🚀 Major Altseason Alert: Bullish Signals Flash Green as Q3 Kicks Off

Altcoins are revving their engines as crypto markets show early signs of a major breakout. Technical indicators haven't looked this promising since the last bull run—just as Wall Street starts 'accidentally' buying the dip.

The setup: Historical patterns suggest altcoins typically outperform Bitcoin after prolonged consolidation. With BTC dominance slipping 3% this quarter, capital appears to be rotating toward Ethereum and smaller caps.

Market mechanics at play: Liquidity pools are deepening while exchange reserves thin out—a classic accumulation signal. Derivatives data shows shorts getting squeezed on every minor rally, creating explosive upside potential.

The cynical take: Of course this aligns perfectly with VC unlock schedules and influencer token dumps. Nothing fuels a rally like bagholders needing exit liquidity.

Whether this marks the start of a sustained altseason or just another fakeout remains to be seen. But one thing's certain: traders ignoring these signals risk missing the first movers—or becoming the greater fools.

Why This Matters

Analysts from CoinGecko, a respected crypto analytics firm, echoed van de Poppe’s. They noted that many blue-chip altcoins saw extended periods of consolidation over the summer months, with significant upward momentum kicking in around July–August. If history repeats, we could be entering a period marked by rapid growth and widespread market rotation away from Bitcoin.

Recent data supports this shift. Over the past two days, Ethereum’s daily on-chain activity has climbed by 8%, while trading volume across DeFi tokens increased by 12%, according to a Messari report—suggesting renewed investor interest in non-BTC assets.

Drivers Behind the Surge

- Macro & Liquidity Dynamics

As central banks worldwide step back from aggressive asset-buying programs, markets seek new injection points. Van de Poppe suggests that this shifting liquidity could fuel altcoin capital flows in the months ahead. - Capital Rotation Pattern

When Bitcoin stabilizes or enters a sideways trend, capital often migrates to top-performing altcoins. With Bitcoin holding firm above $105K, attention increasingly turns to high-beta alt assets. - Emerging Trends & Product Launches

The debut of new altcoin ETFs—including Solana and XRP staking vehicles—has intensified engagement. Santiment’s July data shows these products as among the most-discussed topics in crypto circles, underscoring growing institutional interest.

What Investors Should Monitor

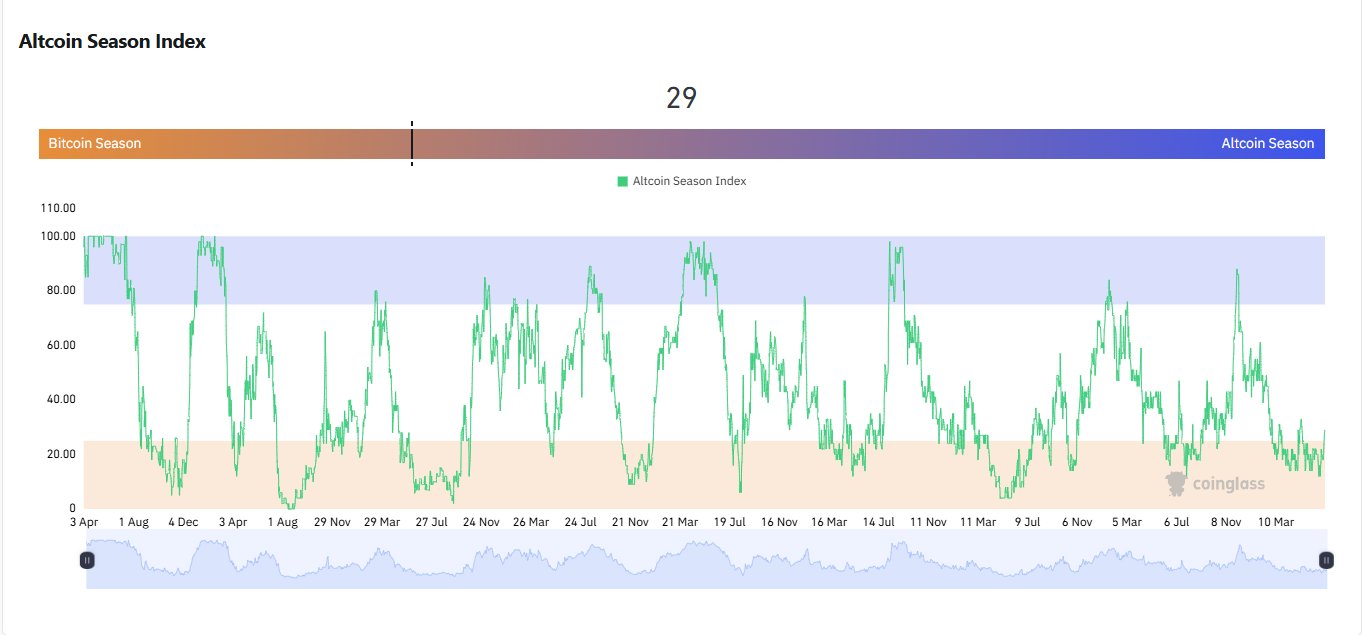

- Altcoin Season Index – Sustained values above 60–70 typically mark the onset of a genuine altseason.

- Trading Volume Spike – Watch for rising activity in top-tier altcoins, which reinforces market momentum.

- Macro Liquidity Updates – Future central bank communications could impact broader asset distribution.

Conclusion

All signs point to the early stages of altseason, potentially stronger than 2023’s. With bullish patterns, increased liquidity, and renewed investor appetite, the final two quarters could bring outsized returns in altcoin markets—provided broader macro conditions remain favorable. Now may be the time for investors to reassess their portfolio stance as the altcoin cycle gains momentum.

![]()