Bitcoin Shatters $91K Barrier: Bull Market Resurgence Confirmed?

Bitcoin rockets past $91,000 as institutional money floods back into crypto markets.

The Reawakening Giant

After months of sideways trading, Bitcoin's explosive breakout signals potential paradigm shift. Trading volumes spike 47% as whales accumulate positions.

Technical Breakout Confirmed

BTC clears critical resistance level that had capped prices since August. The move triggers $280 million in short liquidations—traders caught betting against the rally.

Institutional FOMO Returns

Wall Street's sudden renewed interest mirrors 2021 patterns. Meanwhile, traditional finance veterans mutter about 'irrational exuberance' between sips of champagne.

This isn't just a pump—it's a statement. The question isn't whether Bitcoin's back, but whether traditional finance can keep up with the revolution it once dismissed as a passing fad.

Rate Cuts, Bitcoin ETF Flows, and Hidden Bullish Divergence

CME Group’s FedWatch Now tool indicates an 85% chance of a cut at the December FOMC meeting, up from 30% just a week ago. This largely explains why bitcoin and equities are both rising right now. The S&P 500, for example, has gained over 4% from its lows about a week ago – and lower interest rates boost liquidity for risk assets, which is bullish for everything from Bitcoin to blue-chip stocks.

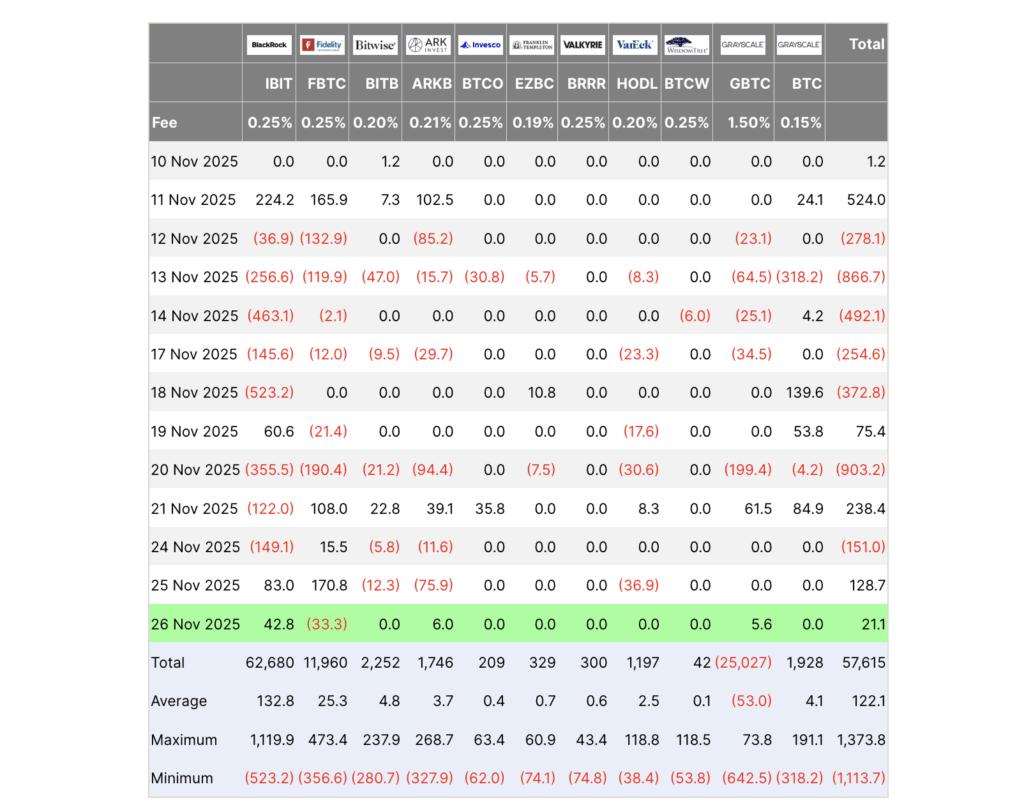

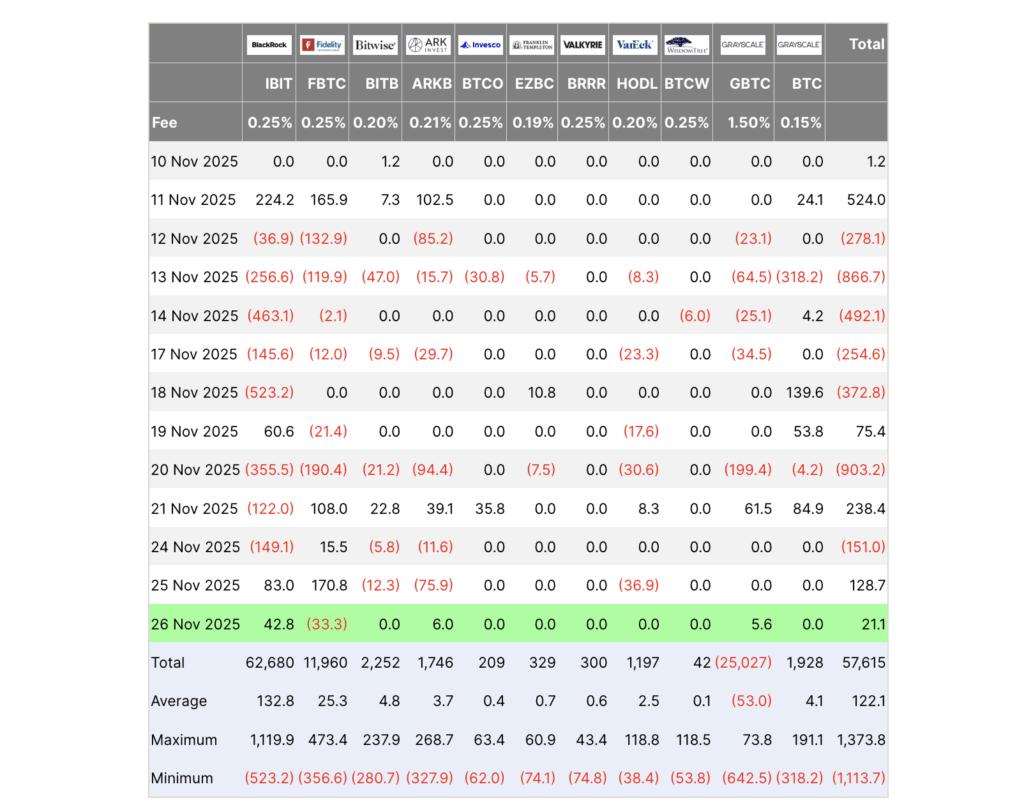

