Tether’s Billion-Dollar Reserve Surge Signals Crypto Market Transformation

Tether just dropped a financial bombshell that's shaking the crypto world to its core.

The Reserve Revolution

Massive billion-dollar movements are transforming Tether's balance sheet—creating the most robust reserve structure in stablecoin history. This isn't just incremental growth; it's a fundamental reshaping of how digital assets maintain stability.

Market Confidence Soars

As traditional finance institutions continue their slow dance with blockchain technology, Tether's aggressive reserve accumulation demonstrates where real conviction lies. The numbers don't lie—billions are flowing into positions that signal long-term bullishness on crypto's infrastructure.

Because nothing says financial stability like needing to prove you actually have the money you claim to hold—welcome to modern finance.

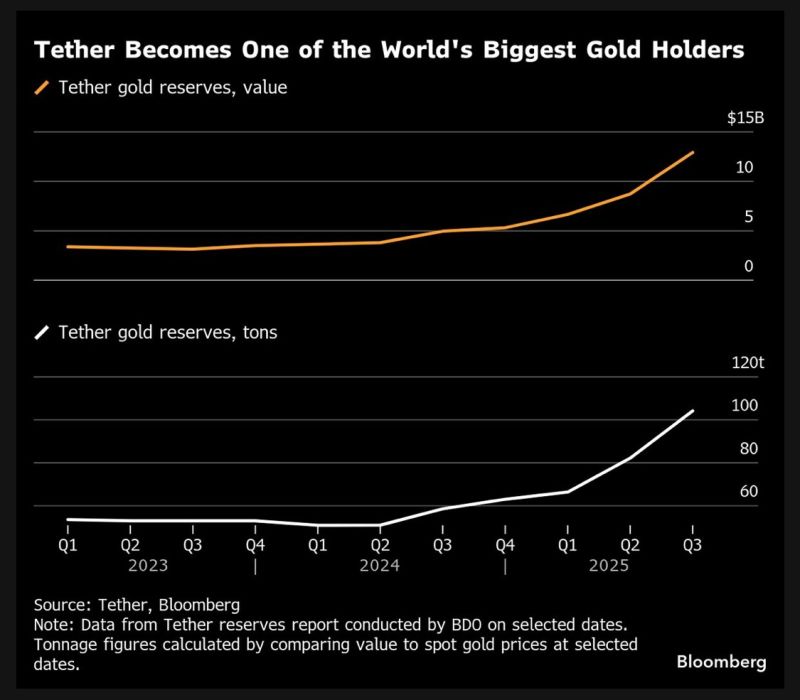

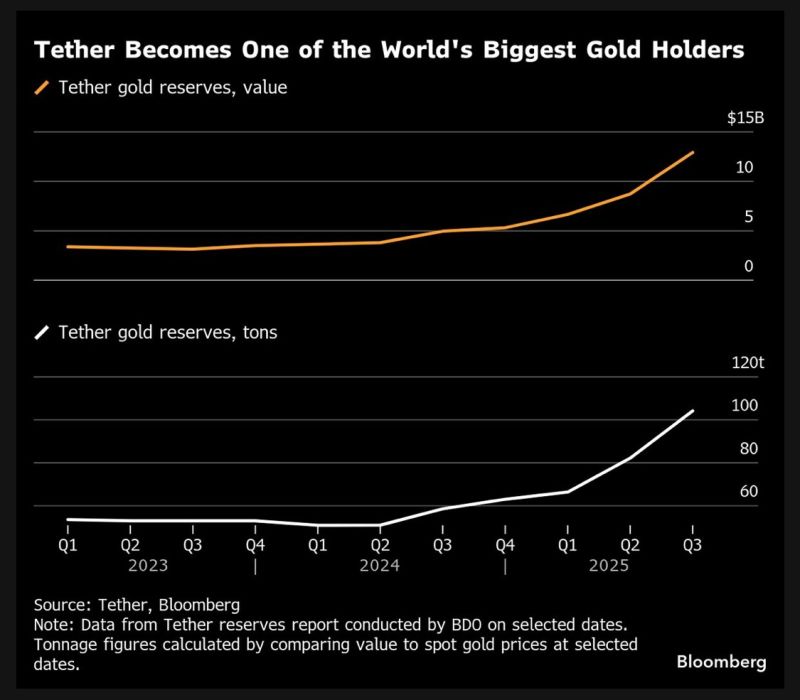

Bloomberg’s chart shows an almost vertical curve during this period, suggesting both continued buying and the tailwind of rising global gold prices.

READ MORE:

This development marks a clear departure from the conventional stablecoin model, which typically relies on short-term government paper and other cash-equivalent assets. Instead, Tether has leaned heavily into gold as a defensive buffer against inflation, geopolitical friction, and wider economic uncertainty. The data reflects two parallel climbs: the physical amount of metal and the dollar value of that metal, now moving toward the $12 – 15 billion range.

For the crypto market, the implications are broad. USDT remains the most widely used stablecoin, and the composition of its reserves directly influences market confidence. By amassing one of the largest private gold positions in existence, Tether is signaling a desire for greater resilience – and, intentionally or not, extending its influence into a market far beyond the digital-asset sphere.

![]()