XRP vs SEC Showdown Nears Climax: Top Cryptos to Watch Before the Verdict Drops

The crypto courtroom drama of the decade is reaching its boiling point—Ripple's XRP battles the SEC in a final showdown that could send shockwaves through the market. Here's where smart money's moving before the gavel falls.

Market movers bracing for impact

Traders are rotating into assets with clear regulatory moats—think Bitcoin as digital gold and Ethereum with its staking economy. Meanwhile, altcoins with actual utility (not just memes) are seeing unusual accumulation.

The compliance playbook

Projects with bulletproof legal frameworks are stealing the spotlight. Watch for chains that preemptively solved their Howey Test problems—because nothing screams 'investment' like lawyers outnumbering developers.

Volatility plays for degens

Liquidity pools are bracing for turbulence. Options traders are loading up on XRP strangles, while perpetual swaps see wild funding rates. Typical Wednesday in crypto—where 'risk management' means doubling down before the news hits.

Whatever the verdict, one truth remains: Wall Street still won't understand any of this—but they'll sure pretend to when the ETFs launch.

Ripple-SEC Settlement Nears Verdict, Awaits Court Nod to End XRP Injunction

Ripple and the SEC jointly asked Judge Torres on June 12th to lift an XRP sales ban and reduce fines. This move aims to settle their long legal fight, marking a key step forward.

The court granted a requested 60-day pause in appeals until August 15th. Lawyer Bill Morgan expects Judge Torres to rule much sooner, avoiding further delays complicating settlement talks.

Morgan clarified that Ripple caused delays by insisting the injunction be dissolved. The SEC actually cooperated to facilitate this change, showing flexibility to reach agreement.

SEC v Ripple: How the settlement process is going

1. Settlement agreement signed by Ripple parties on April 23, 2025 and by the SEC on May 8, 2025 ✅.

2. Parties filed a motion to hold the appeal and cross appeal in abeyance and obtained 60 days abeyance from April 16, 2025 to…

— bill morgan (@Belisarius2020) June 18, 2025

Previously, a settlement motion was rejected for procedural errors. The parties refiled correctly on June 12th, prompting the SEC to seek the appeals pause.

Both sides stress an urgent ruling is needed to finalize their settlement. Without it, costly appeals on key legal issues will proceed as planned.

The settlement outcome critically impacts potential US XRP-spot ETFs. An SEC appeal win could jeopardize them by potentially reclassifying XRP sales.

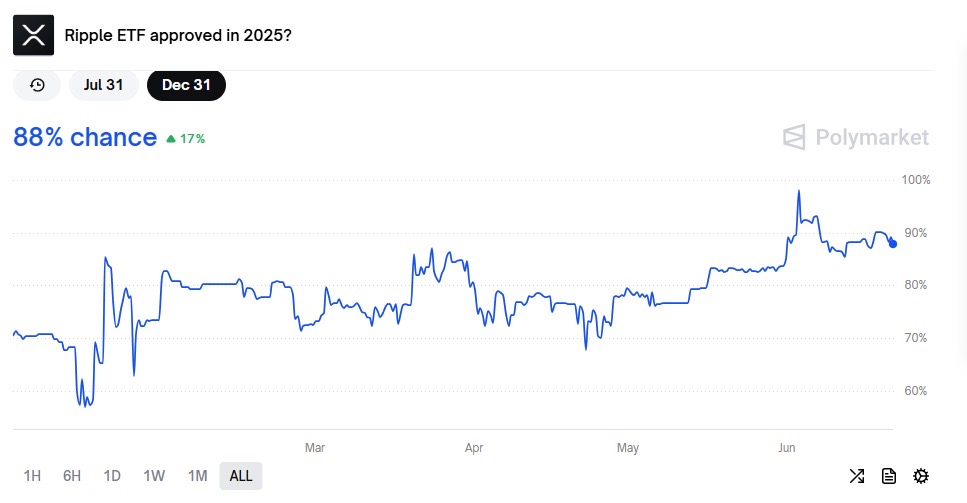

Despite legal uncertainty, Polymarket odds favor a 2025 XRP-spot ETF approval at 88%. This reflects Optimism the settlement will ultimately succeed.

Best Crypto to Buy Now

With the Ripple-SEC case nearing its finish line, legal clarity could ignite fresh market momentum. Investors are eyeing tokens that can capitalize on renewed confidence and regulatory certainty, but only one pick stands out in today’s landscape. It’s time to zero in on the best crypto to buy now.

SUBBD

With the Ripple vs. SEC case coming to an end sooner than expected, legal clarity is fueling optimism for utility tokens across the market, including SUBBD, which is rapidly gaining traction as an AI-powered platform for creators and fans.

![]()

Most content platforms today are built to extract value from fans and funnel it upward. While effective, this model is becoming outdated in the era of Web3.

The future of platforms should treat creators as more than just content producers and fans as more than paying customers. Both should have ownership, influence, and added value beyond content alone.

Current platforms are often rigid, with little input from creators or fans. What if these users could help shape the platform’s direction? That level of control is not possible today.

SUBBD goes beyond being just another platform; it’s a new kind of creator-fan ecosystem. Access is earned, engagement is participatory, and decisions are made collaboratively.

