Bitcoin Holds Steady Under $110K—Is This the Calm Before the Next Bull Run?

Bitcoin''s price action hits the brakes just shy of $110,000, leaving traders wondering if this is healthy consolidation or a warning sign.

Market watchers split on next move

While some see this as a textbook breather after June''s 28% rally, others spot troubling parallels to Q1''s false breakout. Liquidity pools below $105K suggest institutional players are building positions—or preparing stop-loss traps.

The ''smart money'' paradox

Goldman''s crypto desk reports record OTC volumes even as retail FOMO cools off. Classic Wall Street play: shake out weak hands before the next leg up. Meanwhile, crypto Twitter oscillates between ''buy the dip'' and ''this time it''s different'' faster than a meme coin''s 15-minute chart.

As one hedge fund manager quipped: ''In crypto, consolidation is just institutional investors deciding which pocket to take profits from next.''

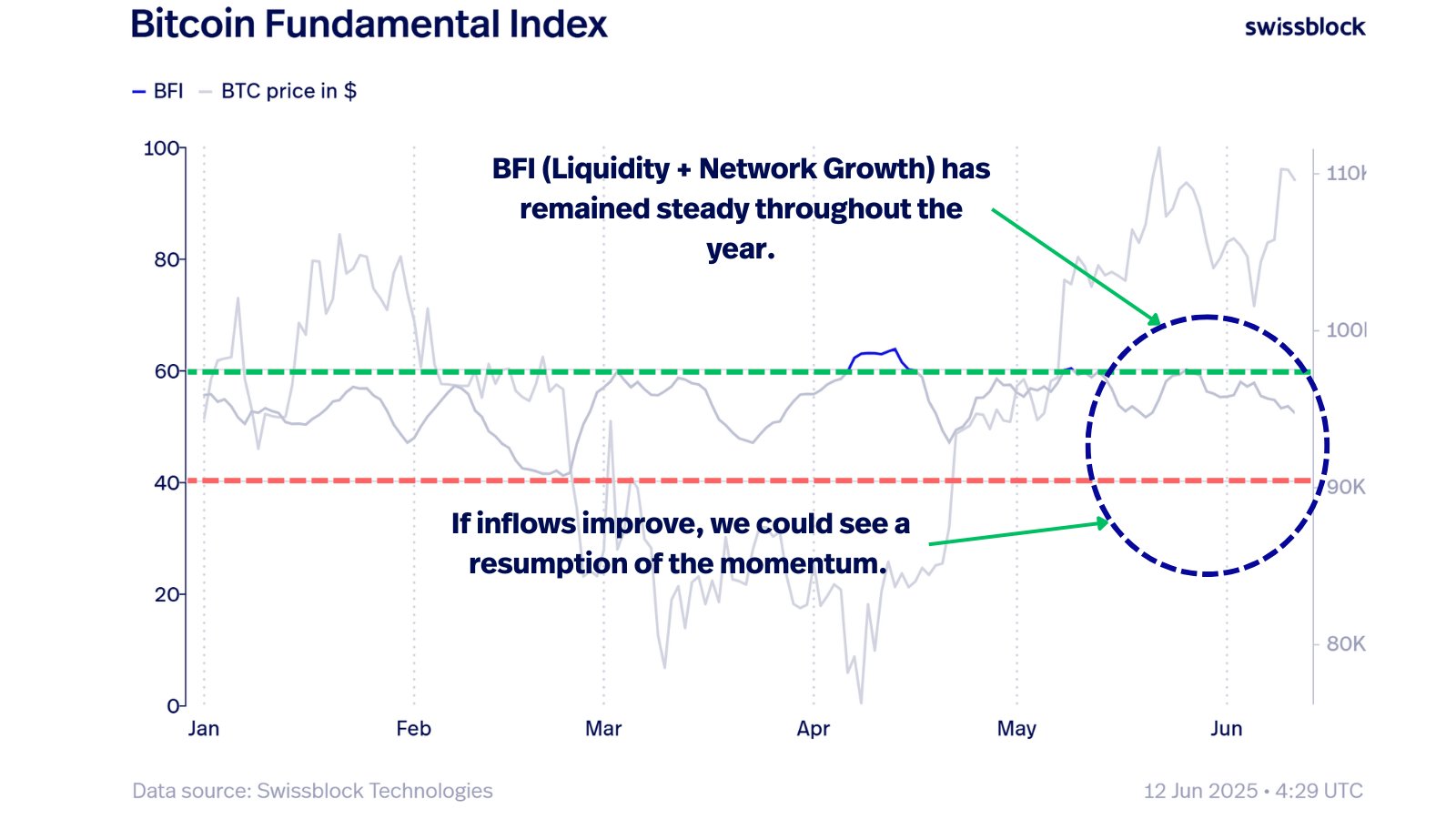

No Clear Breakout Without Fuel

Swissblock cautioned earlier this week that the lack of new capital entering the market raises the risk of a double-top formation, a technical pattern that often signals an impending reversal.

READ MORE:

In parallel, a joint report with analyst Willy Woo, titled Bitcoin Vector, showed that while transaction volumes and liquidity are sliding, the network remains fundamentally stable.

- Liquidity has dipped, with fewer transactions and lower volume.

- Despite this, network activity has held steady, suggesting user confidence remains intact.

- Profit-taking remains limited, meaning sellers aren’t flooding the market.

This combination, according to Swissblock and Woo, suggests that while Bitcoin might remain rangebound for now, a sharp decline is unlikely—at least until sentiment or fundamentals shift more significantly.

![]()