Bitcoin’s Sideways Struggle: Whales Cash Out as Market Hits Profit-Taking Pause

Bitcoin's bull run hits the brakes—whales are dumping, traders are locking in gains, and the charts are flatlining. Here's why this consolidation phase matters more than you think.

The great whale migration: Big players are quietly offloading stacks, turning paper gains into cold hard cash. No fireworks—just calculated exits.

Trader psychology at a crossroads: Every sideways candle tests conviction. Retail FOMO meets institutional caution in a battle for the next directional move.

The boring truth about market cycles: These pauses separate tourists from true believers. Meanwhile, traditional finance bros still can't decide if crypto's a scam or their ticket to early retirement.

One thing's certain: When volatility returns—and it always does—the real players will have positioned during these sleepy summer days. The rest? They'll be chasing the next pump like always.

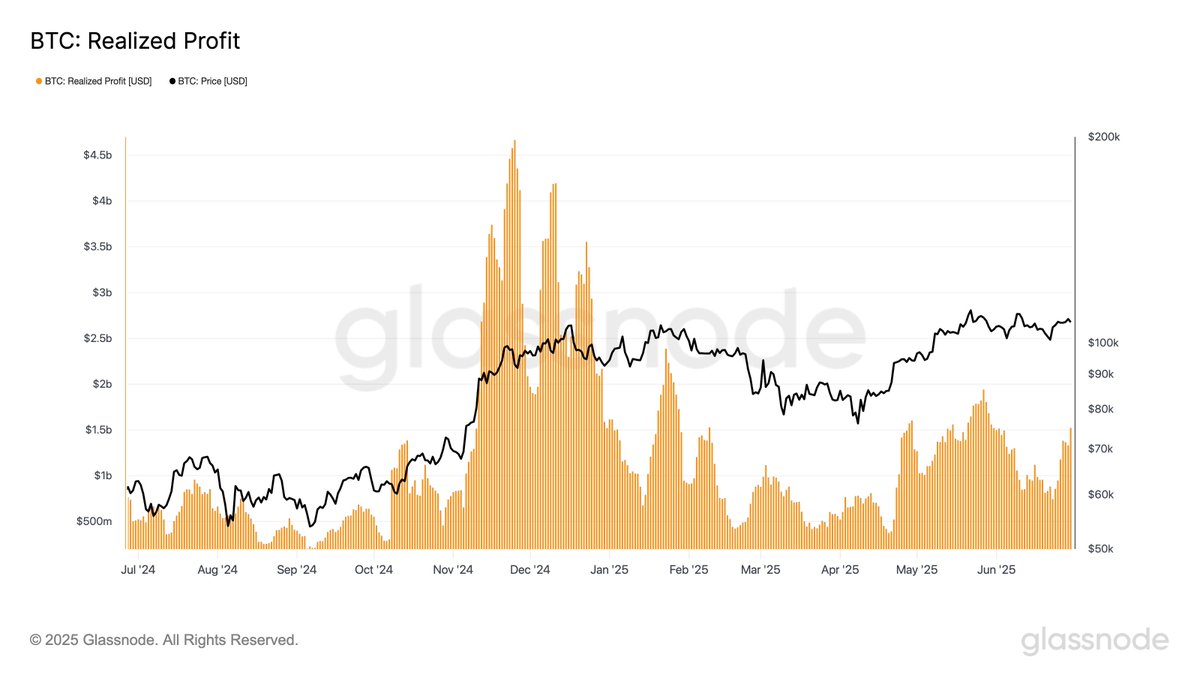

Profit-Taking Intensifies, But Still Below Previous Cycle Peaks

According to on-chainfirm Glassnode, profit-taking activity is rising once again. On June 30, realized profits across the bitcoin network surged to $2.46 billion, while the 7-day simple moving average (SMA) rose to $1.52 billion. That figure significantly exceeds the 2025 YTD average of $1.14 billion, signaling increasing sell pressure.

However, Glassnode notes that these profit levels remain well below the $4–5 billion peaks seen in the November–December 2024 cycle top. While the market is heating up, it hasn’t yet reached the levels that typically precede major trend reversals.

READ MORE:

Whale Supply Declines Despite Institutional Inflows

Meanwhile, newfrom Sentora (formerly IntoTheBlock) shows that wallets holding over 1,000 BTC have been steadily reducing their balances, even as institutional capital continues flowing into Bitcoin.

