Bitcoin’s Asymmetric Risk-Reward: Bitwise Analyst Spots Rare Opportunity in Price Prediction

Forget balanced portfolios—this setup skews wildly in your favor.

Bitwise's lead analyst just flagged what crypto veterans chase: a classic asymmetric trade. The kind where potential upside dwarfs possible downside. Not a guarantee, but a calculated bet with skewed odds.

The Math Behind the Move

It's all about positioning. The analyst points to a convergence of on-chain metrics and macro sentiment creating a lopsided risk profile. Think of it as the market offering a coin flip where heads you win big, tails you lose small. These windows don't stay open long.

Why This Time Feels Different

Institutional plumbing is finally built. Spot ETFs turned Bitcoin into a mainstream asset, not just a speculative toy. That structural shift changes the entire risk calculus—even if Wall Street still charges 2% to buy what you can self-custody for free.

Timing the Untimeable

Predicting exact price points is a fool's errand. The real signal is in the setup. The analyst isn't calling a specific number but highlighting a favorable configuration of factors—liquidity, sentiment, adoption—that historically precede major moves.

Greed and fear still drive markets, but now they're dressed in suits.

Bitcoin’s COVID-Level Risk-Reward Setup

André Dragosch’s research can be summarised in one simple line: Bitcoin is pricing in recession-level growth expectations while growth is anticipated to MOVE in the opposite direction.

The analyst noted on X that he thinks “global growth expectations will accelerate from here, based on the amount of preceding monetary stimulus,” adding, “which points to a reacceleration well into 2026.”

Dragosch then highlighted, “The last time I saw such an asymmetric risk-reward was during Covid,” and underlined that Bitcoin 6x’d within a year that time. He concluded his research by stating, “You’re not even remotely bullish enough.”

Along with the tweet was a chart which showed global growth priced by Bitcoin, with the score at levels last seen in 2022 (post FTX crash) and 2020 (COVID). Both of these prior instances marked a structural bottom for Bitcoin and preceded strong upward repricings.

Supporting this outlook are sentiment and momentum indicators such as the Fear and Greed Index, the RSI, and the MACD, each of which plunged to historically low levels in November.

All of this suggests that Bitcoin may be heavily oversold and therefore poised for a strong rebound into 2026. But how far can it go?

Bitcoin Price Prediction: Analyst Eyes V-Shaped Reversal to $125K

Oftentimes, steep, cascading sell-offs see faster recoveries compared to structural incremental declines – and that’s why analyst Wimar anticipates an explosive V-shape recovery in the months ahead.

He predicts that Bitcoin will reclaim $125K by February 2026, noting that $80K could serve as macro support. Indeed, this WOULD align with momentum and sentiment indicators, as well as Dragosch’s analysis. But can Bitcoin extend beyond $125K?

The $BTC plan is confirmed now.

80 → 125 https://t.co/39wHVIWMyw pic.twitter.com/tGsoFoxsgi

— Wimar.X (@DefiWimar) November 25, 2025

Analyst Top Gainer Today says, “Bitcoin will go to $100K very soon,” but suggests it could reach $150K-$200K by Q1 2026. His price chart shows that the recent Bitcoin rebound is unfolding on a long-term trendline support level, which strengthens the bullish outlook.

This prediction may also better align with Dragosch’s perspective, which holds that BTC is currently heavily underpriced.

$Bitcoin 4th time have bottomed from $80k

Im seeing clearly in this chart $BTC will go $150k – $200k Q1 2026 ✅$Bitcoin will hit $100k very soon 🔥🔥🔥 https://t.co/9Md6UwerLe pic.twitter.com/9WOhs6fRmr

— TOP GAINER TODAY (@RoccobullboTTom) November 28, 2025

If monetary stimulus occurs as Dragosch anticipates, the coming months could be massive for Bitcoin. Indeed, there could be intermittent volatility, potentially leading to a retest of key levels below $90K. That said, the outlook, based on macroeconomics, market sentiment, and technical analysis, strongly signals that Bitcoin could reclaim $100K in December and potentially rise to $125K-$150K in Q1 of 2026.

With that said, let’s take a look at Bitcoin Hyper, a new Bitcoin LAYER 2 that analysts believe is poised to surge as Bitcoin regains bullish momentum.

