Top Altcoin Picks After Michael Saylor’s MSCI Index Clapback

Michael Saylor just dropped a truth bomb on traditional finance - and crypto investors are scrambling to position themselves.

The MicroStrategy chairman's fiery response to MSCI's indexing approach sent shockwaves through digital asset markets, highlighting the growing tension between legacy financial systems and decentralized alternatives.

Portfolio Rebalancing Opportunities

While Bitcoin remains the undeniable king, several altcoins are showing remarkable resilience and growth potential in Saylor's wake. Ethereum continues to dominate smart contract platforms, Solana's transaction speeds keep attracting developers, and Cardano's research-driven approach maintains its loyal following.

Market analysts note that when traditional finance gatekeepers like MSCI face public scrutiny from crypto leaders, it typically signals incoming capital rotation into the digital asset space. The timing couldn't be better for strategic accumulation.

Of course, watching billionaires debate index methodologies while regular investors navigate 20% daily swings does make you wonder who's really in control of your financial future. The revolution might be decentralized, but the profits remain decidedly centralized in a few well-timed wallets.

Saylor Responds to MSCI Letter

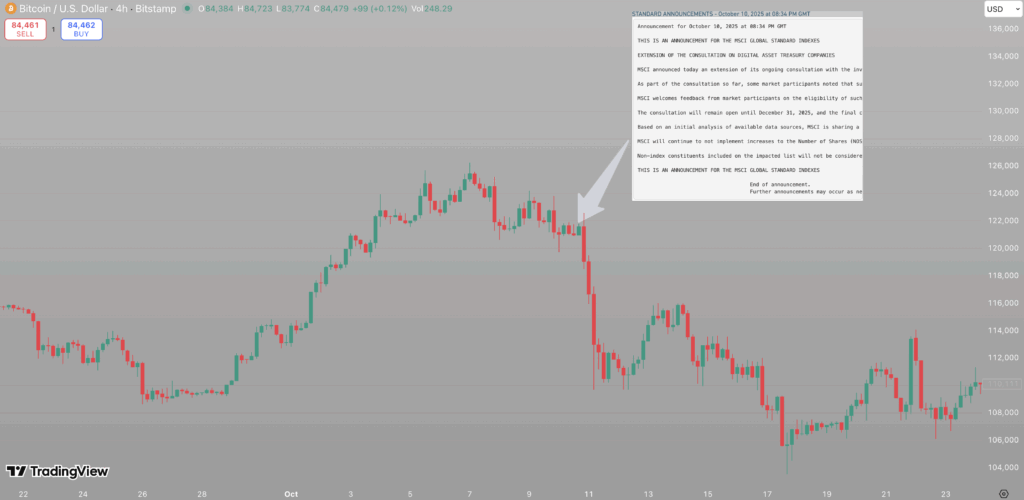

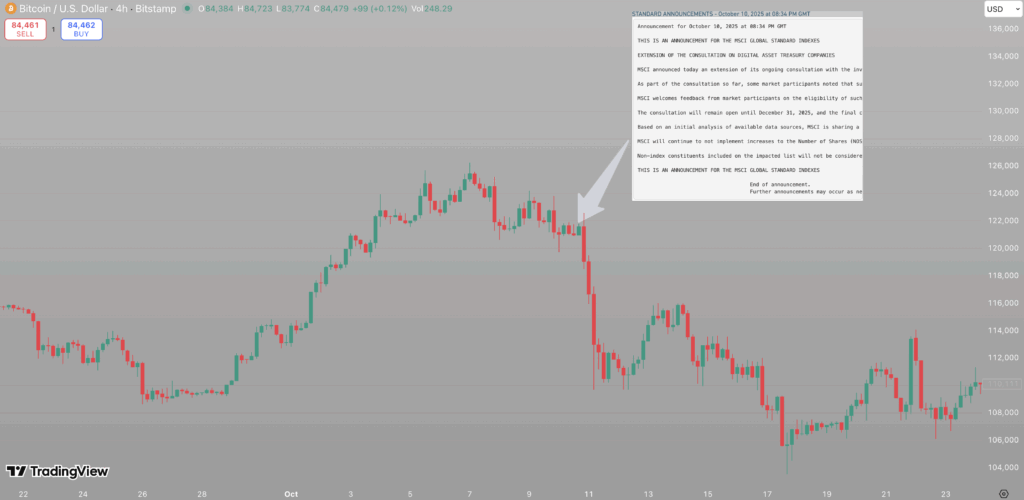

The MSCI announcement may have triggered the October 10 liquidation event, as smart money traders, attuned to its potentially dire ramifications, quickly exited positions, says crypto analyst Ran Nuener.

MSCI’s statement was published on October 10 at 08:34 GMT, and within hours, the Bitcoin price started to crater. This was the same day as the $19.2 billion liquidation event, which triggered a prolonged downturn for BTC and most altcoins.

Nuener explained that the Strategy’s delisting from MSCI indices “would mean that all the pension funds, normal funds, and all other passive index holders WOULD dump their MSTR automatically.”

He continued, “The 10th of October wasn’t a coincidence after all – It was smart money seeing a big risk to crypto and the current market structure.”

However, the issue only became apparent to the broader market after JPMorgan analysts, led by Nikolaos Panigirtzoglou, noted in a Wednesday report that Strategy’s share price had declined below its valuation premium, and suggested the root cause could be that MSTR may be dropped from key benchmark indices.

