Altcoins Sweat as Bitcoin Flexes: The Great Crypto Shakeout Begins

While Bitcoin muscles toward new highs, altcoins wobble like Jenga towers in a windstorm. The king of crypto isn’t just rallying—it’s sucking oxygen from the rest of the market.

The Domino Effect Nobody Wanted

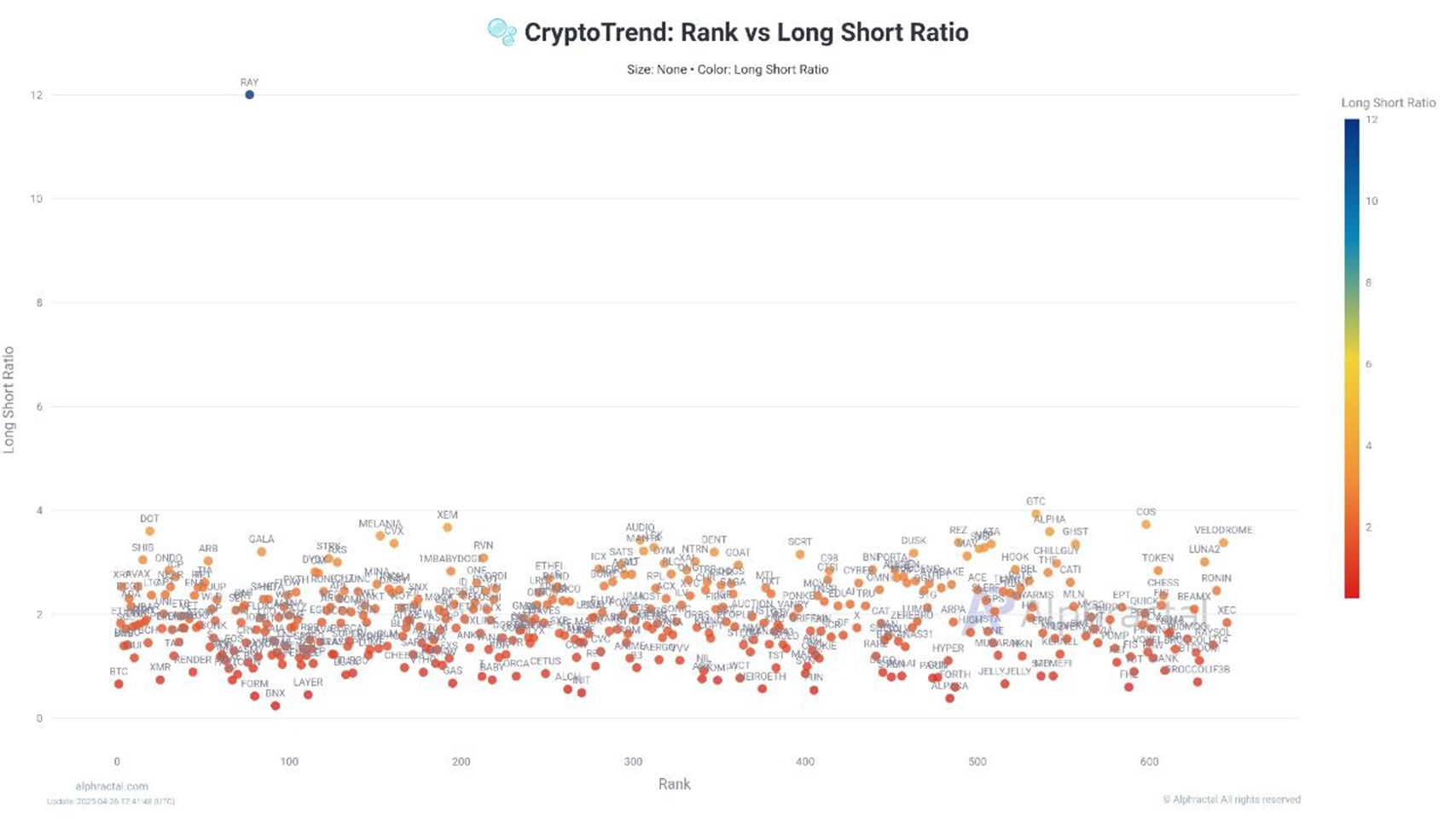

Smaller tokens now face their ultimate stress test: survive Bitcoin’s gravity or become exit liquidity for ’smart money’ (read: hedge funds pretending to understand blockchain).

Portfolios on Life Support

Projects that thrived in the bull market’s lazy river now gasp for attention. Even ’Ethereum killers’ look mortal when BTC decides to eat the entire crypto buffet.

As traders chase Bitcoin’s momentum, the altcoin casino empties—proving once again that 99% of crypto projects exist solely to separate retail investors from their money. The house always wins.

Major Outflows Hit Trump-Linked Memecoin Ahead of Private Event

Major Outflows Hit Trump-Linked Memecoin Ahead of Private Event

Meanwhile, on the Bitcoin side, Alphractal’s CEO Joao Wedson flagged a bullish signal emerging on Binance. He pointed to the Bitcoin/Stablecoin Reserve Ratio moving within the $76,000 to $77,000 range — a pattern that historically preceded major Bitcoin rallies, notably after the 2020 COVID crash and again at the end of 2022.

Wedson explained that rising stablecoin reserves relative to Bitcoin holdings suggest that fresh capital is ready to move into the market, potentially setting the stage for another upward surge.

Despite the cautious tone on altcoins, Alphractal’s report hints that broader market conditions could soon shift if Bitcoin leads another rally. Analysts noted that strong Bitcoin momentum often pulls liquidity back into riskier assets, meaning any significant Bitcoin breakout could eventually breathe new life into altcoin markets as well.