Shiba Inu’s Centralization Crisis: New Data Reveals Hidden Risks

Dogecoin's fiercest rival faces a reckoning—Shiba Inu's decentralized facade cracks under scrutiny.

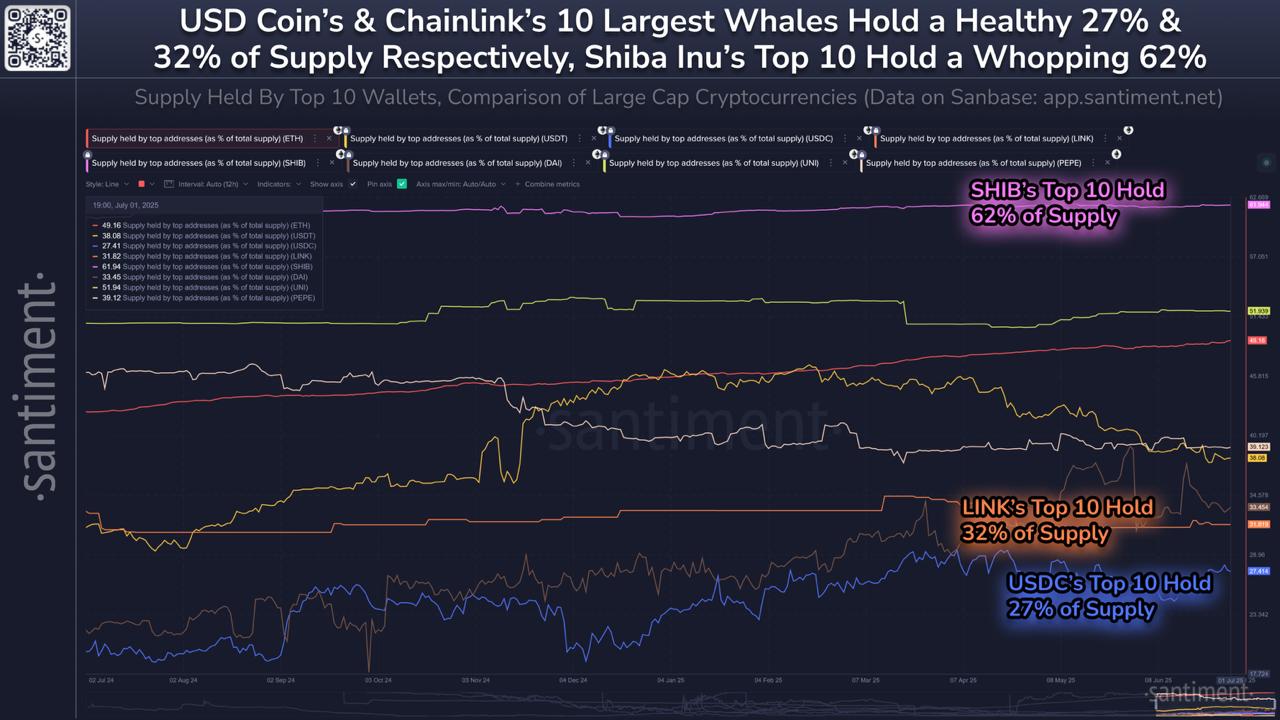

The Whale Problem

A handful of wallets hold enough SHIB to sink the meme coin's 'people's crypto' narrative overnight. Liquidity pools look more like private swimming clubs.

Dev Team Dilemma

Anonymous founders still pull strings behind the scenes—because nothing says 'decentralization' like shadowy figures controlling nine-figure token stashes.

Exchange Exposure

CEX listings became a double-edged sword. Binance and Coinbase now effectively dictate price action, proving Wall Street 2.0 runs on the same old centralization playbook.

Memo to crypto tourists: next time someone pitches 'the next Bitcoin', ask where the white paper is—or if there's even a real team behind the dog logo.

For retail investors and smaller traders, lower whale concentration generally signals a safer trading environment. Assets with decentralized ownership structures are less likely to experience dramatic swings caused by coordinated whale actions. This is especially critical during times of heightened market volatility, when large movements by top holders can amplify price instability.

READ MORE:

Santiment’s analysis underscores the importance of tracking whale wallet activity, not just price trends. As on-chain transparency increases, such data becomes an essential component of due diligence for crypto investors seeking to minimize exposure to centralized supply risks.

Ultimately, while meme coins like SHIB may offer rapid gains, their whale dynamics demand caution. Meanwhile, assets like USDC and LINK appear more stable due to broader supply distribution across holders.

![]()