Spot Bitcoin ETF flows also reflect this shift, with heavy outflows from early November giving way to renewed strength. Three of the past four days have seen net inflows of up to $238.4 million – reflecting a resurging appetite among institutional players.

And here’s where it gets more exciting: Bitcoin’s price chart has formed a hidden bullish divergence pattern on the weekly time frame. This is where the RSI indicator makes lower lows, while the price makes higher lows. It usually indicates that a price is diverging from lower-time-frame bearish momentum, and that a macro uptrend continuation is about to ensue.

In summary, this combination of interest rate cuts, a stabilizing ETF market, and a strong price chart suggests Bitcoin could maintain its higher-time frame uptrend in the coming months. But how far can it go?

Bitcoin Price Prediction: Analyst Forecasts $135K in Q1 2026

The popular analyst Mr. Crypto Whale has noted that Bitcoin is showing bullish momentum off a long-term support level, which he says signals a potential bottom.

Regarding how far BTC could go in the next move, the analyst is looking toward the $135,000 level, which WOULD represent a 48% increase from Bitcoin’s current valuation.

Bitcoin looks bullish here

There’s a very high probability this is the bottom

Invalidation 78k-79k $BTC pic.twitter.com/mkQZM8pGlK

— Mr. Crypto Whale 🐋 (@Mrcryptoxwhale) November 26, 2025

Other respected industry players are also predicting strong gains. Fundstrat and BitMine Co-Founder Tom Lee recently said he believes Bitcoin could reclaim $100,000 by the end of 2025 and potentially reach a new all-time high.