Rather than interpreting this as weakness, analysts view it as a sign of market maturation. Older “whale” coins are being redistributed across smaller holders and newer entrants, reflecting broader adoption and reducing centralized supply risk. This shift, Sentora argues, could strengthen Bitcoin’s long-term decentralization and liquidity profile.

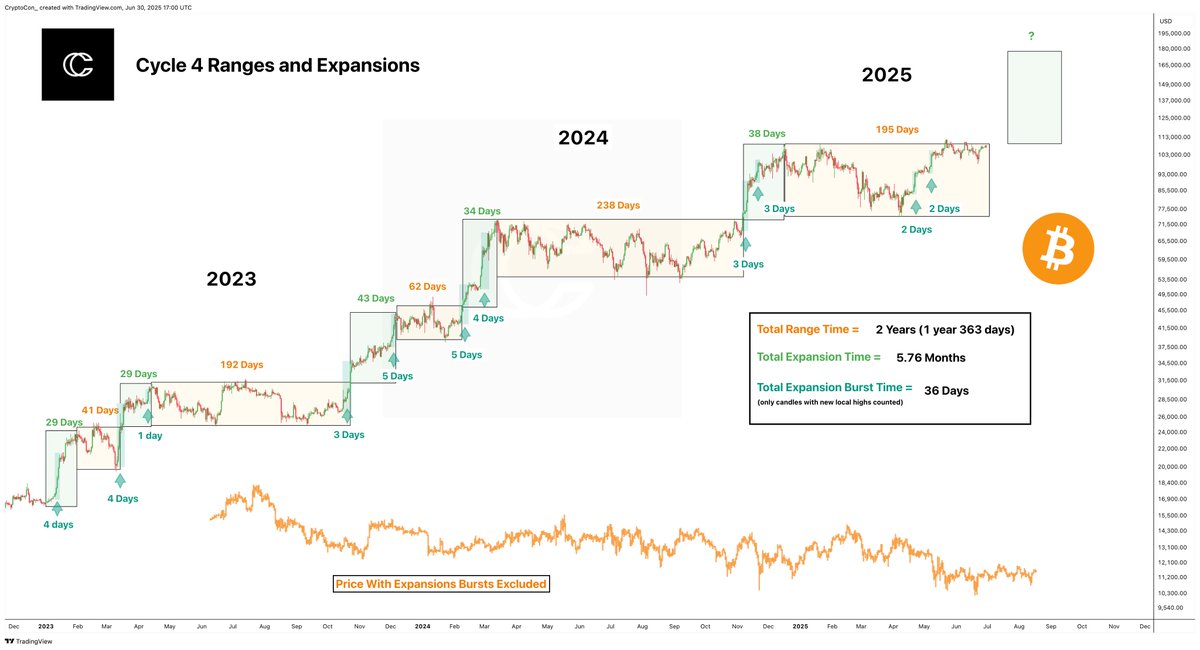

Sideways Action Hits 195 Days: The Slowest Cycle Yet?

Adding to the stagnation narrative, CryptoConthat Bitcoin has now spent 195 consecutive days in sideways price action, dating back to December 18, 2024. While short bursts of upside have occurred—only 36 days in total—nearly 2 full years have been dominated by grinding, non-trending behavior.

“Remove the expansion bursts,” CryptoCon writes, “and you’re left with a brutal sideways cycle and new lows for the entire phase.”

Their cycle chart shows only brief expansion rallies across 2023 to 2025, with the longest stretches of consolidation in Bitcoin’s history. The current cycle is now the slowest on record, though it remains structurally intact.

READ MORE:

Conclusion

Bitcoin’s current phase reflects a maturing yet indecisive market. Rising profit-taking, whale coin redistribution, and record-long sideways movement suggest a buildup rather than a breakdown. While volatility remains subdued, structural shifts in ownership and steady institutional inflows may be laying the groundwork for the next major move. Until a clear catalyst emerges, the market appears poised in quiet anticipation of a breakout—or a reset.

If historical patterns hold, this extended consolidation could act as the foundation for a future breakout. But for now, Bitcoin appears stuck between exhausted bullish momentum and strong hands waiting for the next macro catalyst.

![]()