Billionaire Stock Portfolios: The Blueprint for Thriving in Today’s Market Chaos

Wall Street’s elite aren’t sweating the volatility—they’re capitalizing on it. Here’s how the 0.1% plays the game.

The Contrarian Playbook

While retail investors panic-sell, billionaires double down on undervalued sectors. Tech, energy, and—surprise—crypto derivatives keep showing up in their 13F filings.

Liquidity as a Weapon

Massive cash reserves let these players pounce when markets tank. Your average investor’s ‘dry powder’? About as useful as a screen door on a submarine.

The Ironic Twist

Half their ‘genius moves’ involve buying the dip on stocks they previously talked down on CNBC. But hey, rules are for poor people.

Want to play like the big boys? Start by inheriting eight figures—the rest is just details.

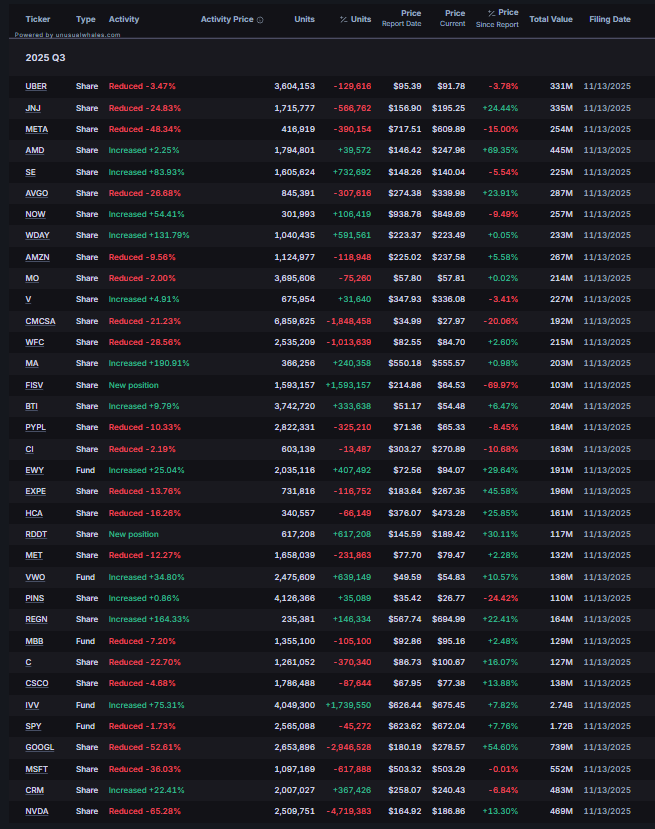

Yet the filing doesn’t show a hedge fund running from risk – only shifting where it wants to take it. Bridgewater simultaneously ramped up exposure to a set of high-conviction names: Sea Limited soared more than 80%, Mastercard nearly tripled, Workday and Regeneron saw triple-digit percentage boosts, and AMD edged higher as well. The addition of Fiserv and Reddit introduces a new mix of digital payments and social-ad-driven growth.

READ MORE:

Bridgewater also broadened its global footprint. Positions tied to emerging markets – including South Korea’s EWY and the broad VWO ETF – were increased significantly. Even the firm’s S&P 500 tracker was expanded, a reminder that Dalio is not exiting U.S. exposure but redistributing it with more caution.

The shape of the portfolio aligns with the warnings Dalio has issued throughout the year. He has repeatedly stressed that the U.S. is entering a period he calls a “danger zone” – a convergence of heavy debt burdens, political strain, and valuations that leave little room for error. In an environment where he sees recession risk rising and geopolitical tensions adding new layers of uncertainty, Bridgewater’s Q3 moves look like a preparation play: reduce the assets most vulnerable to a sharp repricing, and lean into businesses – from biotech to software to emerging-market growth — that may hold up better if the cycle turns.

![]()