War Panic Selling? History Proves Crypto Traders Get Rekt Every Time

When missiles fly, crypto markets nosedive—but the data screams 'hold.'

Fear sells (and tanks portfolios)

Geopolitical shockwaves trigger instant sell-offs, yet historical charts show brutal rebounds within 90 days. Retail traders keep buying high and selling low while whales accumulate.

The PTSD playbook

2022 Ukraine invasion flash crash? BTC dropped 20% in 48 hours—then ripped 140% in 4 months. 2020 Iran tensions? Same script. Even Wall Street's 'hedge' narrative crumbles when Tether volumes spike during crises.

Bonus cynicism: Nothing unites governments faster than watching citizens panic-sell assets to their crony banks at firesale prices.

Next time headlines scream WW3, check the blockchain. The smart money's stacking sats—not stuffing mattresses with dying fiat.

History Repeats in Global Crises

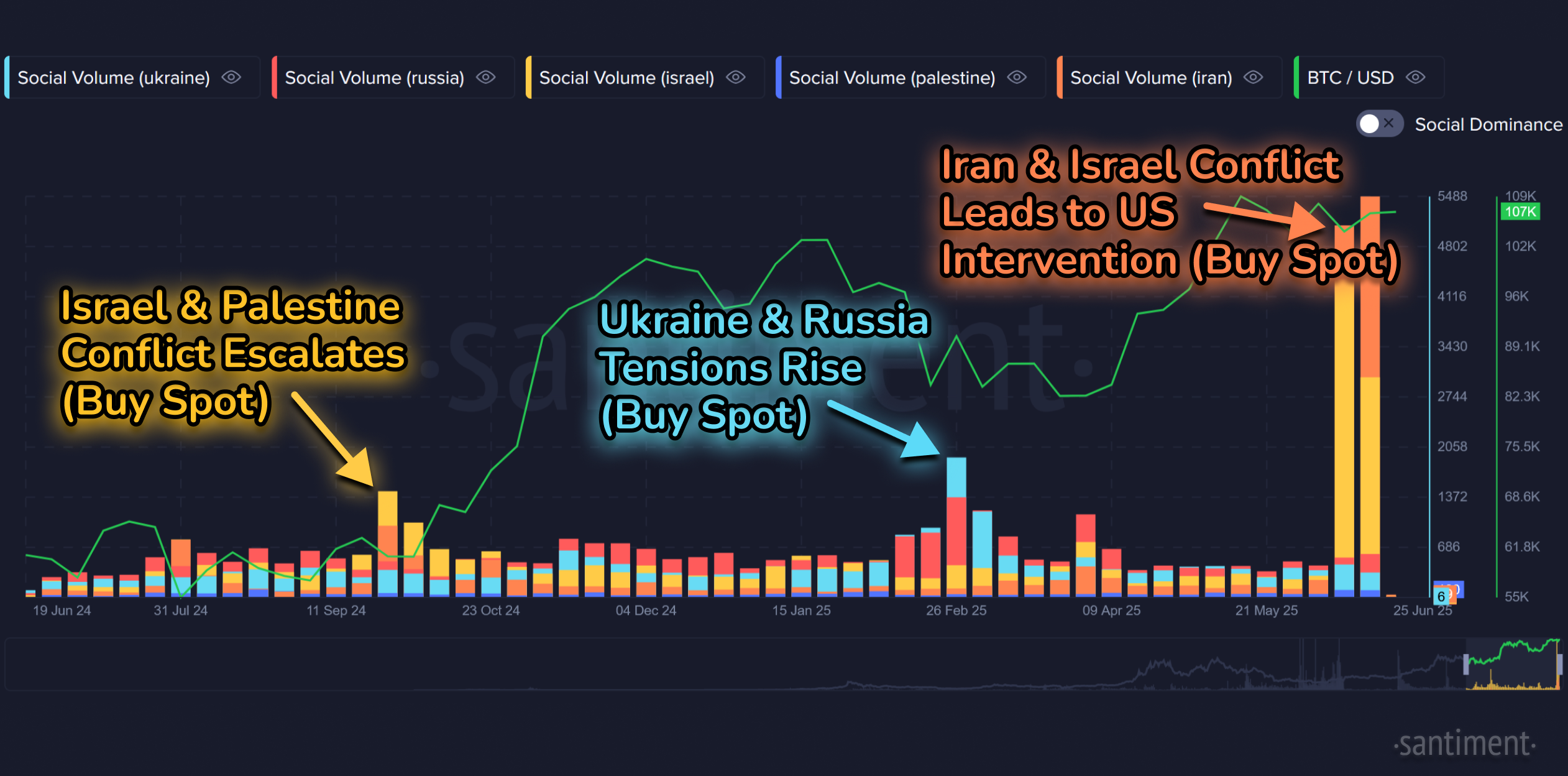

The crypto market saw a familiar pattern unfold over the past week. The U.S. launched airstrikes on three Iranian nuclear sites, heightening tensions across the Middle East. Iran fired missiles in retaliation. Fears of a wider war surged as U.S. embassies went on high alert and regional airspace closures spread. Yet despite this chaos, Bitcoin bounced back above $108,000 by June 25.

This rebound aligns with earlier cycles. In February 2022, Bitcoin initially plunged when the Russia-Ukraine war broke out—only to rally days later. In October 2024, conflict between Israel and Palestine caused similar short-lived dips before a swift recovery. In each case, prices dropped when war dominated headlines, then rebounded once retail traders had exited in fear.

