Bitcoin’s Pullback Mirrors Gold’s 2008 Surge—Traders Bet on June Rebound

Bitcoin’s recent 15% drop has analysts dusting off history books—and spotting eerie similarities to gold’s pre-bull market consolidation in 2008. The crypto’s trading patterns now mirror the precious metal’s behavior months before its legendary 300% rally.

Market mechanics suggest institutional players are accumulating during this dip. Liquidity pools show whales gobbling up BTC below $67k—a level that previously triggered massive buy orders.

June tends to be crypto’s turnaround month. After May’s typical sell-off (thanks, tax season), blockchain data reveals miners are holding rather than dumping—a bullish signal that often precedes major uptrends.

Of course, Wall Street’s suddenly full of ‘gold bugs’ turned ‘BTC maximalists’—funny how six-figure price targets appear right after their funds finish loading bags.

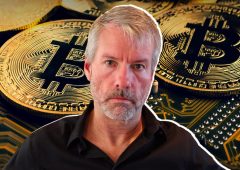

Strategy Adds $75M in Bitcoin to Its Treasury

Strategy Adds $75M in Bitcoin to Its Treasury

Supporting the bullish narrative, analyst PropheticBTC forecasts a MOVE back to $110,000 and plans to enter a long position with a short-term horizon extending to mid-June.

As the crypto market looks for direction, macro factors like upcoming Federal Reserve remarks and political developments could influence near-term sentiment. Still, many believe that if Bitcoin repeats gold’s historical pattern, another leg up could be just around the corner.