Bitcoin Hyper Raises $28M For the Fastest Bitcoin Layer 2

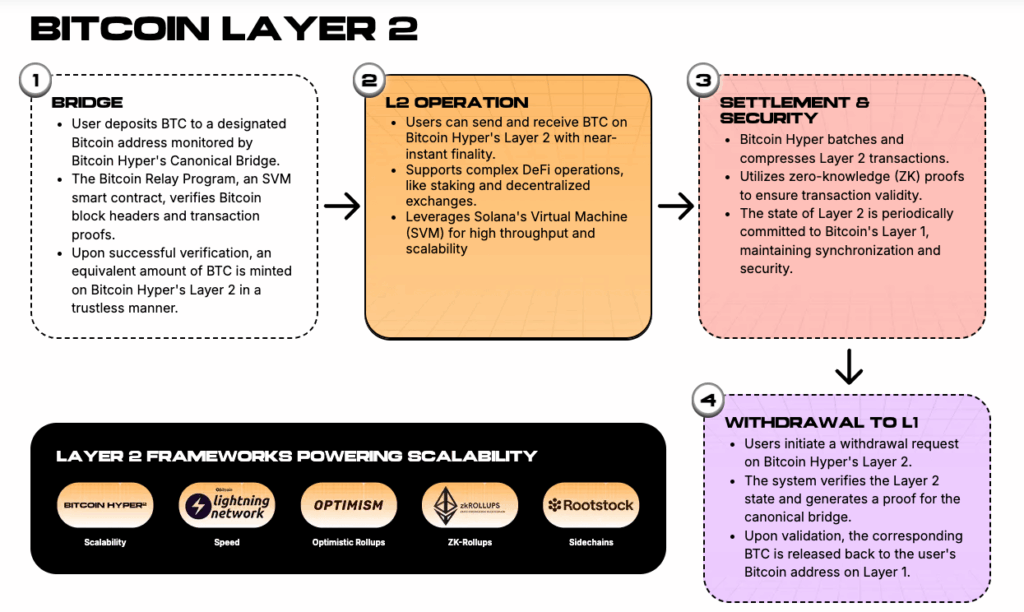

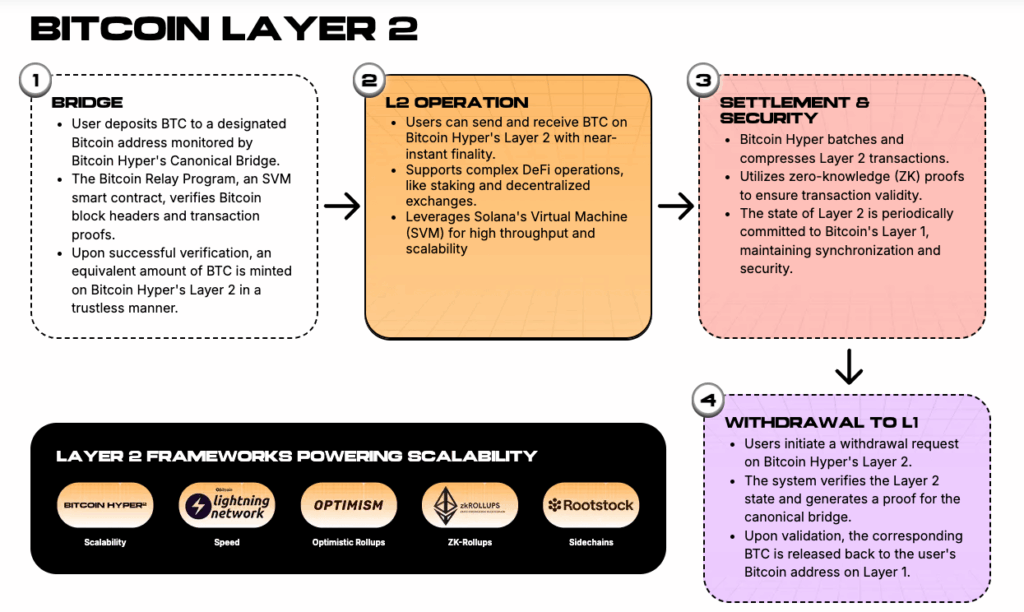

What if Bitcoin were as fast as Solana and could support smart contracts – all while retaining its current level of security and decentralization? That’s Bitcoin Hyper’s vision: it’s building a Bitcoin L2 blockchain using the Solana VIRTUAL Machine (SVM).

It runs as a separate entity to Bitcoin but uses ZK-rollups to securely anchor its state to the Bitcoin base layer, meaning its transactions inherit the L1’s security and immutability.

While Bitcoin Hyper isn’t the first Bitcoin L2, it is the first to integrate SVM, which gives it a speed advantage. The current fastest Bitcoin L2 is Starknet, which can compute 992 transactions per second (TPS). Bitcoin Hyper is expected to mirror Solana’s performance, which is capable of tens of thousands of TPS.

This speed and smart contract support unlocks new possibilities for Bitcoin. It could turn it into a settlement layer for DeFi, payments, meme coins, RWAs, and more. That would completely change the blockchain landscape – and potentially have huge implications on the HYPER price.

According to popular analyst RJ from Cryptonews, HYPER has potential for up to 100x gains if it successfully implements its L2.

Besides its strong use case, RJ’s prediction is based on Bitcoin Hyper’s current early-stage price.

It’s undergoing a presale and has raised $28.7 million so far, a massive amount that clearly reflects market appeal. However, the presale allows investors to secure a ground-floor entry price, thereby maximizing their upside potential.

Visit Bitcoin Hyper Presale

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

![]()