Dogecoin Nears Explosive Rally—On-Chain Metrics Flash Bullish

Dogecoin’s blockchain data screams accumulation—whale wallets are loading up while retail traders nap. Network activity spikes mirror pre-pump patterns from 2021’s meme frenzy.

Key signals: Exchange reserves hit 3-year lows (fewer coins for sale), while dormant coins suddenly move (veteran holders cashing in? Or gearing up?). The 200-day MA just got bulldozed with 28% weekly volume growth.

Of course, this could just be another ’institutional adoption’ narrative to lure bagholders—Wall Street loves a good meme dressed as an asset class. But the charts don’t lie: DOGE’s coiled tighter than a spring in a Elon tweetstorm.

European Police Break Up Crypto-Backed Criminal Network in International Raid

European Police Break Up Crypto-Backed Criminal Network in International Raid

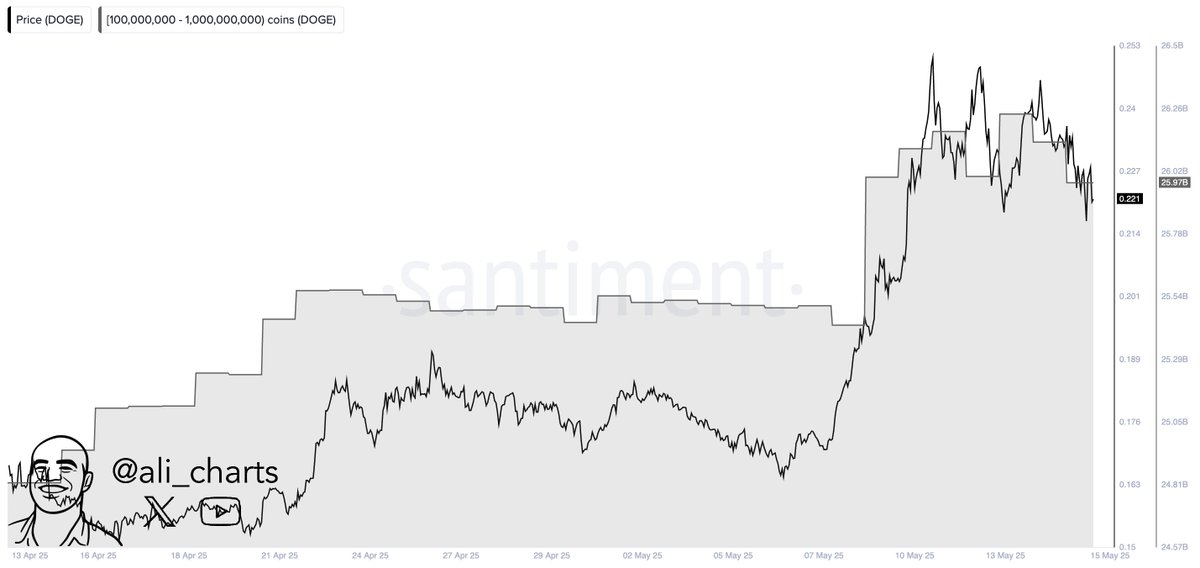

Over the past month alone, dogecoin whales—large holders often seen as market movers—have accumulated more than 1 billion DOGE.

Such aggressive accumulation is often interpreted as a vote of confidence from sophisticated investors. When combined with rising usage and sustained transactional throughput, these indicators paint a bullish backdrop for the coin’s next move.

While Dogecoin remains known for its meme status, the current data suggests something more serious may be brewing beneath the surface.