Ethereum’s Wild Ride: Plunge Below $3K Before Soaring to $4K?

Ethereum faces a critical juncture as technical indicators suggest potential turbulence ahead. The smart contract giant might test investor nerves with a dip below the psychological $3,000 barrier before gathering momentum for its next major move.

The Pre-Rally Pressure Cooker

Market analysts point to consolidation patterns that typically precede significant breakouts. Ethereum's current positioning hints at one final shakeout—clearing weak hands before the real show begins. Trading volumes remain elevated while institutional interest continues building behind the scenes.

The $4K Horizon Beckons

Once Ethereum stabilizes above key support levels, the path to $4,000 appears increasingly plausible. Network upgrades and growing DeFi adoption create fundamental tailwinds that could propel ETH to heights that'll make traditional finance veterans clutch their pearls—though they'll probably still call it a 'speculative bubble' while missing another 100% rally.

Ethereum's proving once again that in crypto, sometimes you need to take two steps back before launching forward—much like traditional banks implementing 'innovation' that's been running on blockchain for years.

Ethereum Price Prediction – Why ETH Might Dip Below $3K Before Rallying

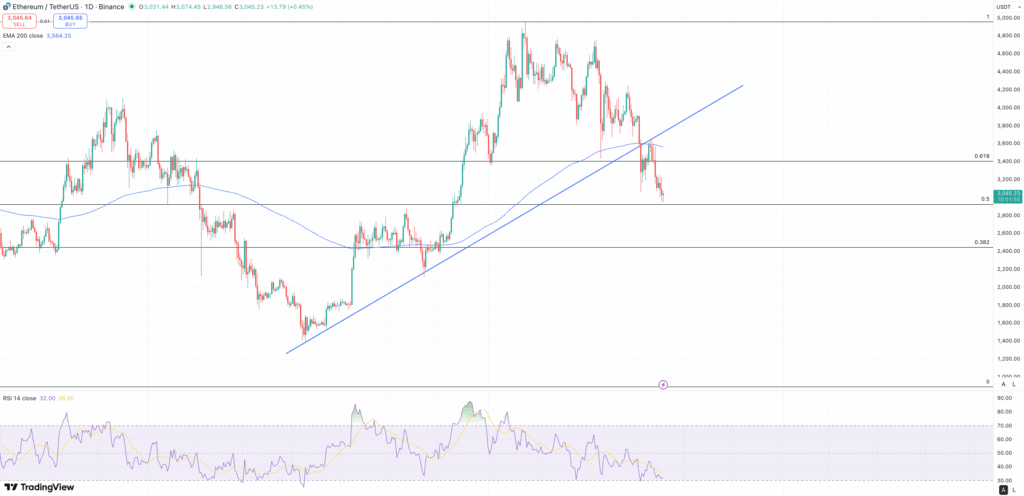

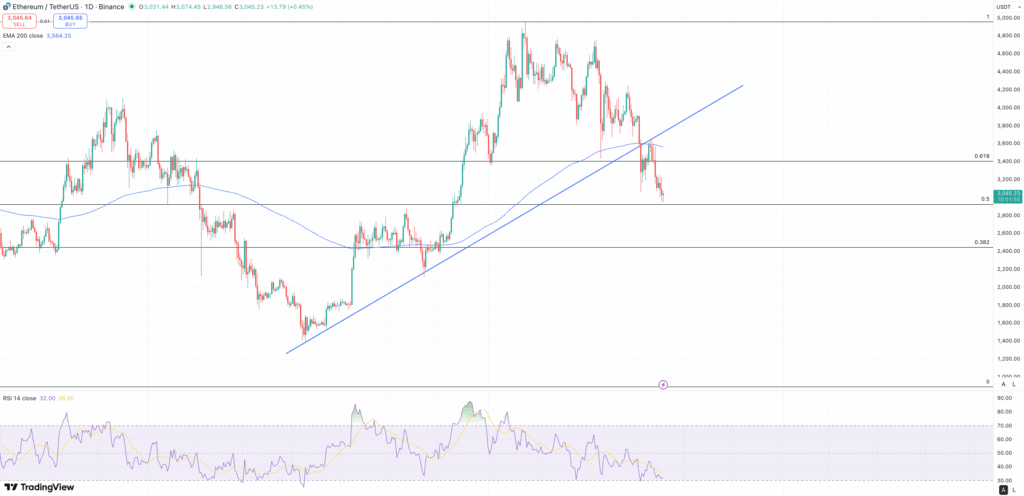

Ethereum has lost a huge multi-month ascending trendline that dates back to April’s low. When you break a trendline that important, you rarely just V-shape back up immediately. Instead, price retests the breakdown level to confirm it as resistance – which is what we’re seeing play out.