This swiftly drew a response from Strategy CEO Michael Saylor, who wrote on X, “We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses bitcoin as productive capital.”

He argues that Strategy’s 2025 investment product launches – $STRK, $STRF, $STRD, $STRC, and $STRE – represent the company is “a new kind of enterprise” – not just a passive fund or trust.

Response to MSCI Index Matter

Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

This year alone, we’ve completed…

— Michael Saylor (@saylor) November 21, 2025

Nuener emphasizes, however, that MSCI will make a final ruling on whether to delist Strategy on 15 January 2026. Until then, he believes Bitcoin will struggle to gain meaningful traction, instead continuing to “dum.”

So how should investors approach this? Recent market moves show a smart-money exodus from DAT-heavy projects like Bitcoin and ethereum into altcoins held in fewer corporate treasuries, such as Zcash, Starknet, and Bitcoin Cash. Each of these projects has made solid, if not parabolic, gains over the past month, while Bitcoin and Ethereum slide.

With that in mind, investors who follow this same approach, strategically positioning in less correlated altcoins within strong-performing sectors, could continue to see significant gains, even before MSCI’s 15 January ruling.

As such, let’s look at three projects that could yield the biggest returns moving forward.

Bitcoin Hyper

Evident in the rise of Bitcoin Cash and Zcash, both of which fulfil a similar role to Bitcoin without the deep entrenchment in DATs, Bitcoin-adjacent projects have real potential to attract BTC capital rotations.

Another project performing well in this space is Bitcoin Hyper, a Bitcoin Layer 2 designed to remove Bitcoin’s speed and functionality barriers. It’s a Solana VIRTUAL Machine (SVM)-powered Bitcoin scaling solution that uses ZK-rollups to report transactions back to the Bitcoin L1 for finality and immutability.

This setup means you get the security of Bitcoin and the performance and smart contract support of Solana, something the market has never seen before. It unlocks possibilities like DeFi, payments, AI, meme coins, RWAs, and much more on Bitcoin.

Bitcoin Hyper is currently in a presale, having raised $28.3 million so far. This presale momentum reflects clear product-market fit and underscores the Bitcoin Hyper’s ability to continue attracting investor demand even as Bitcoin struggles.

