BREAKING: EU Greenlights 53 Crypto Firms Under MiCA—Full List Revealed

The European Union just dropped a regulatory bombshell—53 crypto companies secured MiCA licenses in a landmark move. Here’s why it matters.

The MiCA Domino Effect

Europe’s Markets in Crypto-Assets (MiCA) framework just shifted the playing field. No more regulatory gray zones—just hard stamps of approval for 53 firms. Compliance just became the hottest trend in crypto.

Who Made the Cut?

The list reads like a who’s-who of crypto’s establishment—plus a few dark horses. Stablecoin issuers, exchanges, even DeFi gatekeepers. Guess Wall Street’s lobbyists missed a few spots at the table.

The Fine Print

Licenses aren’t trophies—they’re survival kits. Firms now face quarterly audits, capital buffers, and the EU’s infamous paperwork gauntlet. Some will thrive. Others? Let’s just say compliance costs love burning through runway.

The Bottom Line

Europe just called crypto’s bluff on ‘self-regulation.’ Now the real game begins—where balance sheets matter as much as whitepapers. (And yes, bankers are already seething over the missed revenue stream.)

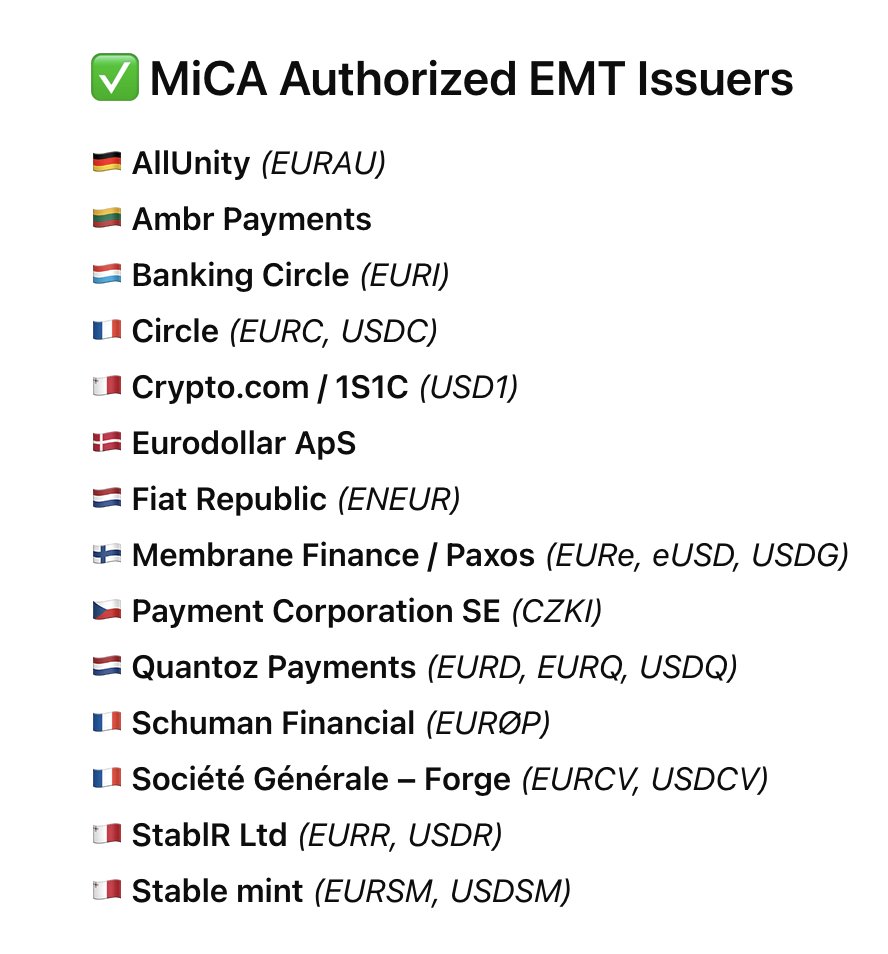

The 14 EMT issuers originate from seven EU member states and are collectively issuing 20 fiat-backed stablecoins: 12 pegged to the euro, 7 to the U.S. dollar, and 1 to the Czech koruna. Leading names include Circle, Société Générale – Forge, Membrane Finance, and Crypto.com. These approvals aim to standardize stablecoin compliance under MiCA and expand consumer trust in digital euro and dollar equivalents.

Meanwhile, 39 CASPs have secured full MiCA licenses, allowing them to operate across the entire European Economic Area (EEA). Countries like Germany (12 firms), the Netherlands (11), and Malta (5) dominate the approvals. The list includes a blend of traditional financial institutions (e.g., BBVA, Clearstream), fintech platforms (eToro, N26), and major crypto exchanges (Coinbase, Kraken, Bitstamp, OKX).

MiCA Momentum Builds Amid Oversight Gaps and Compliance Push

Despite the progress, the MiCA rollout has revealed regulatory blind spots. No asset-referenced token (ART) issuers have been approved, indicating tepid market interest in non-fiat-backed assets. About 30 whitepapers have been filed under MiCA Title II for major assets like BTC and ETH, reflecting increasing institutional alignment with crypto regulation.

READ MORE:

At the same time, over 35 firms are flagged as non-compliant—many by Italy’s CONSOB. Transition periods have ended in multiple jurisdictions, including Finland, Poland, and the Netherlands, where the Dutch AFM is leading license issuance. With MiCA enforcement underway, firms are racing to gain approval and passport their services across 30 EEA states.

![]()