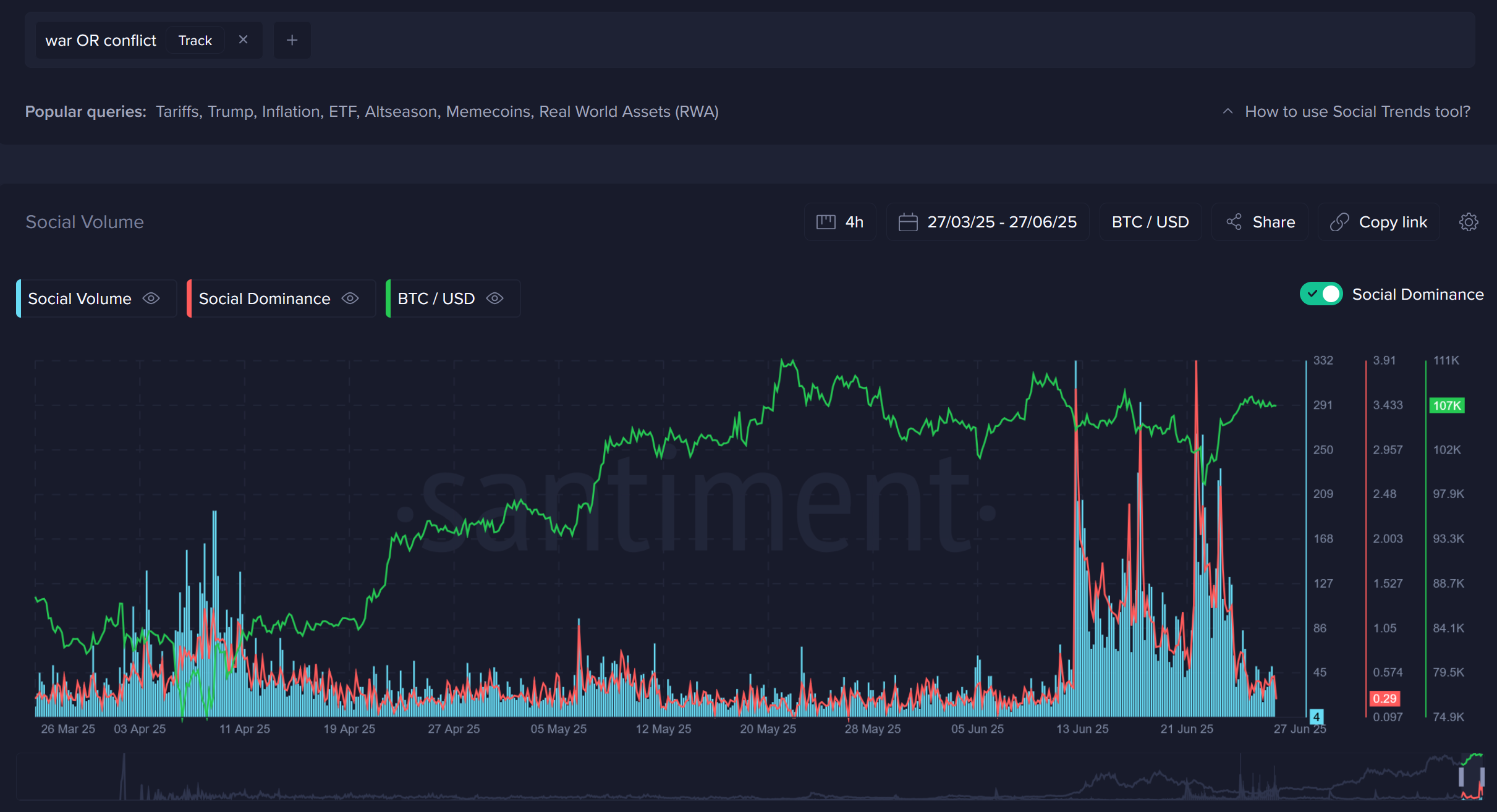

Santiment’s data shows crowd sentiment often peaks in fear just before markets rally. Mentions of “war” and “conflict” surged as the U.S.–Iran tension escalated. Meanwhile, social media showed a sharp rise in bearish price predictions for Bitcoin—just before it rebounded by 10%.

Panic Selling Benefits the Whales

Santiment’s on-chain metrics indicate retail traders often overreact to geopolitical shocks, while whales quietly accumulate. On June 12, following Israel’s initial strike on Iran, $335 million was liquidated across crypto markets in just one hour. By June 22, President TRUMP confirmed U.S. airstrikes on Iranian nuclear facilities, which spiked online mentions of “Iran”—but didn’t lead to a major price collapse.

Instead, as smaller traders sold out, the market found support. bitcoin began climbing just as the majority expected further declines. A ceasefire between Israel and Iran followed, offering a possible turning point. As seen in past events, these de-escalation moments often mark the start of a new bullish phase.

Correlation With Stocks Adds Stability

Unlike past cycles, crypto now moves more closely with equities. Since early 2022, Bitcoin has trended in line with the S&P 500 and Nasdaq-100. This correlation means that broader market strength can provide support even during global crises.

While war-related panic still triggers short-term volatility, macroeconomic conditions—like inflation and stock performance—now play a bigger role in crypto’s direction. That’s why Bitcoin’s rebound has mirrored stock market resilience despite geopolitical headlines.

READ MORE:

Don’t Fight the Data

Traders hoping to time war headlines have historically gotten burned. Bitcoin’s current rise—despite rising oil tensions, missile strikes, and U.S. military action—proves once again that emotional trading is costly. As Santiment’s charts show, when fear peaks, it often signals opportunity.

The key takeaway: war-related news doesn’t always mean a sustained crash. In fact, it often sets the stage for rallies. This isn’t to downplay the seriousness of geopolitical conflict—but in markets, sentiment can mislead.

With Bitcoin still NEAR its all-time high and traders divided between fear and greed, the coming weeks will test investor discipline. If the crowd stays fearful, whales may keep accumulating. If the crowd turns euphoric too soon, a pullback could follow.

For now, history suggests this: when war strikes and panic hits the headlines, don’t rush for the exit. Patience—and a level head—tends to win.

![]()