With Bitcoin making a comeback, other cryptocurrencies are also gaining notable traction. One project that stands out is Bitcoin Hyper, with several respected analysts backing it for up to 100x returns once it lists on the open market.

Top Trader Predicts 100x ROI for Bitcoin Hyper as Presale Raises $27.5M

Bitcoin is used to store value and combat inflation, but people are beginning to realize that it could serve many other purposes. For example, JPMorgan recently announced an IBIT structured note that offers clients passive yields with potential for 16% APY or more.

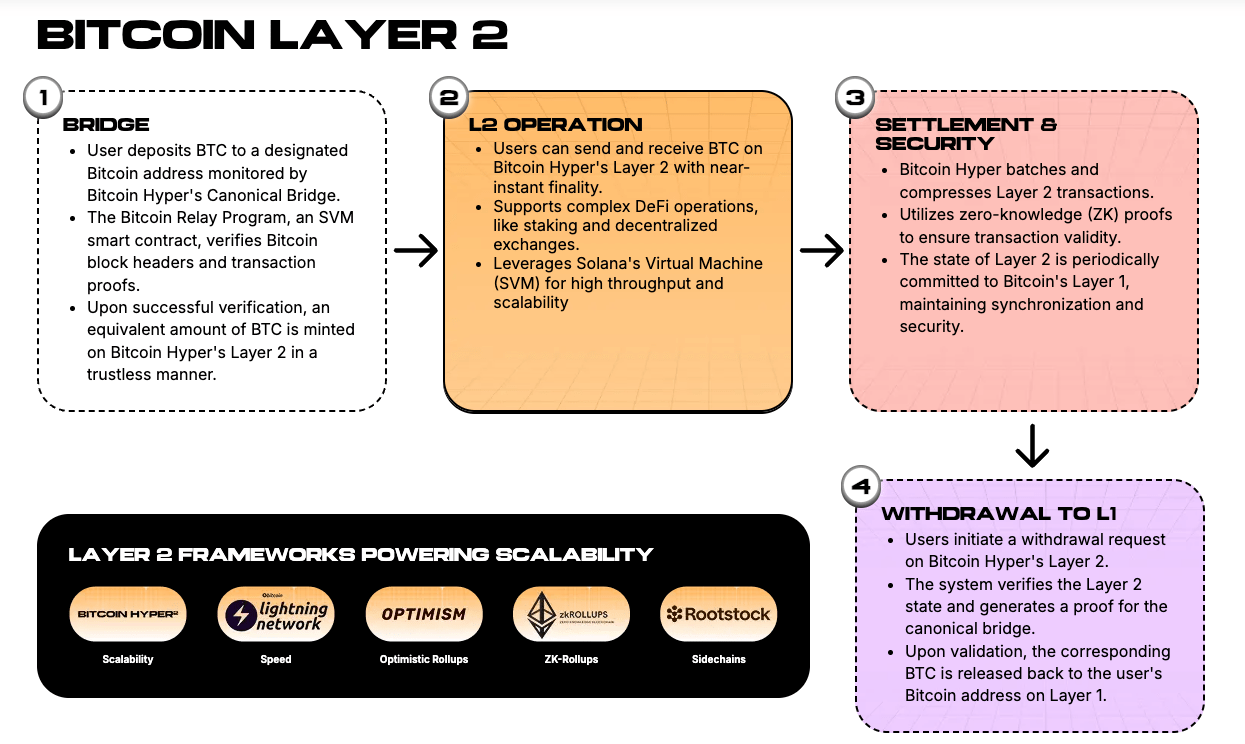

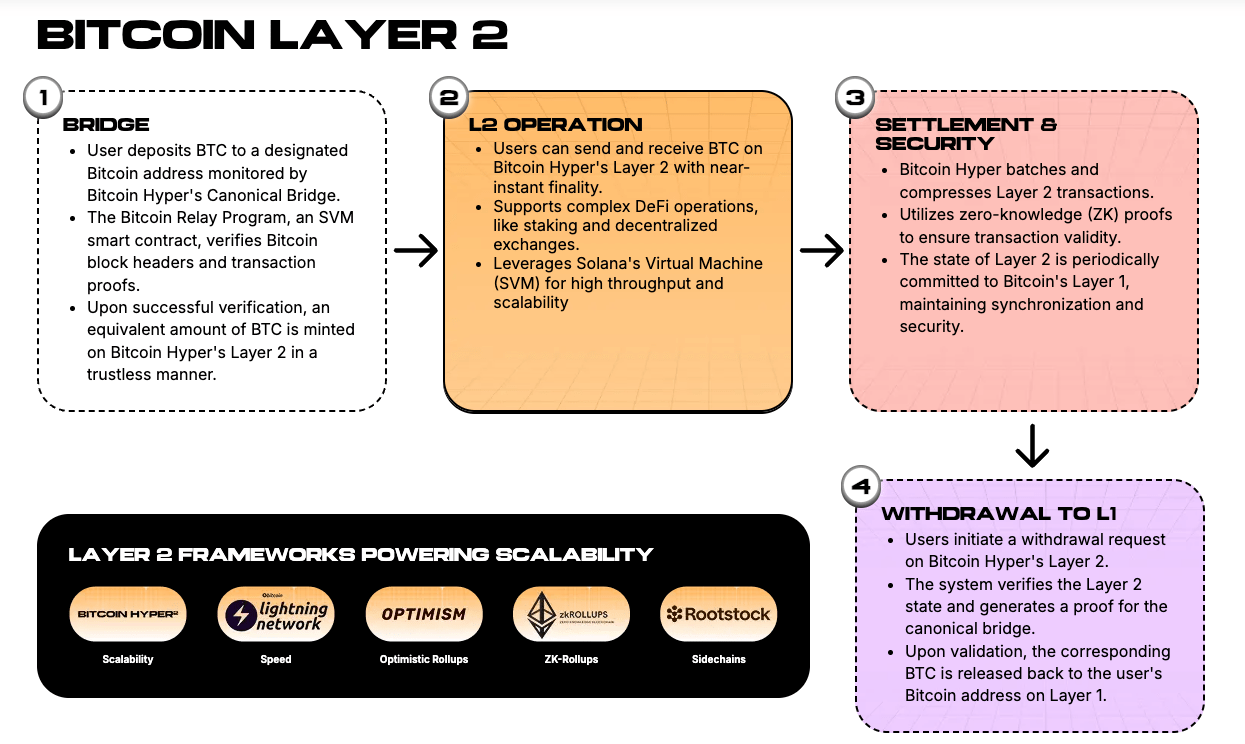

Meanwhile, Bitcoin Hyper is expanding Bitcoin’s use cases in a crypto-native way: serving as a fully decentralized Layer 2 blockchain. The Layer 2 utilizes the Solana VIRTUAL Machine (SVM) and ZK-rollups, offering the speed and programmability of Solana while reporting the network’s state back to Bitcoin L1 for security and immutability.

Bitcoin Hyper supports smart contracts – opening the door for DeFi, stablecoins, meme coins, gaming, and more on Bitcoin. This creates a setup with the potential to attract millions of new users.

In short, Bitcoin Hyper could give Bitcoin a second wind – and the market is buzzing. The project’s ongoing presale has raised $28.5 million to date, demonstrating serious momentum. However, analyst Borch Crypto believes HYPER is just getting started, predicting it could 100x once it lists on the open market.

Bitcoin is in an exciting position right now – fundamentals are strong, and it remains significantly discounted from its October all-time highs. But as Bitcoin continues its rebound, we’ll likely see new and innovative altcoins outperform it with bigger gains.

Bitcoin Hyper is exactly the kind of project that could set the pace, with its Bitcoin-backed use case, community support, and early stage status pointing toward significant upside potential.

Visit Bitcoin Hyper Presale

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

![]()