27,750 BTC Flee Binance in Single-Day Exodus—Largest Outflow Since 2022

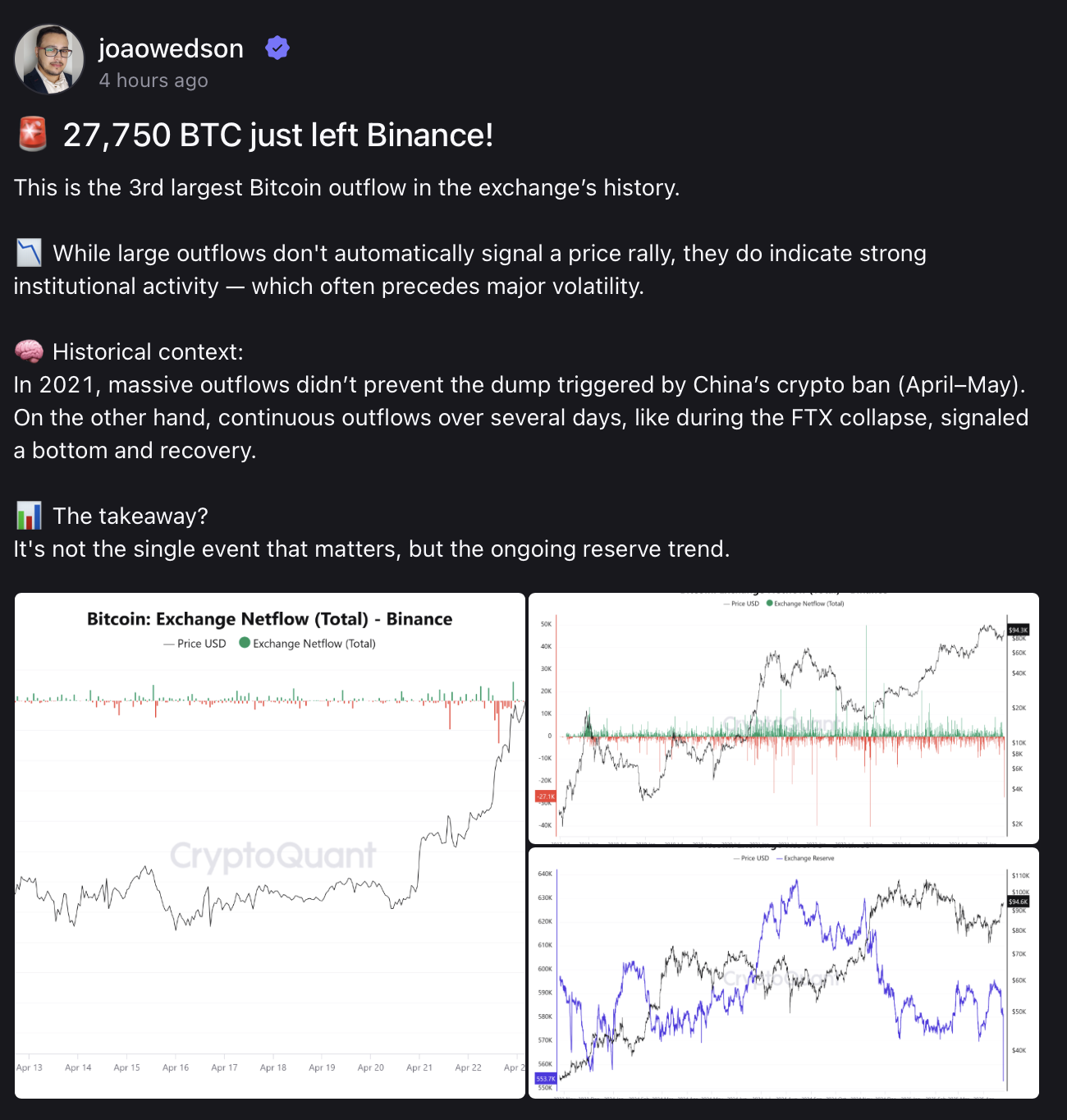

Binance just bled Bitcoin at a rate that’d make a vampire squid blush. A staggering 27,750 BTC ($1.8B at current prices) vanished from exchange wallets in 24 hours—the biggest single-day outflow since the FTX collapse.

Where’d it go? Cold storage, mostly. Whales are bunkering down ahead of the halving, proving once again that crypto’s ’institutional adoption’ narrative still bows to the cult of HODL.

Funny how ’not your keys, not your coins’ suddenly matters again when CZ’s exchange starts looking like a regulatory piñata. The market’s response? A 3% pump, because nothing makes crypto traders buy like the smell of someone else’s fear.

Institutional Activity or Early Signal?

Large-scale outflows don’t guarantee a price surge, but they often indicate strategic positioning. In many past cases, institutions have moved BTC off exchanges to hold long-term, which can tighten market supply and add upward pressure — especially if retail demand follows.

However, not every outflow leads to a rally. In 2021, massive withdrawals preceded a market crash as China imposed a sweeping ban on crypto. Conversely, during the FTX collapse in late 2022, consistent BTC outflows were an early sign that the market had bottomed, leading to months of recovery.

Trend Over Time Matters Most

Analyststhat it’s not just the size of a single withdrawal that counts. What matters more is the longer-term trend of reserves across exchanges. Sustained outflows over several days or weeks have historically carried more bullish weight than one-off events.

READ MORE:

If this latest movement proves to be the start of a new trend — especially amid growing regulatory uncertainty and macro volatility — it could lay the groundwork for the next leg of Bitcoin’s rally.

Whether this marks the beginning of sustained accumulation or remains a blip, it signals growing confidence from large holders. And that, in itself, could be a powerful shift.