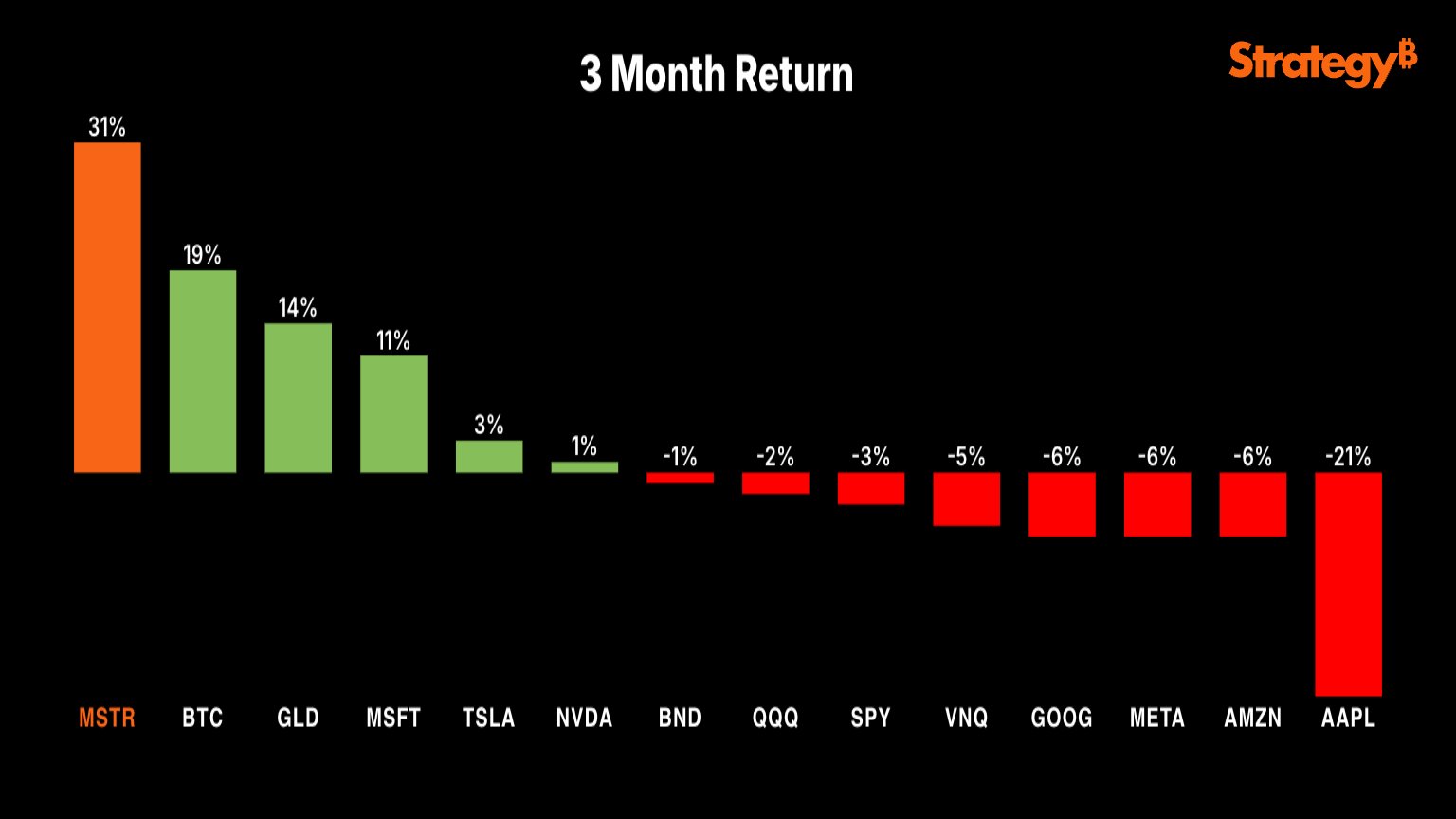

Bitcoin Crushes Tesla, Apple, and Gold—Here’s How Michael Saylor Played It Right

Move over, traditional assets—Bitcoin’s eating your lunch. While gold bugs stacked ounces and tech bros hyped Tesla stock, Michael Saylor’s laser-eyed BTC strategy quietly smoked them all. No fancy footwork, just a relentless accumulate-and-hold play that left Wall Street’s darlings in the dust.

Forget ‘safe havens’ or ‘blue chips.’ The real alpha? A guy who bet big on digital scarcity while everyone else recycled tired inflation hedges. Gold’s got weight, Apple’s got iPhones—but Bitcoin’s got a supply cap. Game recognizes game.

Of course, the finance world will spin this as luck. Just like they called Tesla overvalued at $50 billion. Meanwhile, the orange coin keeps printing—and the suits keep missing the point.

The outperformance is no coincidence. With over 576,000 BTC on its books, MicroStrategy functions as a high-leverage Bitcoin proxy. The company’s aggressive buying—often funded through debt—has tied its market valuation to Bitcoin’s movements, making MSTR a go-to choice for investors seeking amplified BTC exposure.

READ MORE:

But Saylor’s message went beyond numbers. In recent interviews and social posts, he argued that buying Bitcoin—even at all-time highs—remains a smart long-term move. He pointed to historical four-year holding data showing consistent profitability, regardless of market timing. For Saylor, Bitcoin’s strength lies in its resilience against inflation and fiat currency decay.

He also warned of a coming shift: once banks and large institutions formally embrace Bitcoin, the window for everyday investors could close. As regulatory green lights emerge, Saylor predicts demand will surge—possibly outpacing supply and making BTC far less accessible to the public.

“Time in the market beats timing the market,” Saylor wrote, signaling that the best time to buy Bitcoin may always be now.