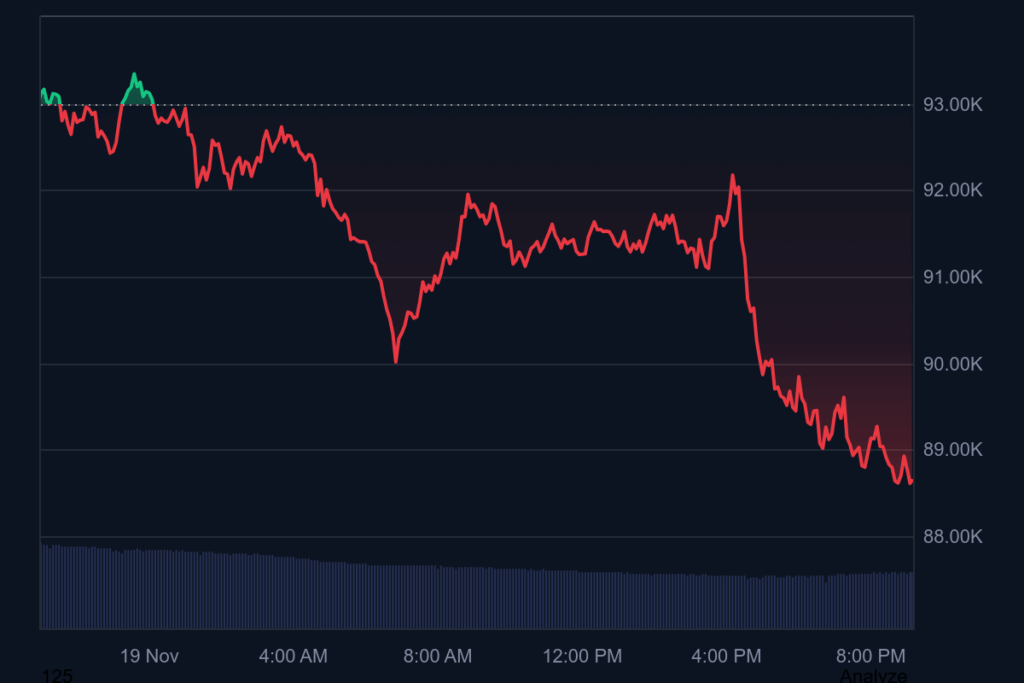

Bitcoin Plunge to $88K Triggers Market-Wide Panic as Fear Gauges Hit Red Zone

Digital assets face brutal selloff as Bitcoin craters toward $88,000 support level.

Fear & Greed Index flashes extreme fear signals across crypto markets.

Traders scramble for exits while institutions watch for bottom formation.

Market veterans see buying opportunity in the bloodbath—because what's another 20% drop between friends?

Ethereum has been hit even harder. ETH fell to $2,874, marking a brutal 9% daily drop and a 15% loss over the week. Its slide mirrors broader risk-off sentiment, with liquidity thinning across key trading pairs and long-leveraged positions getting flushed out.

READ MORE:

Among altcoins, the pain is widespread.

- BNB slipped below $875,

- Solana retreated to $130, down nearly 14% this week,

- XRP fell to $2.03, continuing its steep decline,

- TRON dropped to $0.283, one of the more stable performers but still in red territory.

Stablecoins like USDT and USDC remain anchored to their pegs despite massive market turbulence, signaling that liquidity flows remain orderly even as risk assets plunge.

Across the board, the charts tell the same story: aggressive selling, collapsing momentum, and traders bracing for more volatility. With fear spiking and market structure weakening, many are watching closely to see whether Bitcoin can defend the high-$80K region – or whether another wave of capitulation is around the corner.

![]()