Visit Bitcoin Hyper Presale

Monero

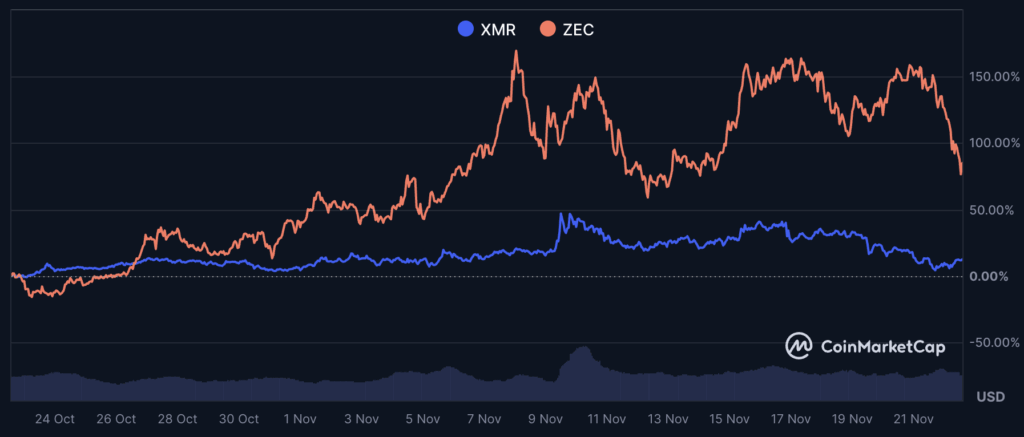

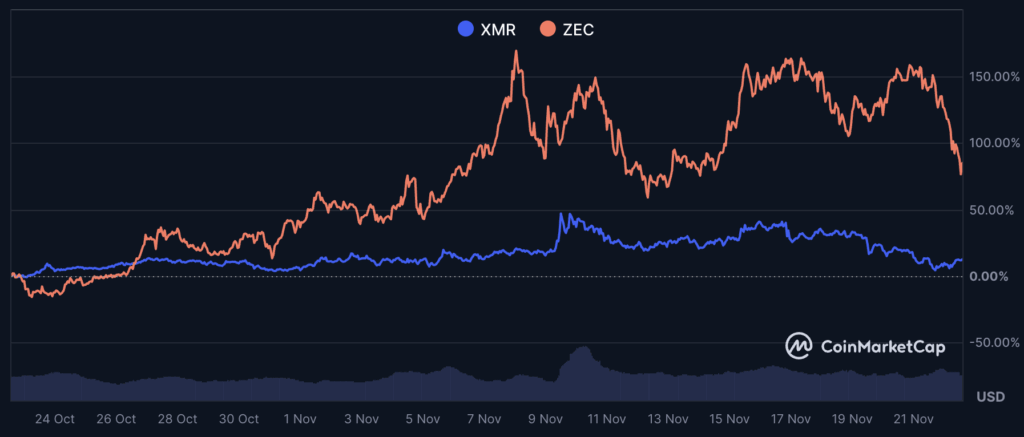

Monero falls into the same category as Zcash, offering native privacy for network users. It has underperformed Zcash this month, rising 7.4% while Zcash is up 104%.

However, Zcash has tumbled 27% in the last 24 hours, while Monero is up 2.4%. That clearly represents shifting mindshare and potentially indicates that XMR could catch ZEC in the weeks and months ahead.

Technically speaking, Monero differs from Zcash in the way it achieves privacy. It relies on ring signatures, stealth addresses, and confidential transactions rather than zero-knowledge proofs. This provides an advantage, since privacy is included by default rather than relying on shielded pools like Zcash, ultimately leading to consistent privacy rather than occasional.

It’s also worth noting that Monero has historically held the majority market share in the privacy coin space, although Zcash now has a larger valuation. This could mark another signal that a repricing is imminent if Zcash’s HYPE begins to fade.

