Bitcoin ETFs Gobble Up Capital for Fifth Straight Day—Wall Street Finally Gets FOMO

Institutional money keeps flooding into crypto’s shiny new wrapper—because nothing screams ’mature asset class’ like chasing momentum with a 75% year-to-date gain.

Five straight days of net inflows prove two things: 1) TradFi can’t resist a bull market, and 2) Bitcoin remains the only hedge against central bankers’ money printers. The ETFs now hold over 800,000 BTC—roughly 4% of the total supply locked up by suits who still call it ’digital gold.’

Meanwhile, SEC lawyers sharpen their pencils to draft the inevitable ’investor protection’ crackdown... right after their bosses finish front-running the approval decision.

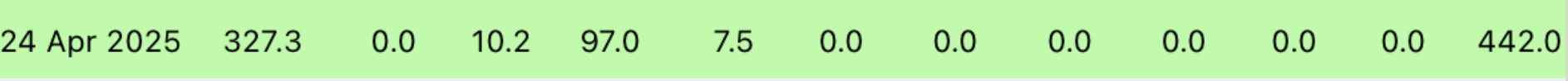

The streak follows two blockbuster sessions earlier in the week, with inflows of $936.4 million on Tuesday and $916.9 million on Wednesday. Despite Thursday’s healthy inflow figures, total ETF trading volume dropped to $2 billion from $4 billion the previous day.

READ MORE:

Momentum Builds Despite Market Volatility

The sustained inflows underscore persistent institutional demand for Bitcoin exposure via regulated channels. Analysts suggest this trend may signal growing investor confidence in Bitcoin ETFs as long-term vehicles, even amid broader market uncertainty.

With continued momentum and capital flows, Bitcoin ETFs are proving to be a key force in the current market cycle.