Fans can join token-gated communities, participate in exclusive livestreams, and enjoy immersive digital experiences, all powered by AI tools that bring creators and fans closer together.

On SUBBD, fan engagement isn’t limited to likes or follows. Fans unlock premium content, access exclusive livestreams, and earn rewards simply by holding $SUBBD tokens or staking them for credits.

By holding $SUBBD, users gain access to AI-powered tools for creating lifelike images, videos, and fan-driven media. This transforms content creation into a two-way experience for everyone involved.

Solaxy

As legal certainty boosts market sentiment, projects delivering real utility, such as Solaxy, are increasingly seen as the next wave of breakout opportunities in the evolving crypto landscape.

Solaxy’s presale has raised an impressive $56 million, just days before its exchange listing. The project aims to solve Solana’s congestion issues, allowing for smoother transactions during peak periods.

This innovation could change how users interact with Solana. Instead of using Solana’s Layer 1 directly, builders and traders could use Solaxy, which will then settle transactions on the solana main network.

With Solana valued at over $77 billion and $56 million raised for Solaxy, the project’s potential for growth is clear. Solaxy’s success could play a major role in expanding Solana’s ecosystem.

Looking ahead, the Solaxy community is excited for the launch of its main network, native DEX, and meme coin launchpad, all scheduled for July. These milestones are highly anticipated by investors and users alike.

Solaxy made waves last week by burning 35 billion tokens, worth $62 million, in a strategic move to increase scarcity. This action aims to ensure the project’s long-term success and sustainability.

The burn event generated strong positive reactions from the community. Media outlets highlighted the move, analysts praised it, and new investors flooded into the presale. In response, Solaxy burned another 20 billion $SOLX on Tuesday.

Another broken barrier for $SOLX 🚀

56M Raised! 🔥 pic.twitter.com/G97yaSko3k

— SOLAXY (@SOLAXYTOKEN) June 21, 2025

In total, 55 billion $SOLX tokens have now been burned, representing 40% of the total supply. With fewer tokens in circulation, increased demand could lead to a sharper rise in the $SOLX price.

Bitcoin Hyper

Bitcoin Hyper marries Bitcoin’s rock‑solid foundation with hyper‑scalable sidechains. In an era craving both stability and speed, this hybrid play might just be the breakout star once regulatory dust settles.

In a world where most crypto projects take cautious routes, Bitcoin Hyper is emerging as a top contender for 2025. It stands out by offering something distinct in a crowded market.

Bitcoin Hyper operates on the Solana VIRTUAL Machine, a framework known for performance and transparency. This powerful combination could help it thrive if regulatory pressures grow.

With bitcoin Hyper, users can send, receive, and interact with Bitcoin in near real-time. They can also tap into the growing Bitcoin-based DeFi ecosystem, unlocking new financial opportunities.

One of Bitcoin Hyper’s standout features is the Canonical Bridge, which facilitates all withdrawals from and to LAYER 2. This bridge plays a key role in the ecosystem’s functionality.

Bitcoin Hyper is building a comprehensive ecosystem, including a bridge, wallet, staking, and meme features. These elements could make it one of the most utility-rich Bitcoin projects on the market.

While Bitcoin is the original cryptocurrency, its aging infrastructure is starting to show limitations. Bitcoin Hyper offers a solution, enhancing Bitcoin’s capabilities with modern technology.

According to a well-known crypto YouTuber, 99Bitcoins, Bitcoin Hyper is expected to deliver 100x returns.

XRP

The courtroom drama that shaped crypto law is finally winding down, and XRP stands at the center. As a ruling nears, this veteran token could shake off its legal constraints and reclaim its place among the heavyweights.

XRP is the native token of the XRP Ledger, an open-source blockchain designed to improve global financial transfers and currency exchanges. It’s also used for storing value and capitalizing on price changes.

Ripple, a blockchain services company, uses XRP and the XRP Ledger to facilitate transactions between financial institutions, businesses, and organizations. This enhances cross-border payments and liquidity.

The XRP Ledger was developed in 2011 by Jed McCaleb, David Schwartz, and Arthur Britto to address Bitcoin’s limitations. It was launched in 2012, with XRP created to support its functionality.

The chart shows XRP consolidating in a sideways range after a decline from early June highs NEAR $2.35. Price has found a floor around $2.10 on multiple occasions, indicating a clear demand zone, while the area around $2.25 has capped upside attempts. Volume has tapered off slightly during the recent pullback to support, suggesting the move lower was more a lack of new buyers than aggressive selling.

A decisive break above $2.25 on increased volume WOULD signal renewed bullish interest and could target the June 9 peak near $2.35. Conversely, a break below $2.10 on heavy volume would likely open the door to the next support near $2.05. Traders may look to buy near the lower boundary with a stop just under $2.09 and target the top of the range, or wait for a confirmed breakout before committing.

Conclusion

The joint motion by Ripple and the SEC is a sign that a landmark decision regarding XRP is coming, and sooner than most anticipated. Aside from the short-term effect on XRP’s price, this case is a reflection of the crypto industry’s process towards regulatory maturity and institutional acceptance.

For investors, it means a more defined roadmap for portfolio management and risk allocation. By concentrating on utility tokens with practical uses and established teams, one can get ahead of the curve. After all, with legal ambiguity in the rearview mirror, now is the best crypto to buy now.

![]()