridge that seamlessly transfers BTC between the base layer and the Layer 2.

Users send real BTC to a bridge contract on Bitcoin’s Layer 1 (L1), and that transaction gets validated via zero‑knowledge proofs and locked on‑chain. Simultaneously, an equivalent amount of wrapped BTC will be minted on the Bitcoin Hyper network.

The entire process is trustless and non-custodial – and zero-knowledge proofs ensure that the Layer 2 only mints tokens when provably backed 1:1 by BTC on the L1, thereby preserving security.

From that point, the deposited Bitcoin will exist in Bitcoin Hyper’s high-speed environment, and transactions using the wrapped BTC will settle in seconds and cost only fractions of a cent in fees. Users can send payments, trade assets, deploy smart contracts, or engage in yield farming and lending capabilities that are impossible on Bitcoin’s base layer alone.

More importantly, all activity on Bitcoin Hyper is still anchored to Bitcoin’s ledger. Every batch of Layer 2 transactions will be regularly committed to Bitcoin’s blockchain, maintaining decentralization and integrity.

Why Analysts See Bitcoin Hyper as the Next Big Layer 2 Success Story

Everything on the Bitcoin Hyper network will revolve around the HYPER token. Beyond serving as the gas token for every transaction on the Layer 2 network, HYPER will also provide high staking rewards and governance rights.

In other words, HYPER captures the economic upside of bringing new utility to Bitcoin. If Bitcoin Hyper succeeds in attracting users and developers, demand for HYPER could scale in tandem with on-chain activity.

History has already proven that Layer 2 tokens can capture significant upside when a scaling solution gains traction. For example, Polygon’s MATIC and Arbitrum’s ARB (two of the most popular Ethereum Layer 2 cryptos) both rallied with growing adoption of their own networks, as well as Ethereum itself.

A popular analyst from 99Bitcoins believes that HYPER could follow a similar path – but with the added advantage of supporting a much larger store of value, and taking advantage of Bitcoin’s global brand recognition.

To buy HYPER, investors can visit the official Bitcoin Hyper presale page and connect a crypto wallet to purchase HYPER using ETH, USDT, BNB, or even a traditional card. Buyers can also stake their tokens for an annual reward of up to 350%.

![]()