Bitcoin Miners Defy 3.5% Hashrate Dip—Hodling Strong as Market Stumbles

Bitcoin's backbone shows cracks—but the miners aren't buckling.

Despite a 3.5% drop in hashrate—the equivalent of entire mining farms going offline—network validators keep stacking sats like Wall Street stacks fees. No panic, no fire sales... just the relentless hum of ASICs weathering another storm.

Meanwhile, traditional finance bros still can't decide if crypto is 'digital gold' or a 'speculative asset'—pick a narrative, guys.

Miner Selling Activity Remains Muted

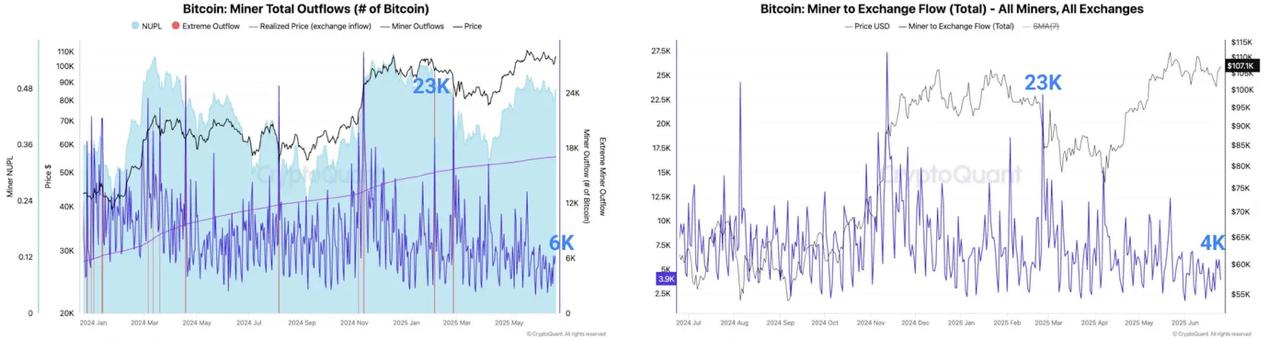

According to CryptoQuant, outflows from miner wallets have dropped sharply — from 23,000 BTC per day in February to just 6,000 BTC currently. Moreover, there have been no major BTC transfer spikes to exchanges, a typical precursor to mass selling.

Wallets linked to Satoshi-era miners have also remained largely inactive, with just 150 BTC sold in 2025, compared to nearly 10,000 BTC in 2024. This suggests long-term holders are staying put.

Miner Reserves Continue to Climb

In a key signal of conviction, miner-held reserves are growing, implying that most miners are choosing to weather the downturn rather than offload their coins at current price levels — with Bitcoin hovering near local lows.

“This further suggests there’s no selling pressure coming from miners at these price levels,” CryptoQuant concluded.

READ MORE:

Long-Term Strategy Over Panic

The data paints a picture of a mining sector choosing to hold — either in hopes of a near-term rebound or as a deliberate long-term strategy. Even amid falling incentives, most miners appear willing to burn through cash instead of liquidating BTC at unfavorable levels.

As Bitcoin’s network adjusts post-halving, miner behavior remains surprisingly resilient, reinforcing the notion that supply-side pressure is not a concern — at least for now.

![]()