The daily chart isn’t offering any relief either, with lower highs and lower lows well below the 200-day EMA. Plus, the RSI is now hovering just above oversold, which is a dangerous spot. It often comes before an “acceleration phase” – one final flush to wreck the last batch of longs before a reversal.

If Ethereum drops below $3,000, the $2,800-$2,900 zone will be an important one to watch. It’s a high-volume node from earlier this year, and lines up perfectly with the 0.618 Fibonacci retracement of the entire bull leg. That is a clear demand zone.

Tagging that zone could trigger violent mean reversion – traders often visualize it as a rubber band snapping back. That’s why a clean bounce from $2,800 or $2,900 puts a MOVE back to $4,000 on the table for Ethereum.

Ethereum’s Fundamentals Align for a Reversal

Ethereum’s Fusaka upgrade hits mainnet on December 3 – just weeks away. This upgrade expands future blob capacity with PeerDAS and effectively drives Layer-2 fees toward zero. Historically, major upgrades mark local bottoms for ETH.

Plus, the timing couldn’t be better for institutions. Institutional ETF inflows were minimal above $4,000 ETH, as big players tend not to chase highs. So, a dip below $3,000 gives them the entry they’ve been waiting for, mirroring the Bitcoin ETF accumulation we saw in 2024.

December’s Fusaka upgrade is a major step in Ethereum's roadmap.

It's proof that Ethereum can evolve responsibly, scaling to meet global demand without compromising decentralization.

Learn how Fusaka will unlock the next wave of growth: https://t.co/3TOda5KjY2 pic.twitter.com/jjckxKB28H

— Ethereum (@ethereum) November 12, 2025

The supply side of ETH is also incredibly tight. Over 35% of all ETH is now staked and locked, leaving the liquid float – the coins actually available to buy – lower than ever. The sell-side liquidity simply isn’t there to support a longer-term bear trend.

This creates an exciting scenario. Any demand shock – like a larger Fed rate cut than expected – will hit a market with no supply to give. When that happens, Ethereum’s repricing could be explosive.

Could PEPENODE Offer Higher Returns Than ETH? New Mine-to-Earn Project Raises $2.1M

All that said, for those who don’t want to wait weeks for an Ethereum rebound, PEPENODE (PEPENODE) could be a viable alternative. It solves a specific boredom problem in crypto: instead of buying a token and just passively holding, you can actually do something with it.

PEPENODE effectively turns the complex (and expensive) world of crypto mining into a browser-based strategy game. You join the presale to buy PEPENODE tokens, which you can use after the game goes live to build and upgrade VIRTUAL “Miner Nodes” in a digital facility.

PEPENODE is building something special from the ground up. 🚨

Buy Meme Nodes. Upgrade Facilities. Earn meme Coins.

All on one platform 🔥https://t.co/FaKIaBpf4I pic.twitter.com/JUTG2F6eXG

— PEPENODE (@pepenode_io) November 11, 2025

The gameplay loop is simple: better nodes equal higher hashrates, and higher hashrates mean more crypto rewards. These rewards are paid out in PEPENODE and other established meme coins, like Fartcoin and PEPE.

So far, PEPENODE’s presale has raised $2.1 million, with the current token price sitting at $0.0011546. For yield hunters, there’s also a staking protocol offering an APY of 595%. That’s an incentive to lock up supply early.

And there’s even a deflationary mechanic. Every time a user upgrades their virtual mining rig, they burn PEPENODE tokens – creating a system in which gameplay directly supports the token price. So, if holding through an ETH dip below $3,000 seems like a tough challenge, projects like PEPENODE could deliver the kind of upside that Ethereum can’t.

Visit PEPENODE PresaleThis publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

![]()