PEPENODE

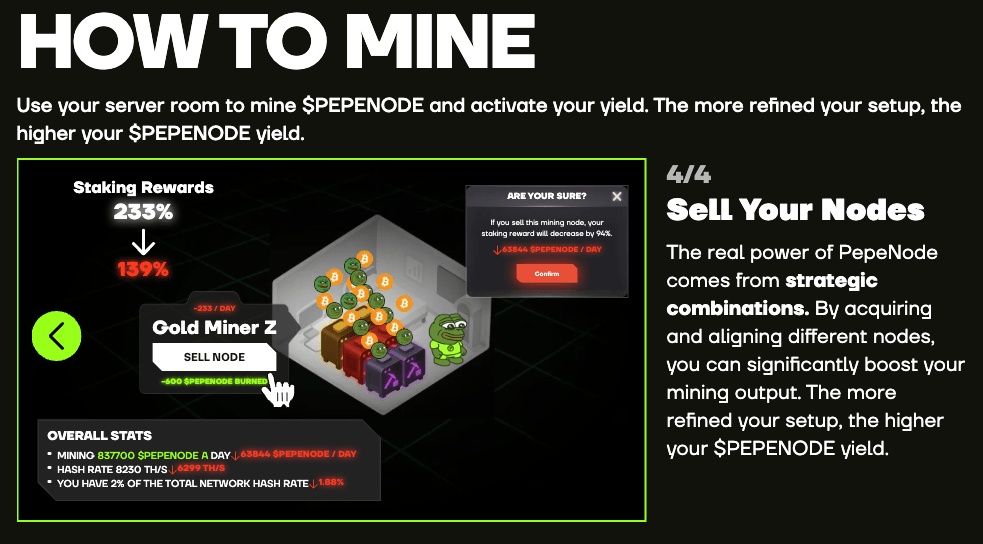

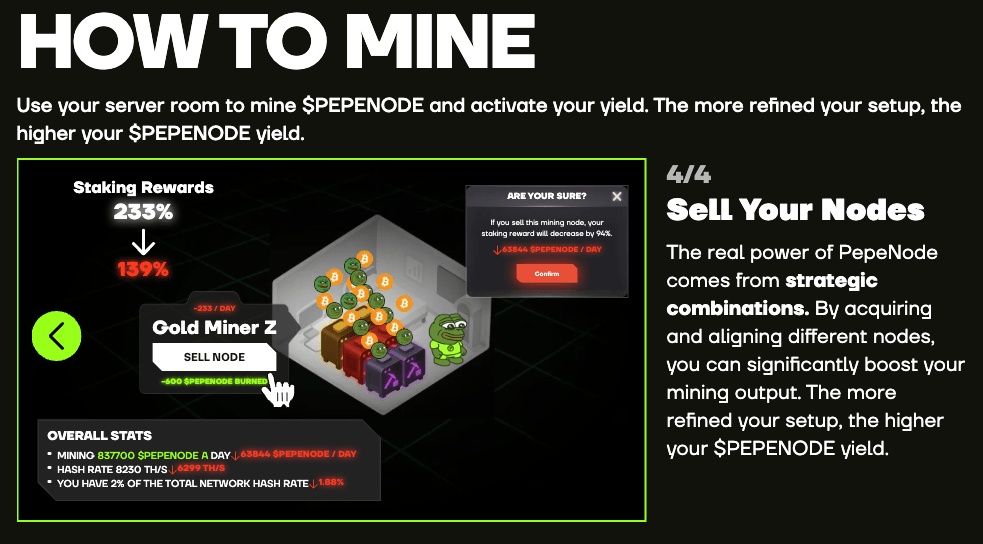

PEPENODE holds a unique position in the Bitcoin alternative conversation because, by definition, it’s a meme coin. But don’t let that distract you – the project takes a unique approach to distributed and community-driven rewards, introducing a concept known as “Mine-to-Earn.”

This is essentially a reboot of Play-to-Earn, but it’s built around crypto mining. Users spend PEPENODE tokens to build mining rigs, and these rigs generate mining power, which earns PEPENODE rewards.

It’s a fully on-chain game, meaning it doesn’t rely on the same expensive hardware and electricity costs as traditional crypto mining. This also removes the environmental risk of mining, which could better align with institutional players and green investors.

Another benefit is that 70% of PEPENODE tokens spent in the in-game store are burned, creating long-term deflationary pressure.

PEPENODE is also in a presale and has raised over $2 million to date. That’s a solid amount, but it still leaves significant upside given the high valuations of crypto mining projects and the capital that PEPENODE could attract as word spreads.

Visit PEPENODE Presale

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

![]()